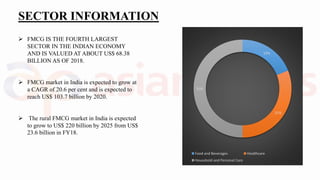

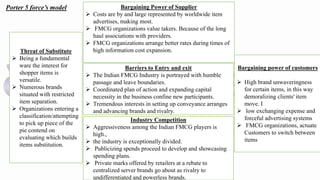

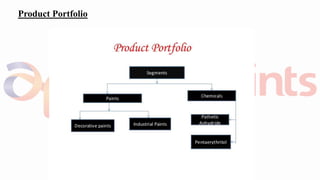

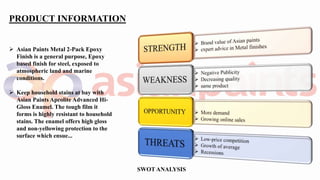

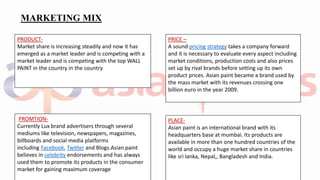

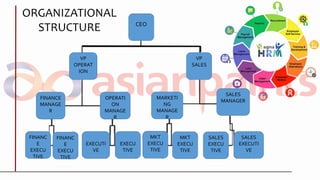

The document provides information about Asian Paints, the largest paint company in India. It discusses the FMCG sector in India and highlights that Asian Paints has the largest market share of 54.1% in the Indian paint industry. It then analyzes Asian Paints' organizational structure, marketing strategies, financial performance, and share price trends. In addition, it discusses the company's products, SWOT analysis, and competition in the paint industry.