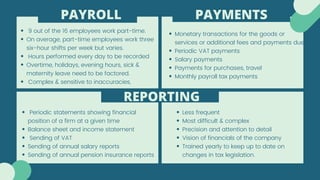

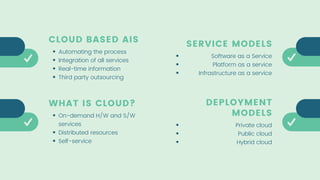

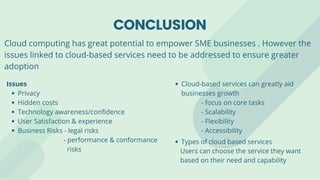

This document discusses the potential move of Kluuvin Apteekki, a privately owned pharmacy in Helsinki, to adopt cloud-based accounting services. It currently employs 16 people and the owner, Pia Moksi, handles all accounting tasks which has become burdensome. The summary discusses the accounting processes currently used, the potential benefits of cloud-based services including automation, integration and real-time access. It also notes potential risks like loss of control over data, dependence on software providers and issues with integration. It concludes that while cloud-based services could aid growth through flexibility and scalability, potential issues around privacy, costs and technology readiness need to be addressed.