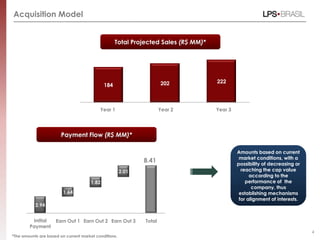

LPS Brasil acquired a 60% stake in Pronto Erwin Maack Consultoria de Imóveis S.A. for a base value of R$8.41 million. Pronto Erwin Maack is projected to generate over R$184 million annually in secondary real estate market sales. The acquisition expands LPS Brasil's platform to penetrate the mortgage loan market and provides exclusivity for all mortgages from Pronto Erwin Maack. Pronto Erwin Maack specializes in the mid-high income segment with over 45 years of experience in the secondary real estate market and one store in southern São Paulo.