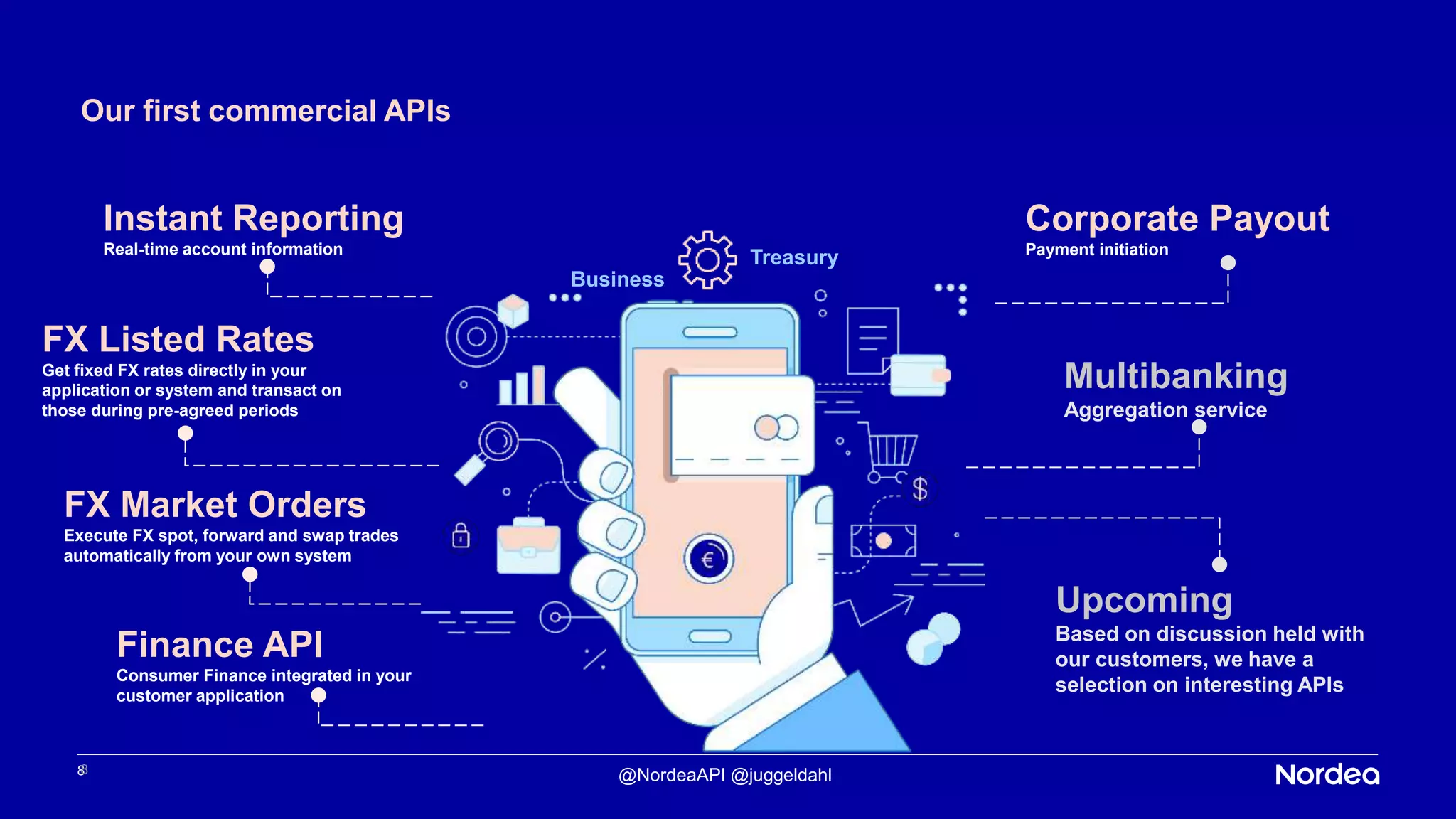

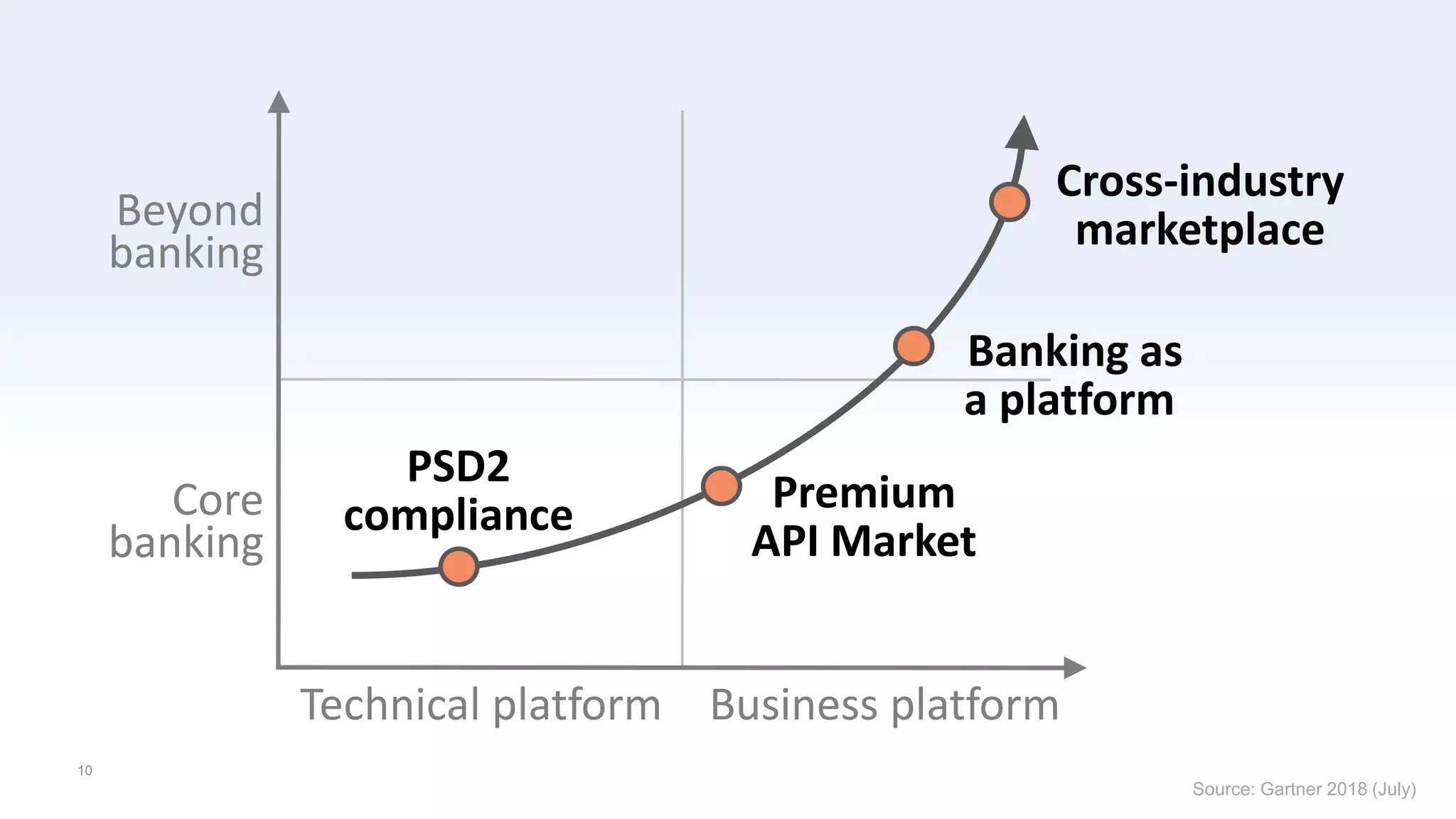

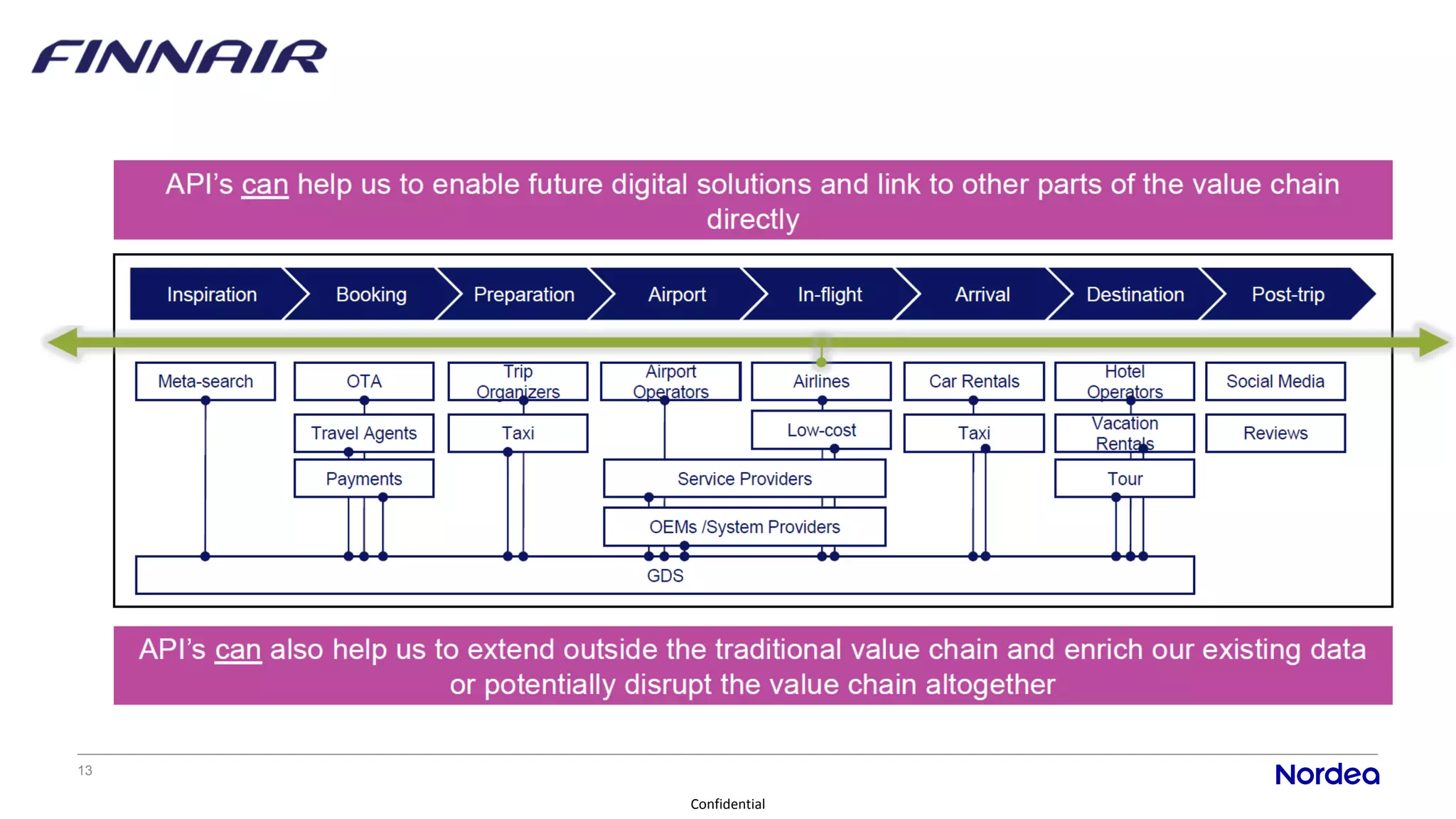

Janne Uggeldahl discusses common myths surrounding open banking, emphasizing that it is not merely about compliance and is actively engaging corporates and developers. The presentation highlights Nordea's achievements in open banking, including successful API implementations and high user involvement from the developer community. It challenges perceptions around the PSD2 license acquisition complexity and illustrates the ongoing evolution in banking services through collaboration and innovation.