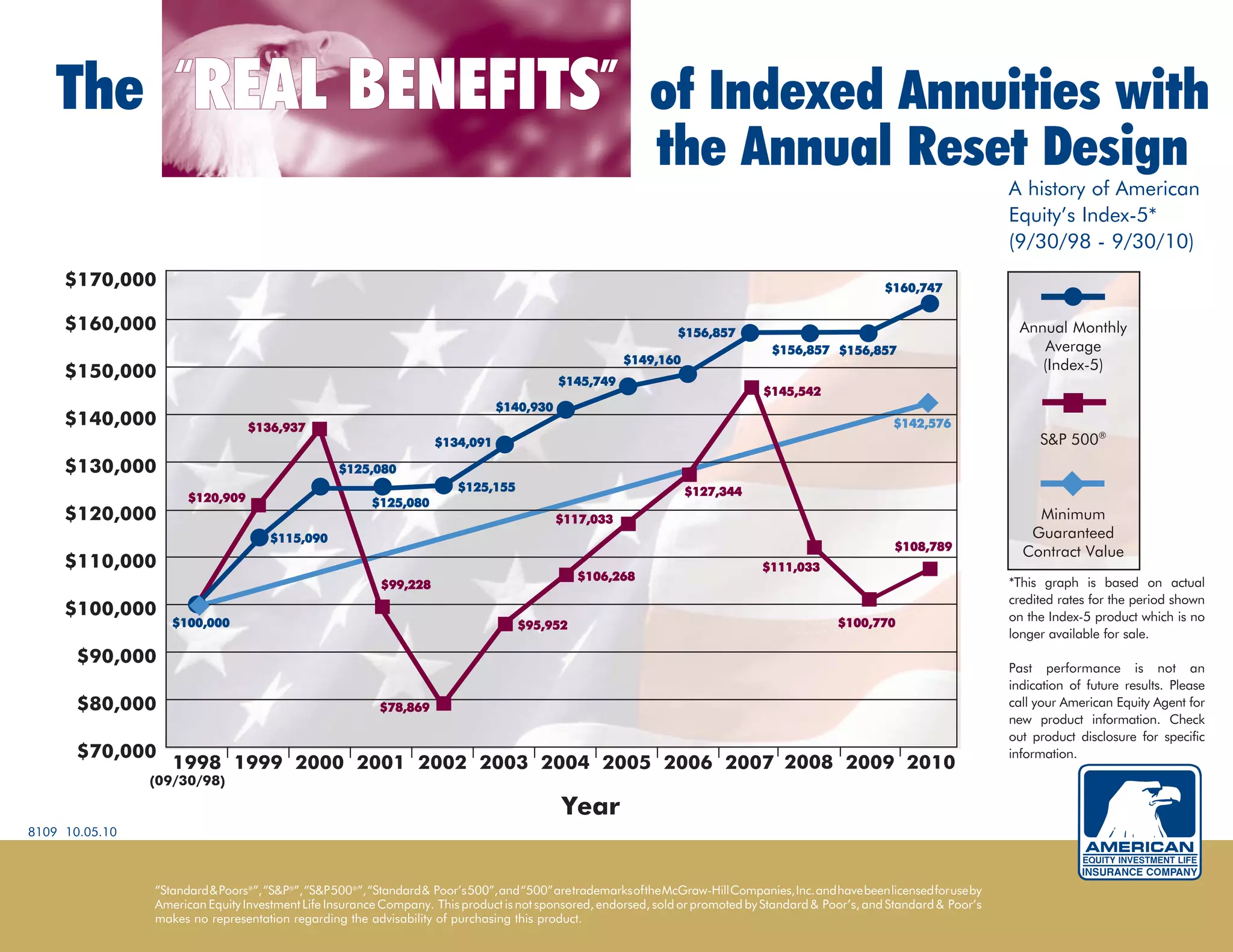

The document demonstrates the benefits of an indexed annuity product called Index-5 from American Equity over a 12-year period from 1998 to 2010. The Index-5 was able to accumulate value based on the appreciation of the S&P 500 index without losses in down years of the index due to its annual reset design. It provided upside potential while guaranteeing the principal. Indexed annuities offer benefits like minimum guarantees, tax deferral, guaranteed lifetime income and preservation of premium.