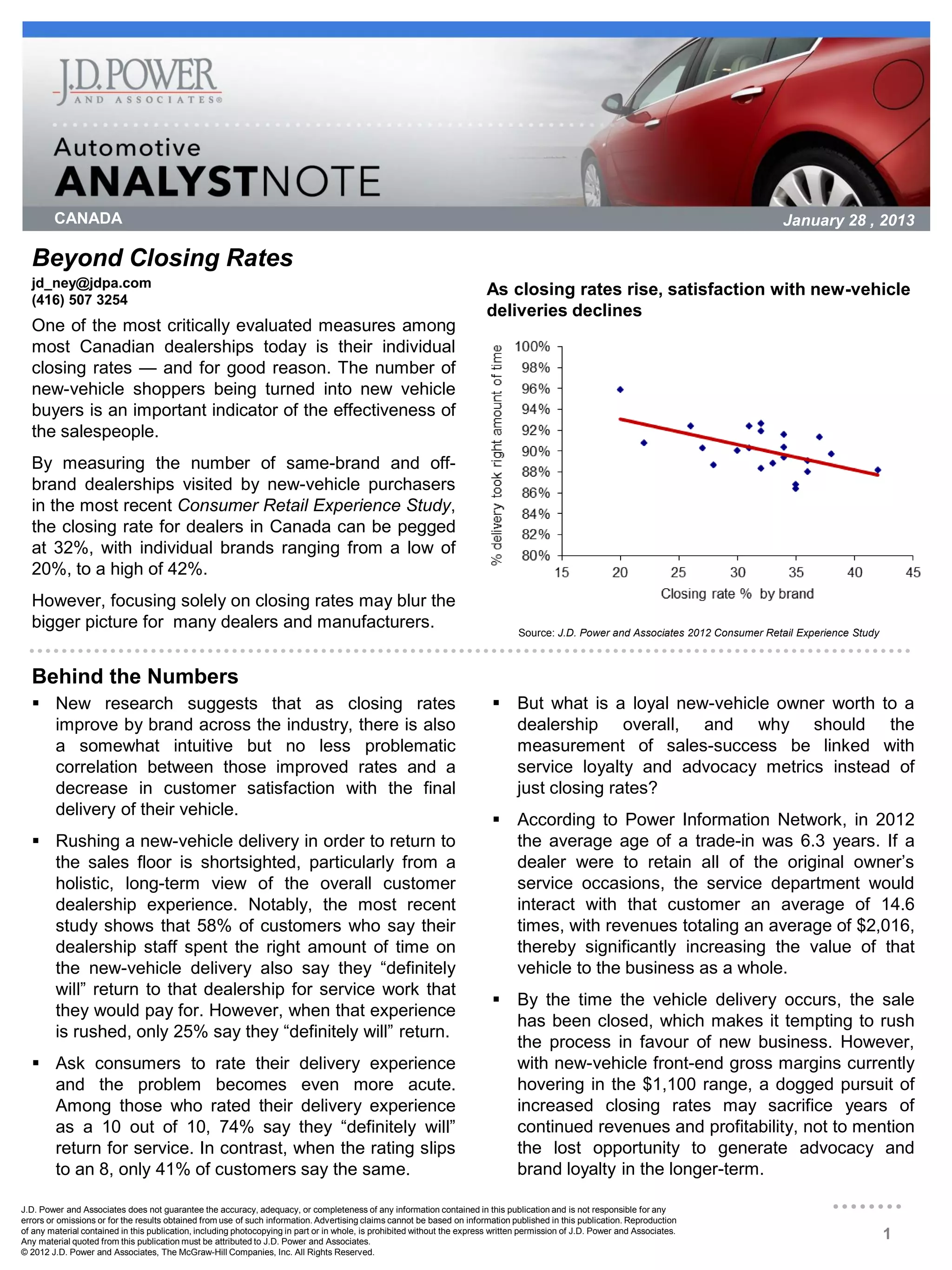

Closing rates for new vehicle sales in Canada average 32%, ranging from 20-42% by brand. However, focusing only on closing rates risks overlooking customer satisfaction, as research shows satisfaction declines as closing rates rise. Specifically, dealers who rush the vehicle delivery process in order to make more sales achieve lower customer loyalty and return rates for service. Prioritizing customer experience during the entire dealership relationship, including delivery, leads to higher customer retention and long-term value for dealerships.