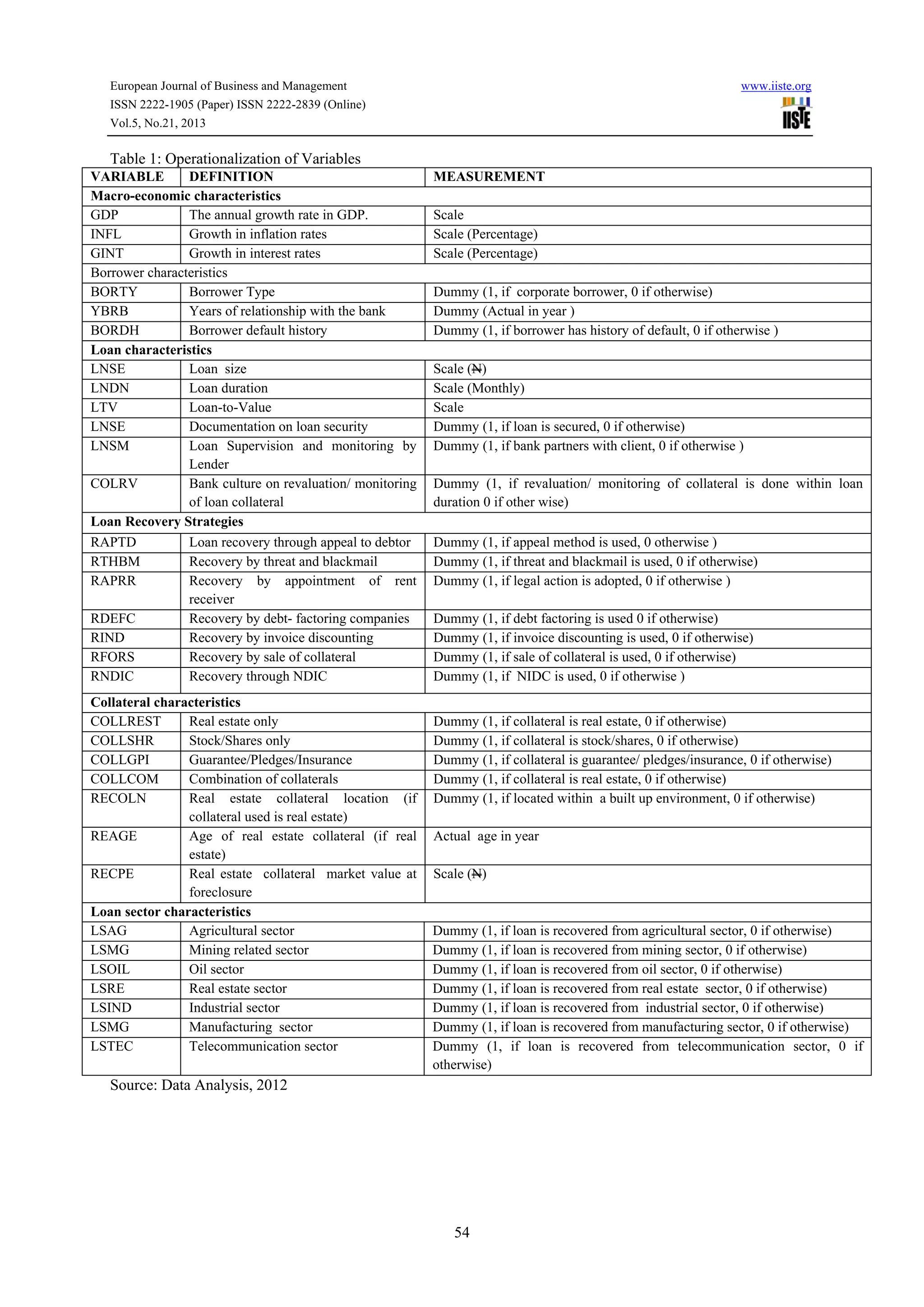

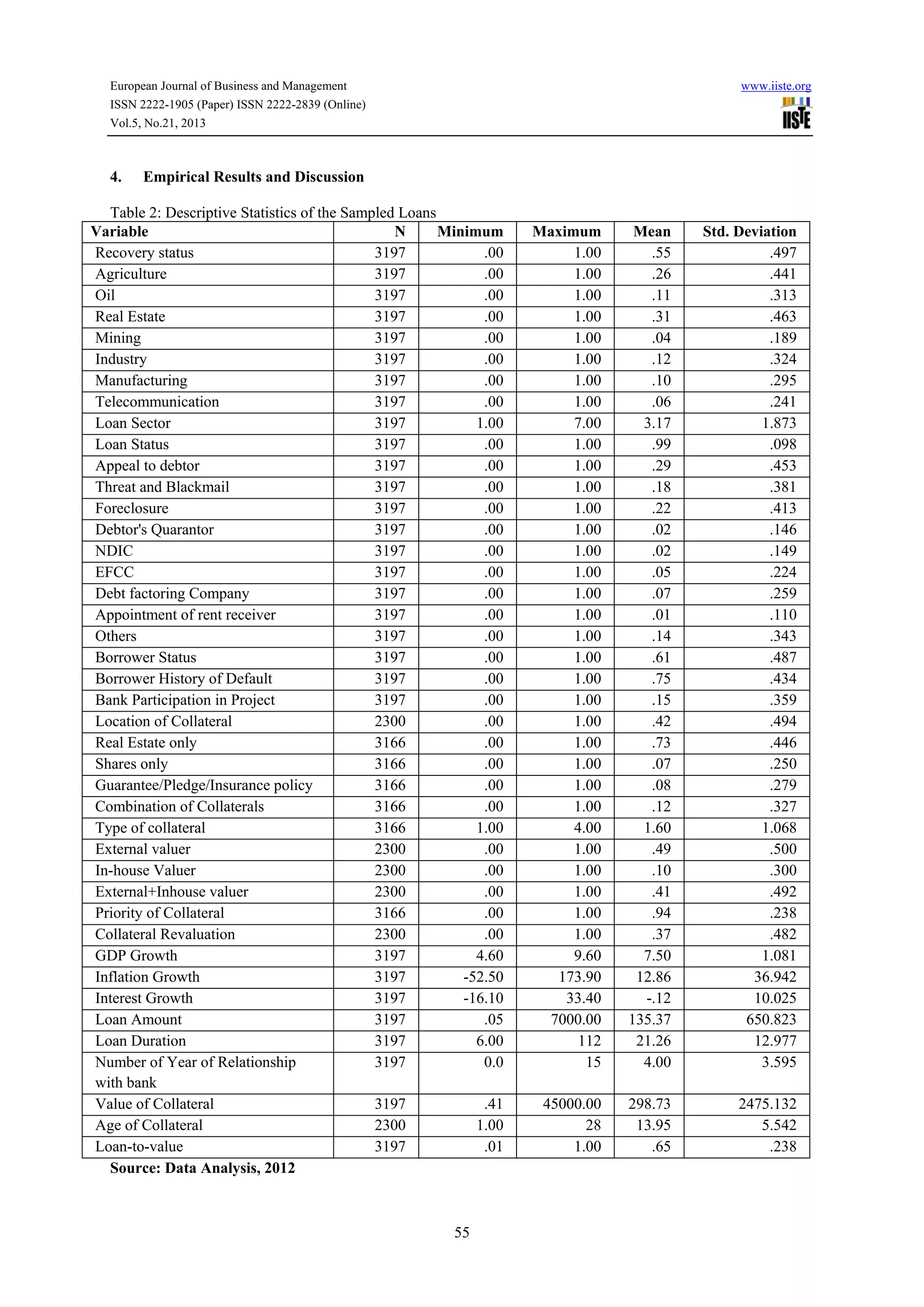

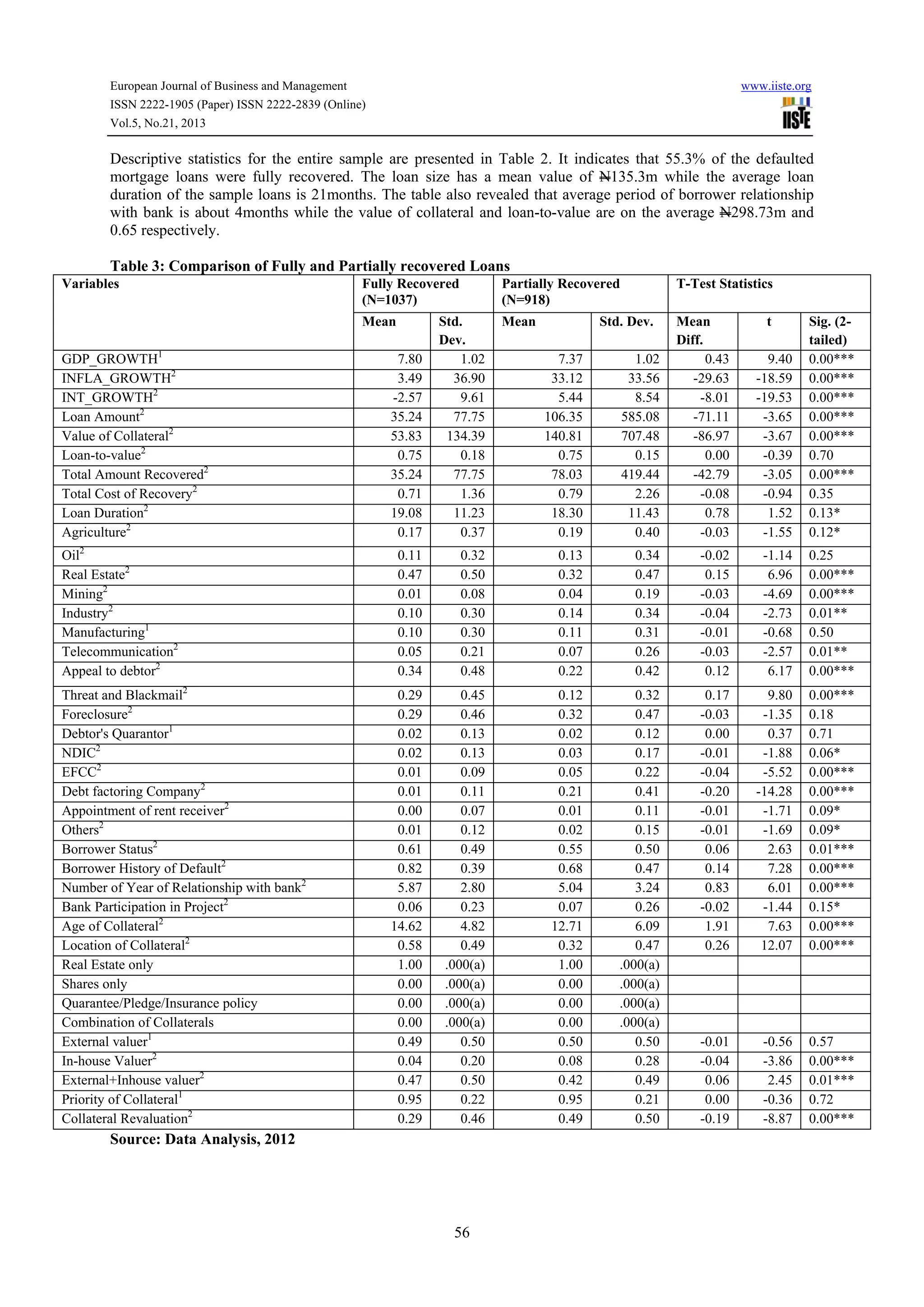

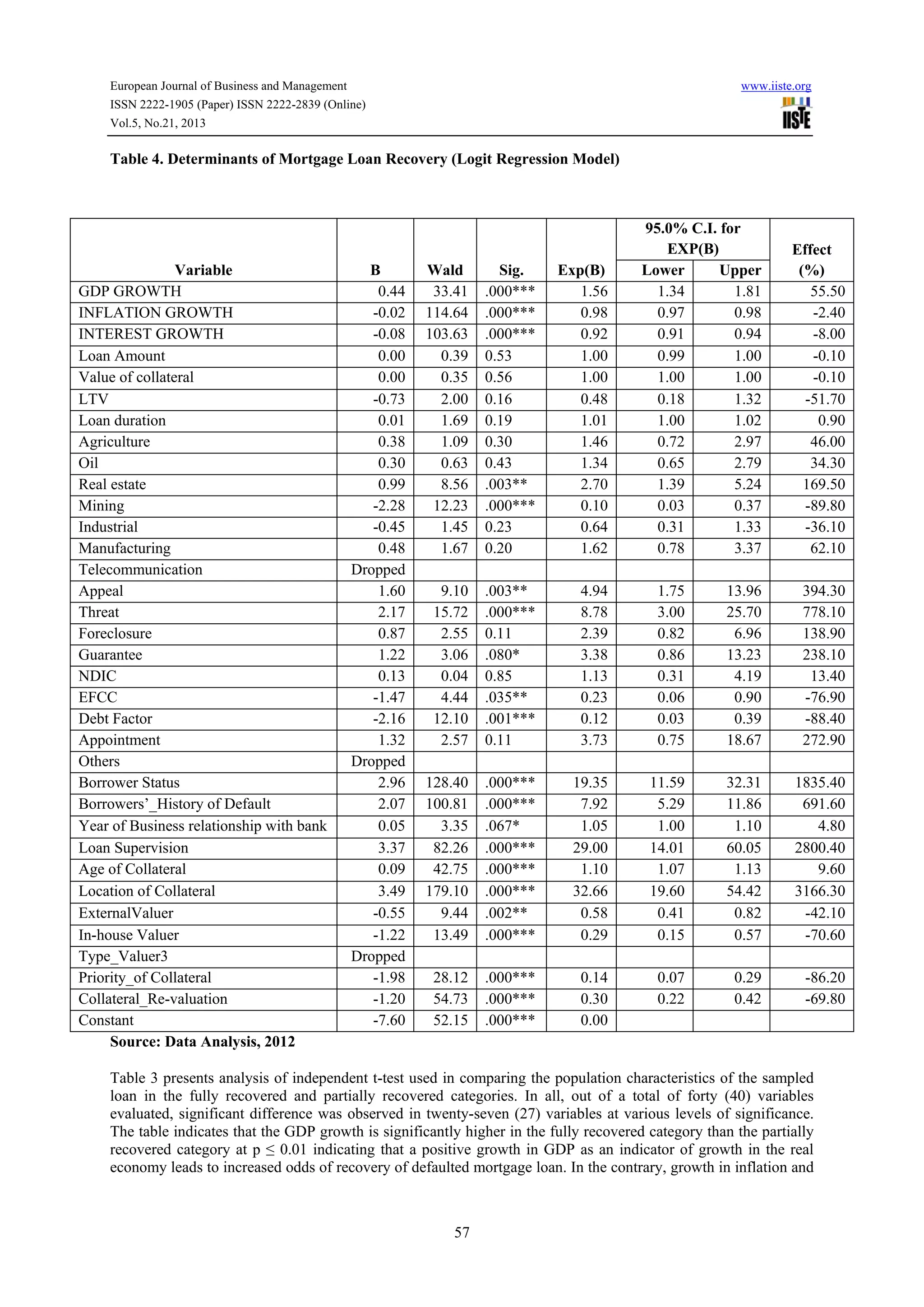

This document summarizes a research paper that analyzed the determinants of recovery of defaulted mortgage loans in the Nigerian lending industry. The study used logistic regression analysis on data from 3,197 defaulted mortgages from 1999-2011 at commercial banks and primary mortgage institutions in Nigeria. The results showed that GDP growth, borrower status, borrower default history, year as a borrower, bank relationship, loan supervision, collateral age, and collateral location were positively associated with loan recovery rates. Meanwhile, inflation growth, interest rates, collateral priority, and collateral revaluation were negatively associated with recovery rates. Other factors like loan-to-value ratio, loan size, and loan duration had insignificant but positive effects on recovery possibility.