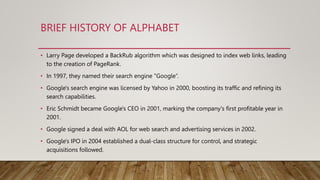

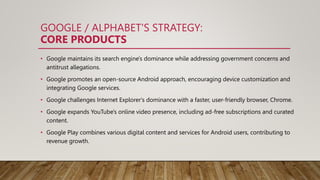

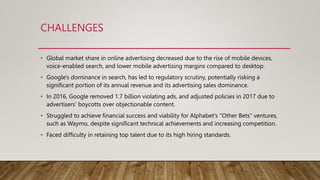

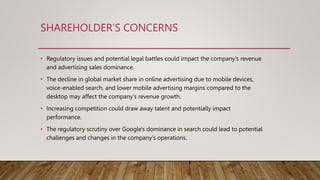

Larry Page developed the Google search engine in 1997 which became dominant through partnerships with Yahoo and AOL. Google diversified into advertising through AdWords and acquisitions like DoubleClick, establishing its dual-class share structure. While global market share and regulatory concerns present challenges, Google maintains leadership across search, Android, Chrome, and YouTube through innovation and strategic acquisitions.