The document discusses the treatment of goodwill when admitting or retiring a partner from a partnership.

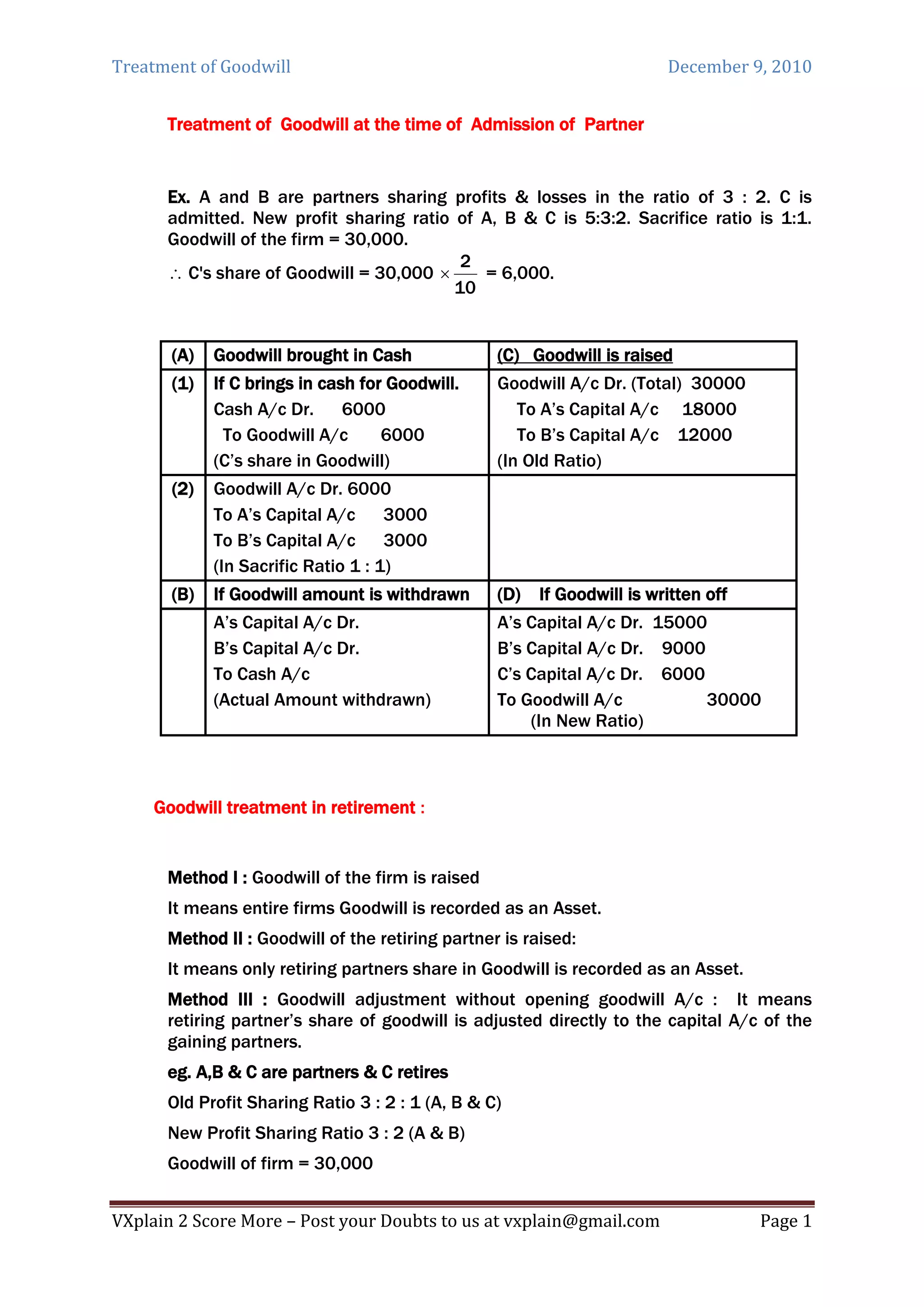

When admitting a new partner C, the goodwill of the existing partnership (Rs. 30,000) is divided according to the new profit sharing ratios. C's share of goodwill (Rs. 6,000) can either be paid in cash or adjusted against the capital accounts of existing partners A and B.

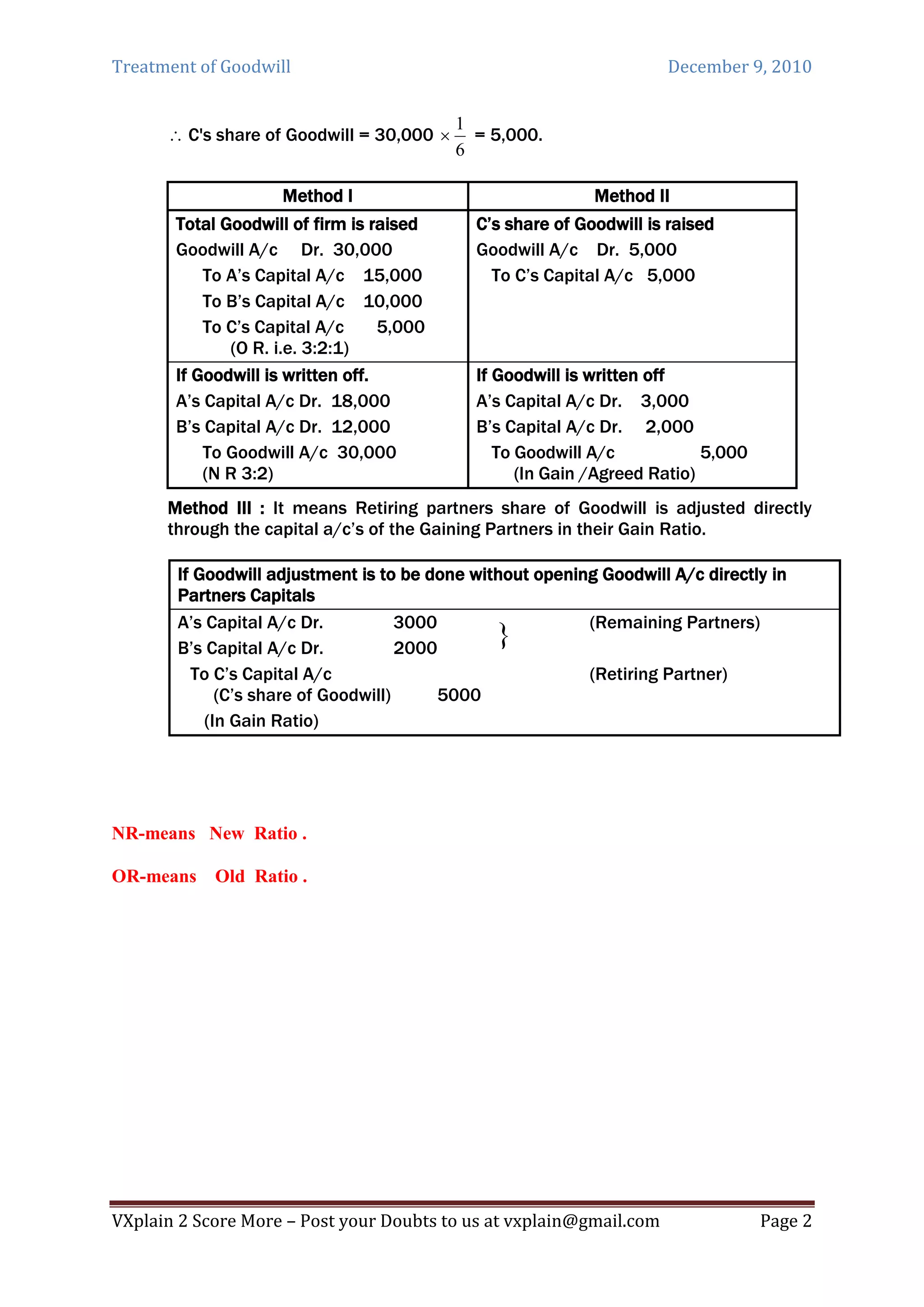

When a partner retires, there are three methods to account for goodwill - raising the total goodwill, raising only the retiring partner's share, or directly adjusting the retiring partner's capital against the gaining partners' capital. The document provides examples of journal entries for each method.