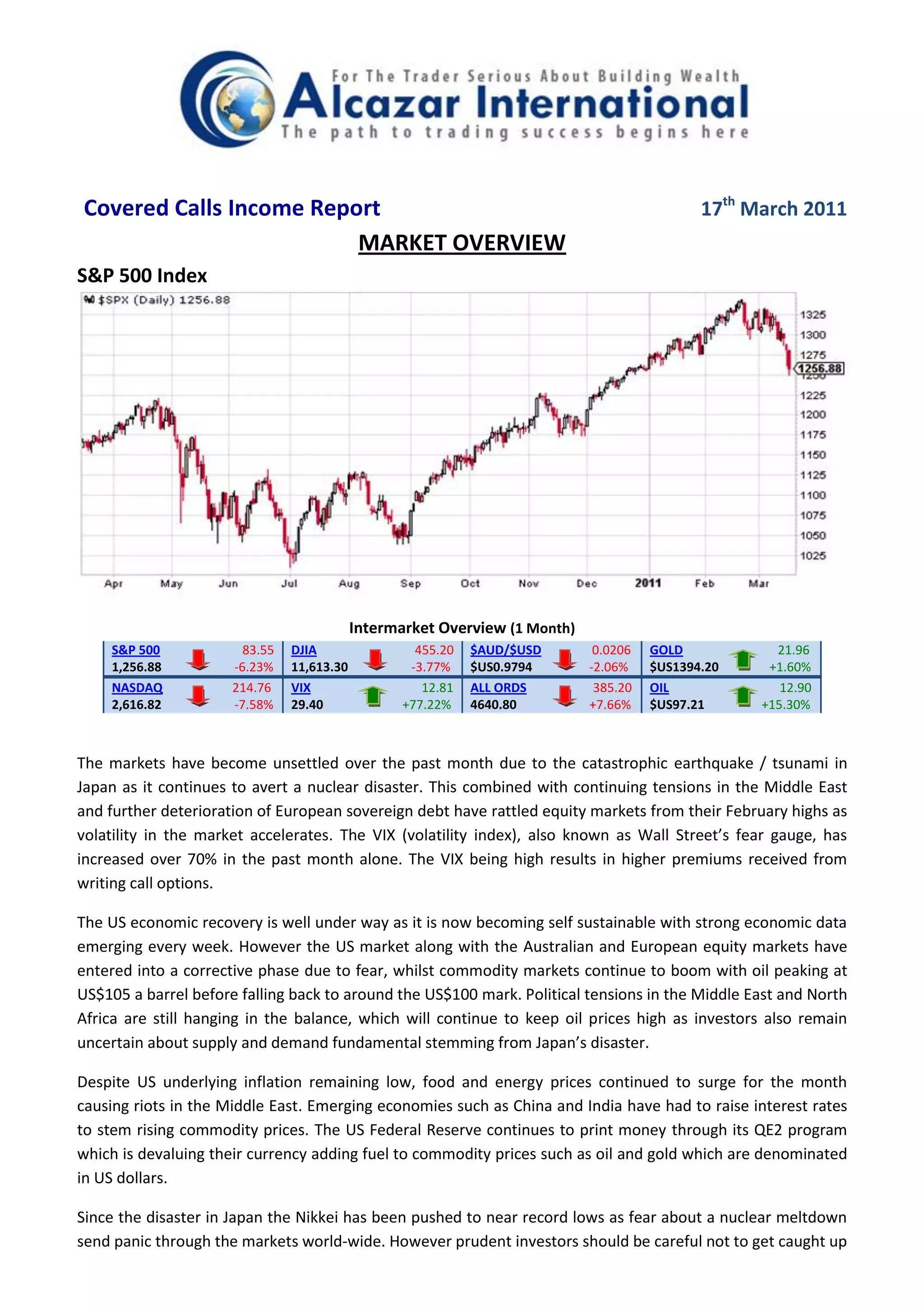

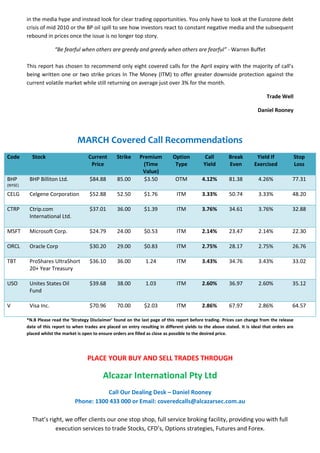

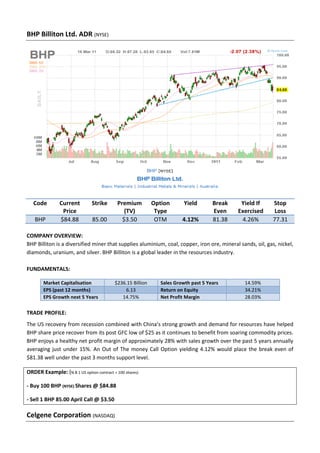

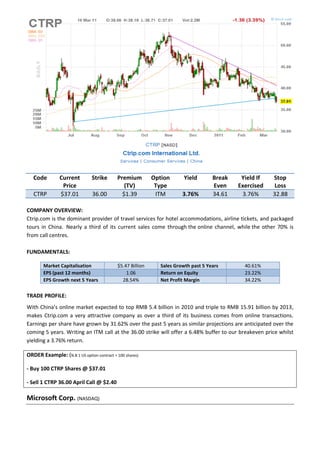

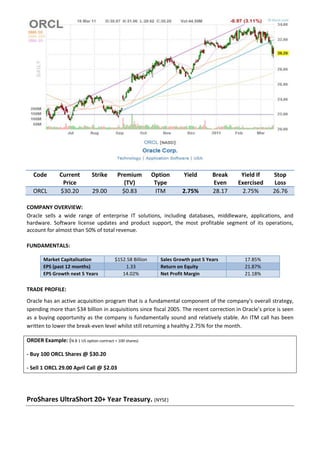

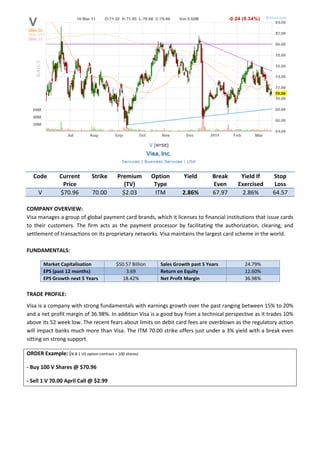

The document provides an income report on covered call recommendations for the month of April. It summarizes 8 covered call trades on stocks and ETFs, including the current price, strike price, premium, option type, yield if exercised, and stop loss. The trades are designed to generate average monthly returns of over 3% while providing downside protection given current market volatility. A majority of the calls are written in-the-money to balance yield and protection of capital.