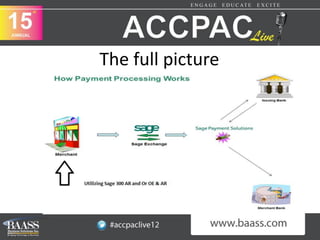

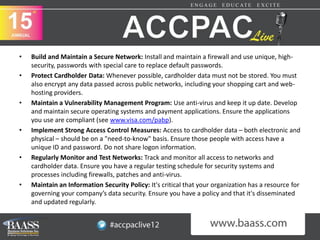

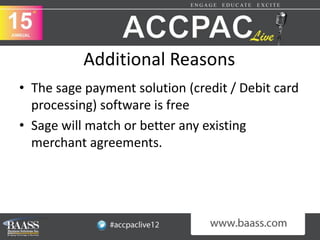

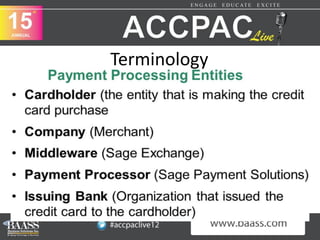

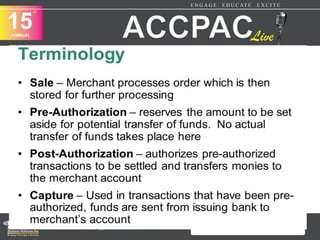

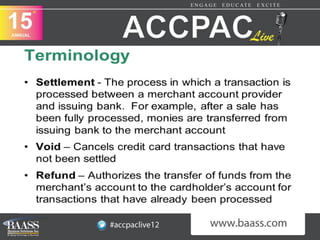

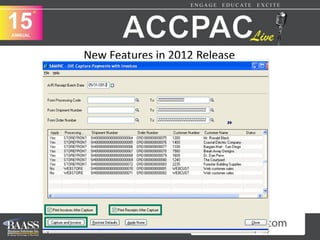

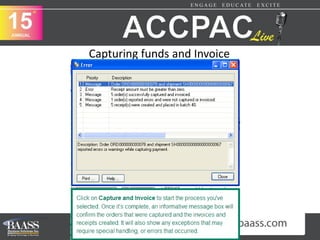

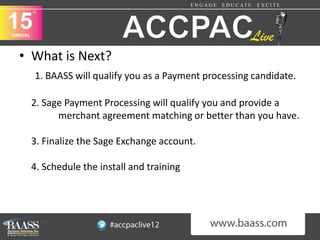

The document presents an overview of Sage Payment Solutions, highlighting benefits such as PCI DSS compliance, improved productivity, and cost savings by processing credit card payments directly within Sage ERP systems. It outlines the requirements of PCI DSS for payment data security and details the top reasons to choose Sage Payment Processing, including tight integration, compliance, and enhanced cash flow. The presentation concludes with steps for businesses to get qualified and set up with Sage Payment Solutions.