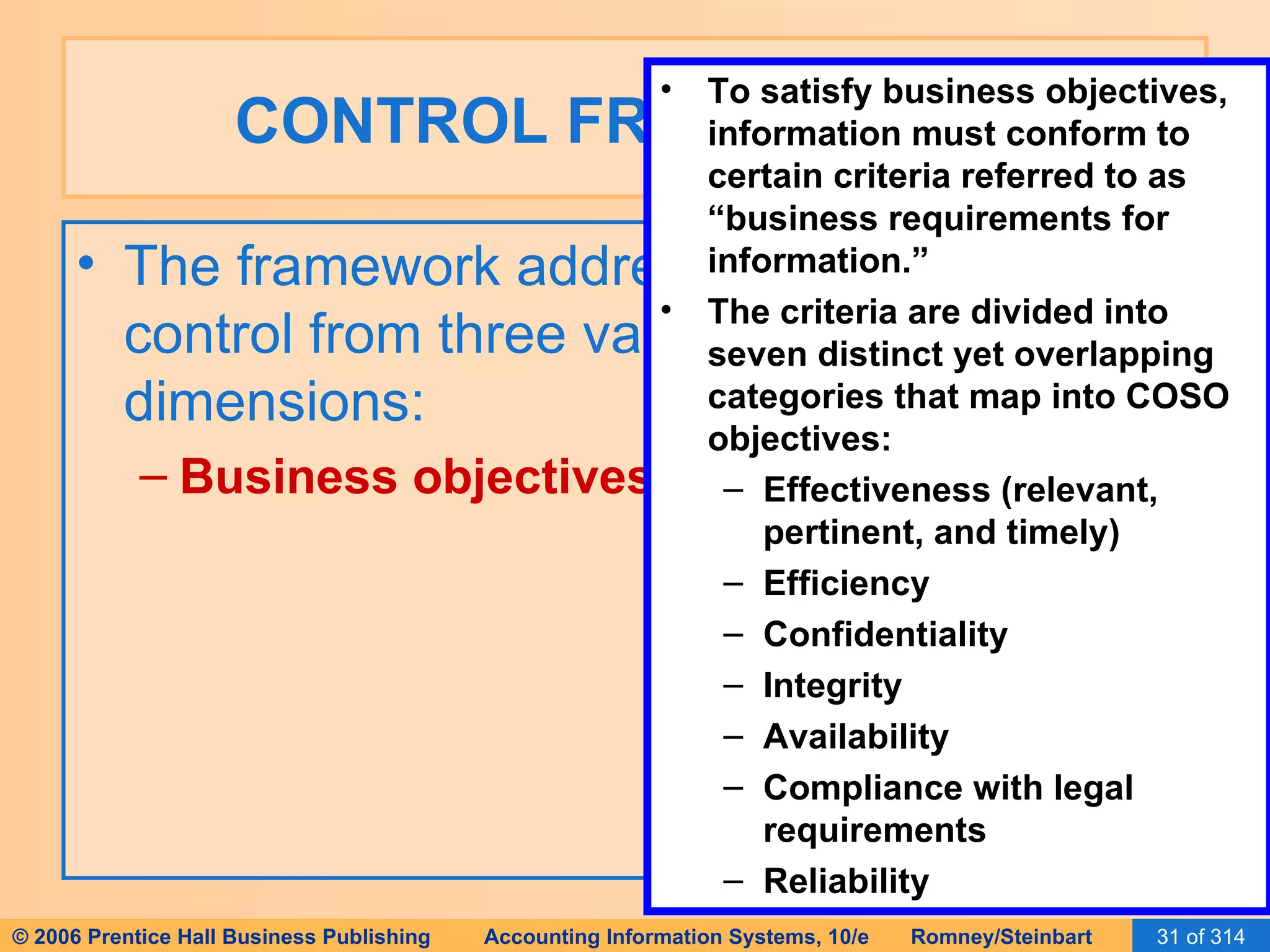

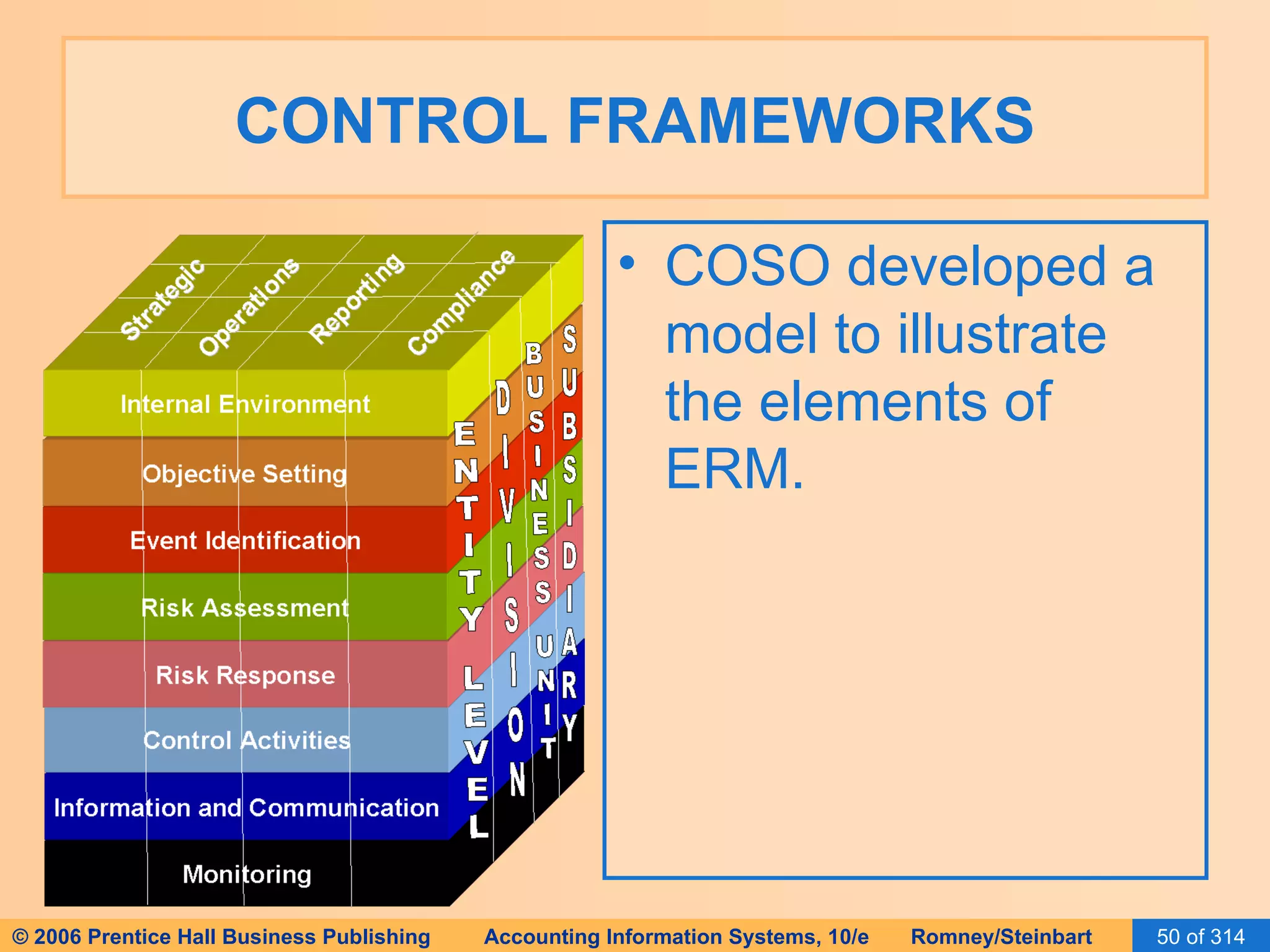

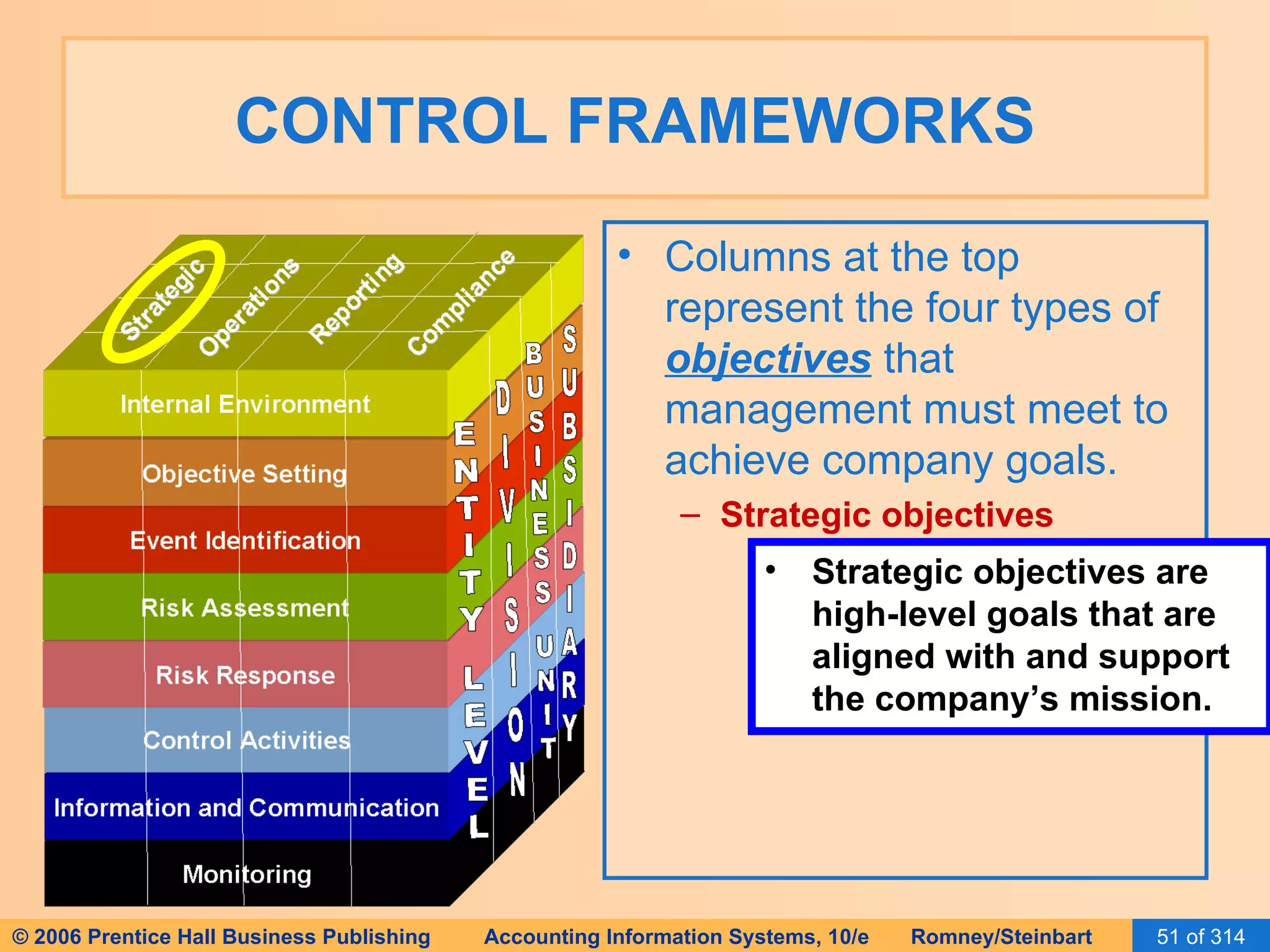

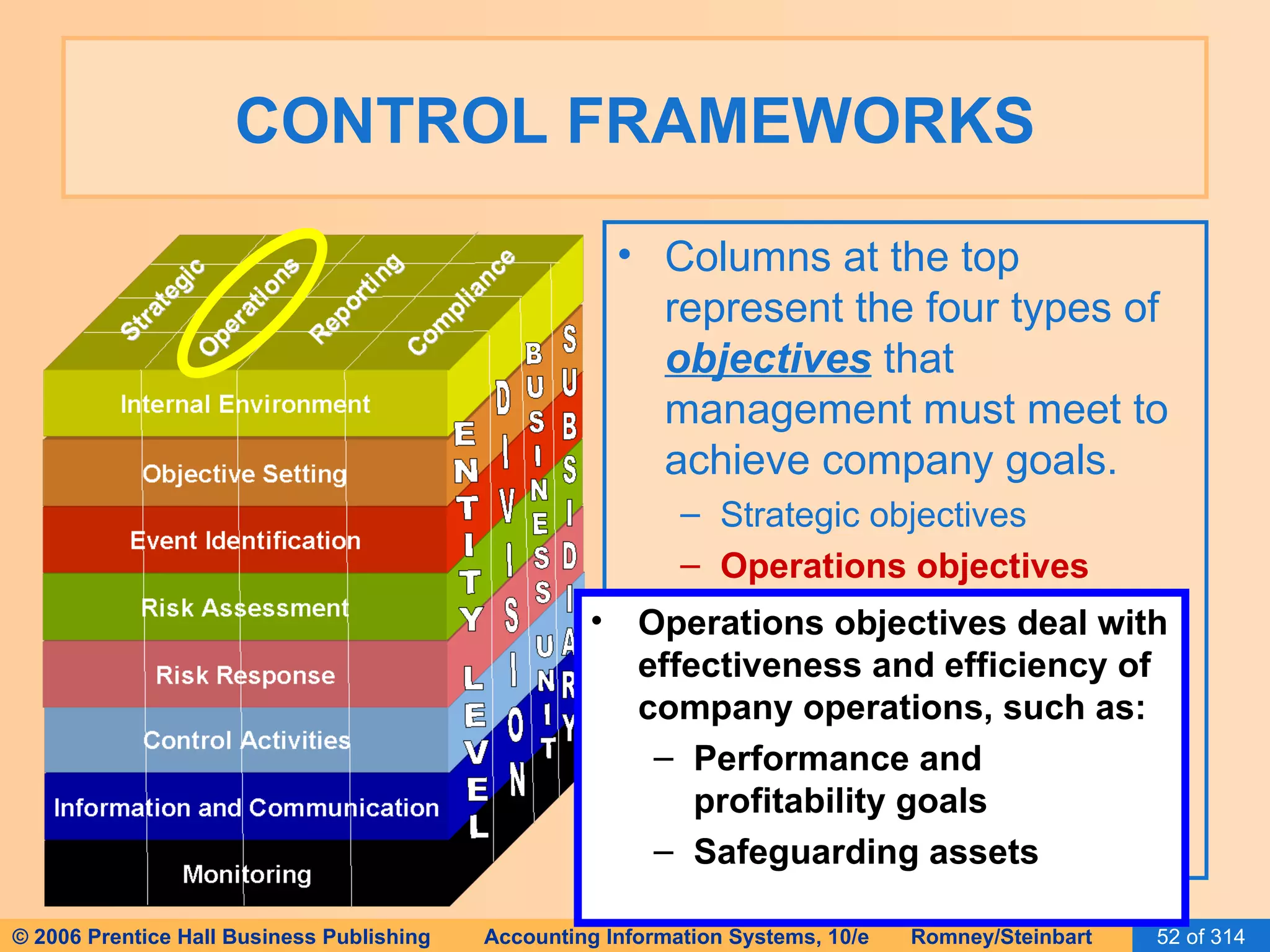

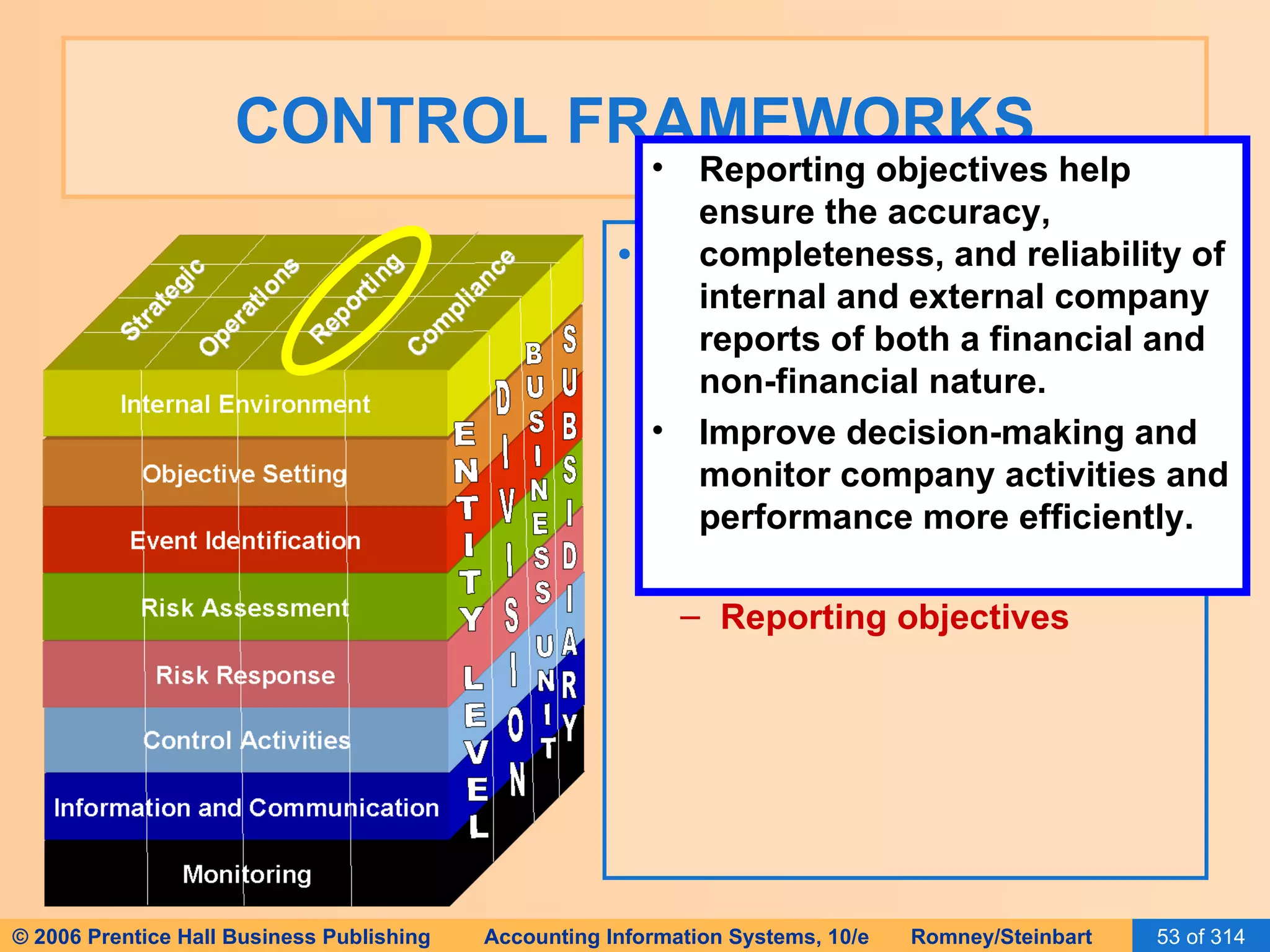

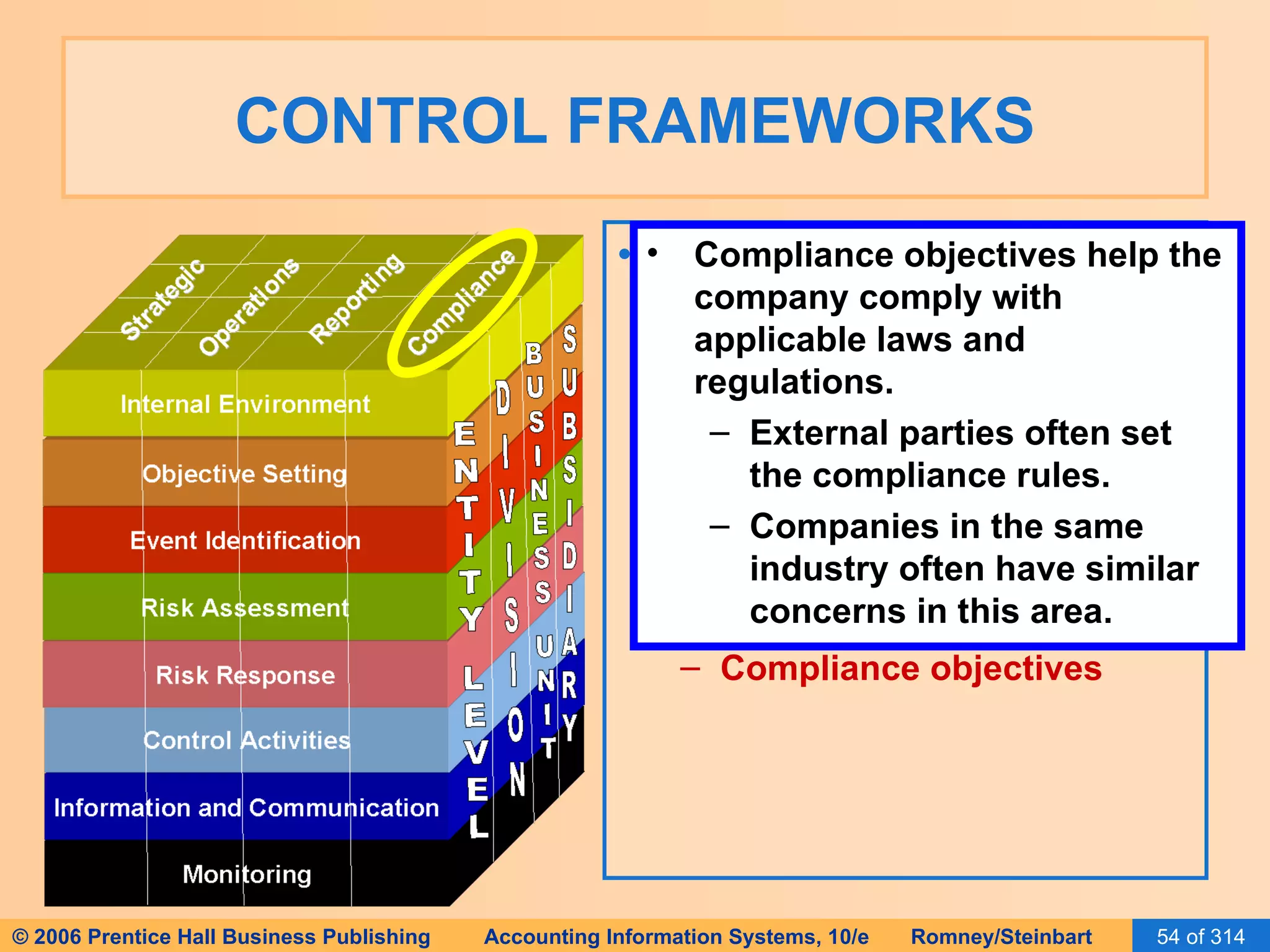

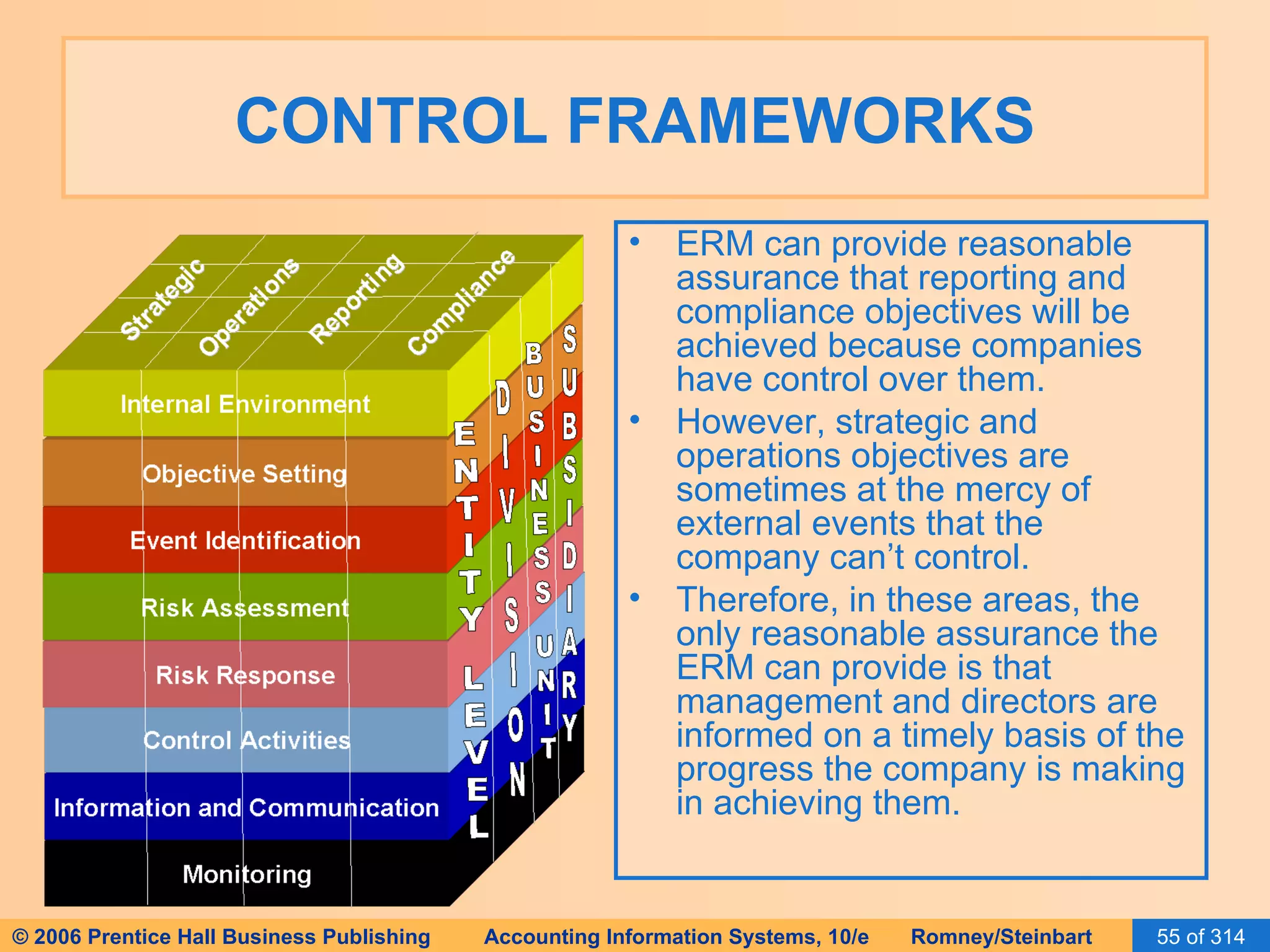

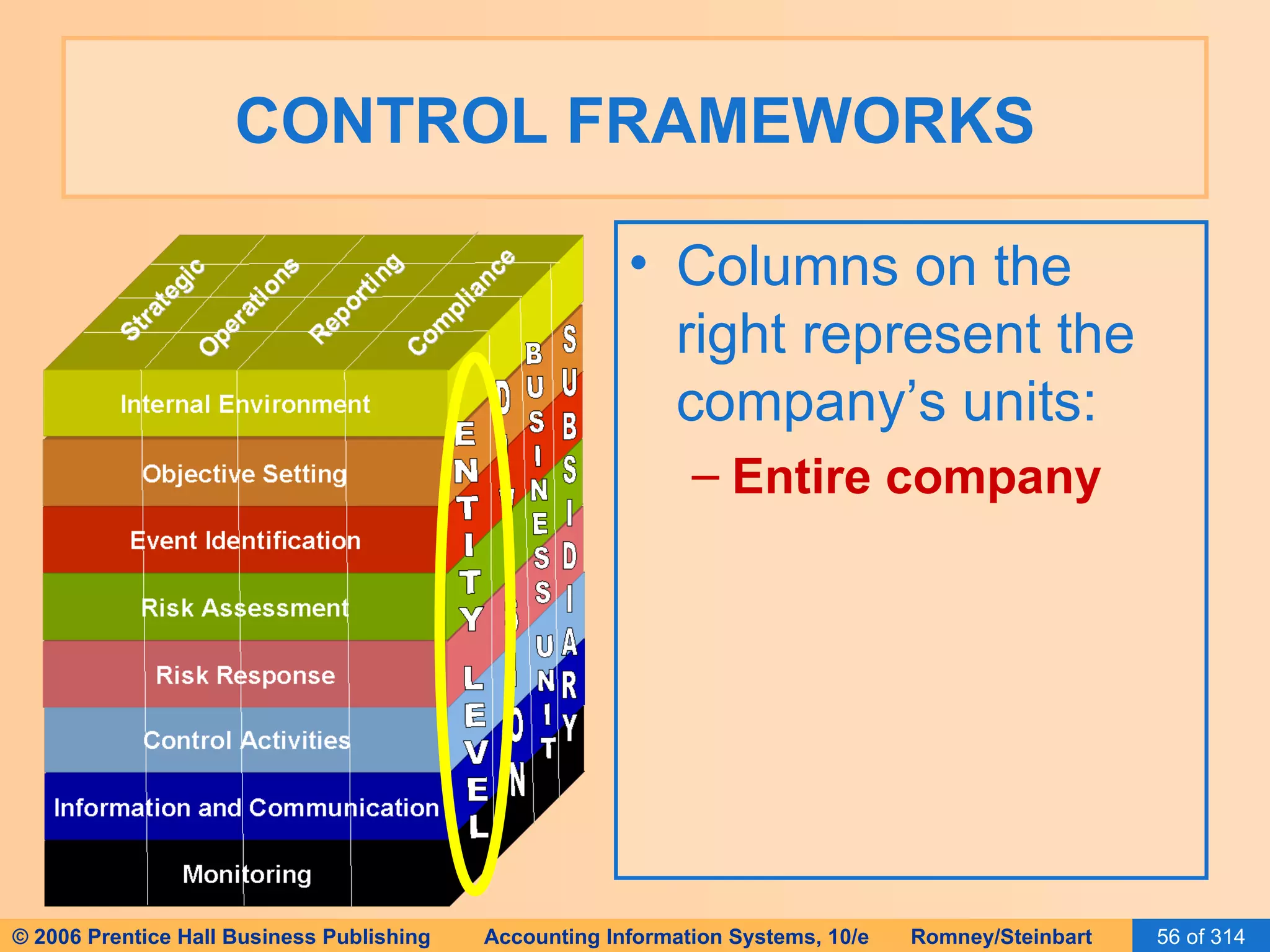

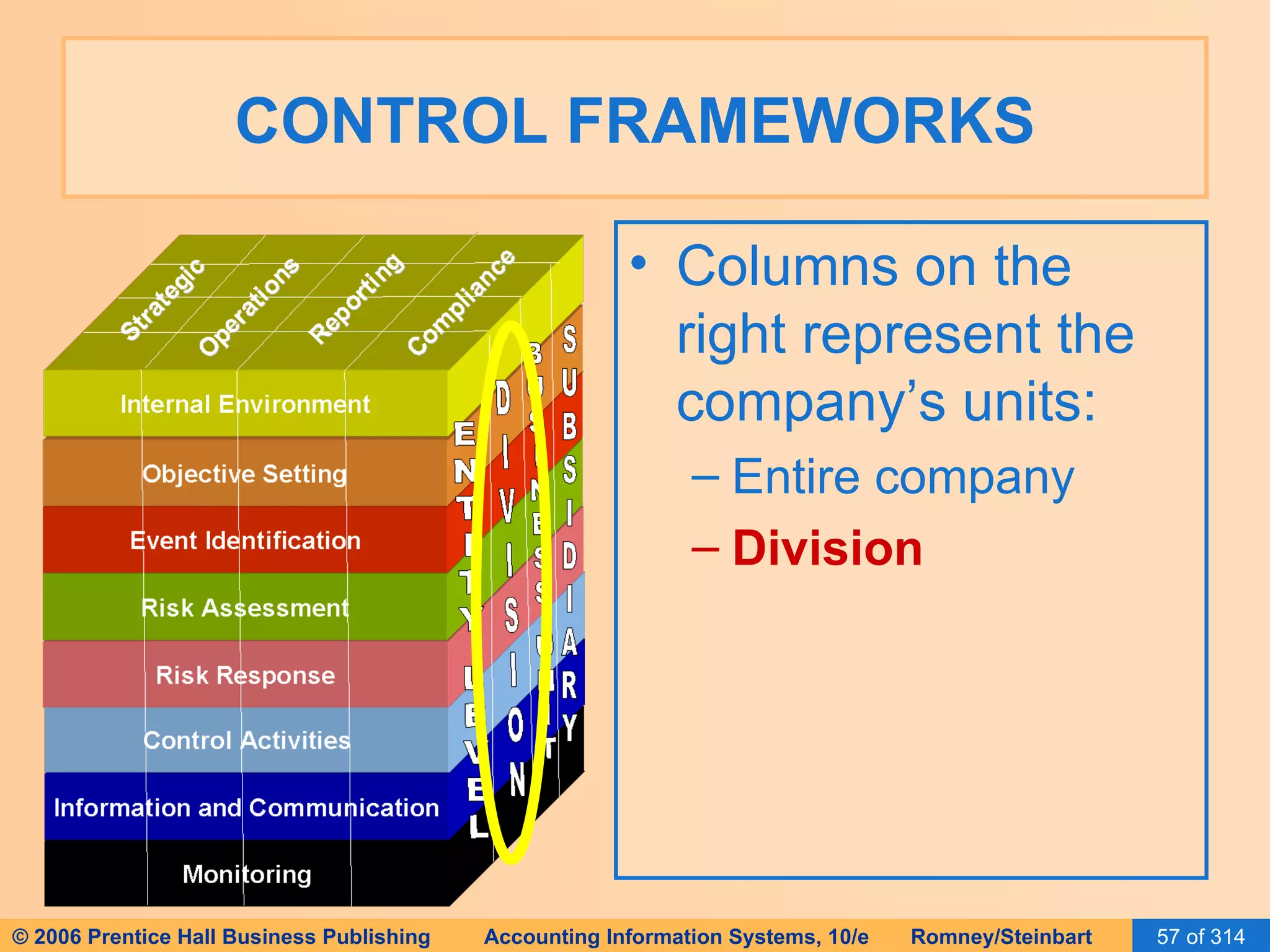

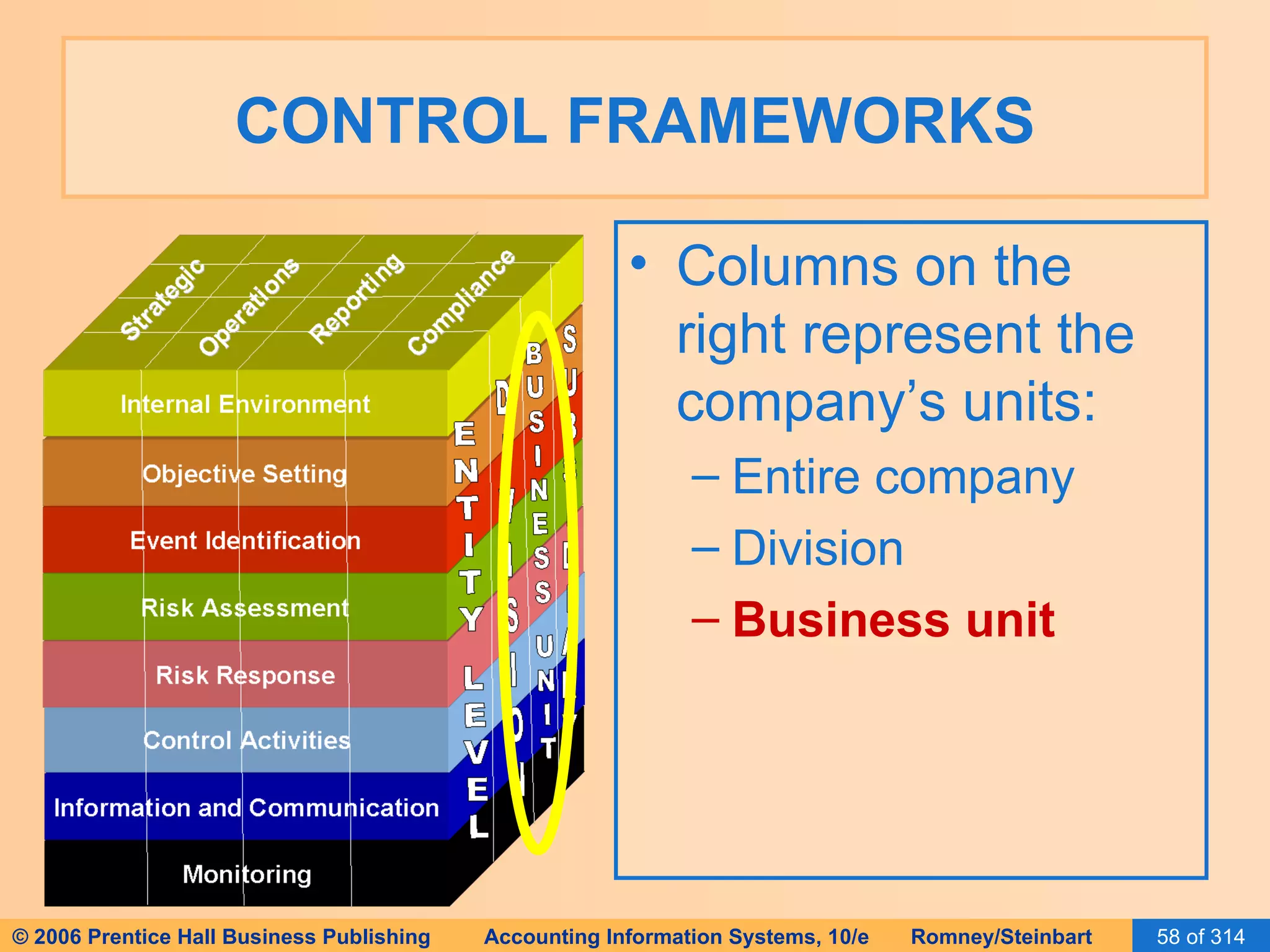

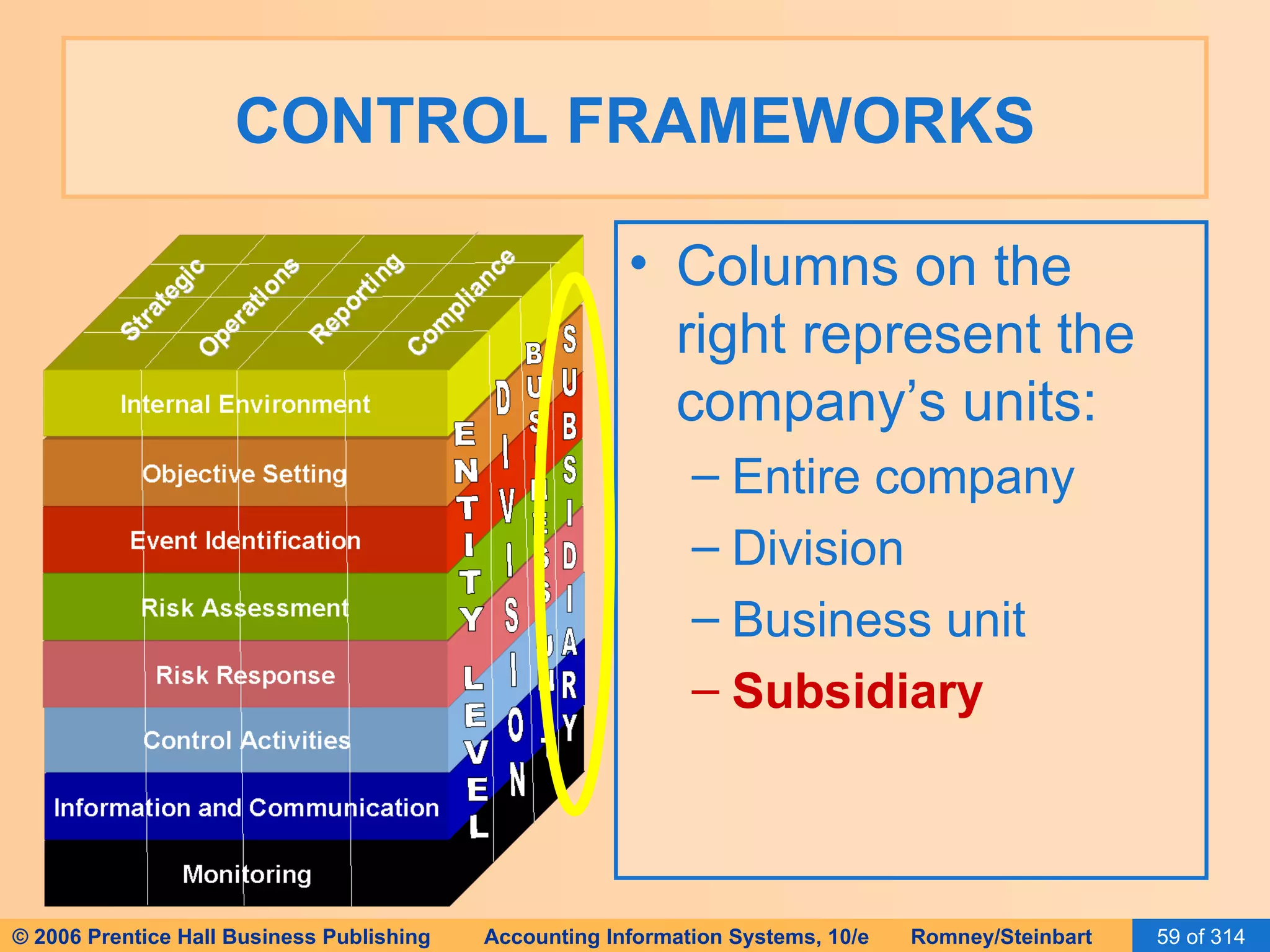

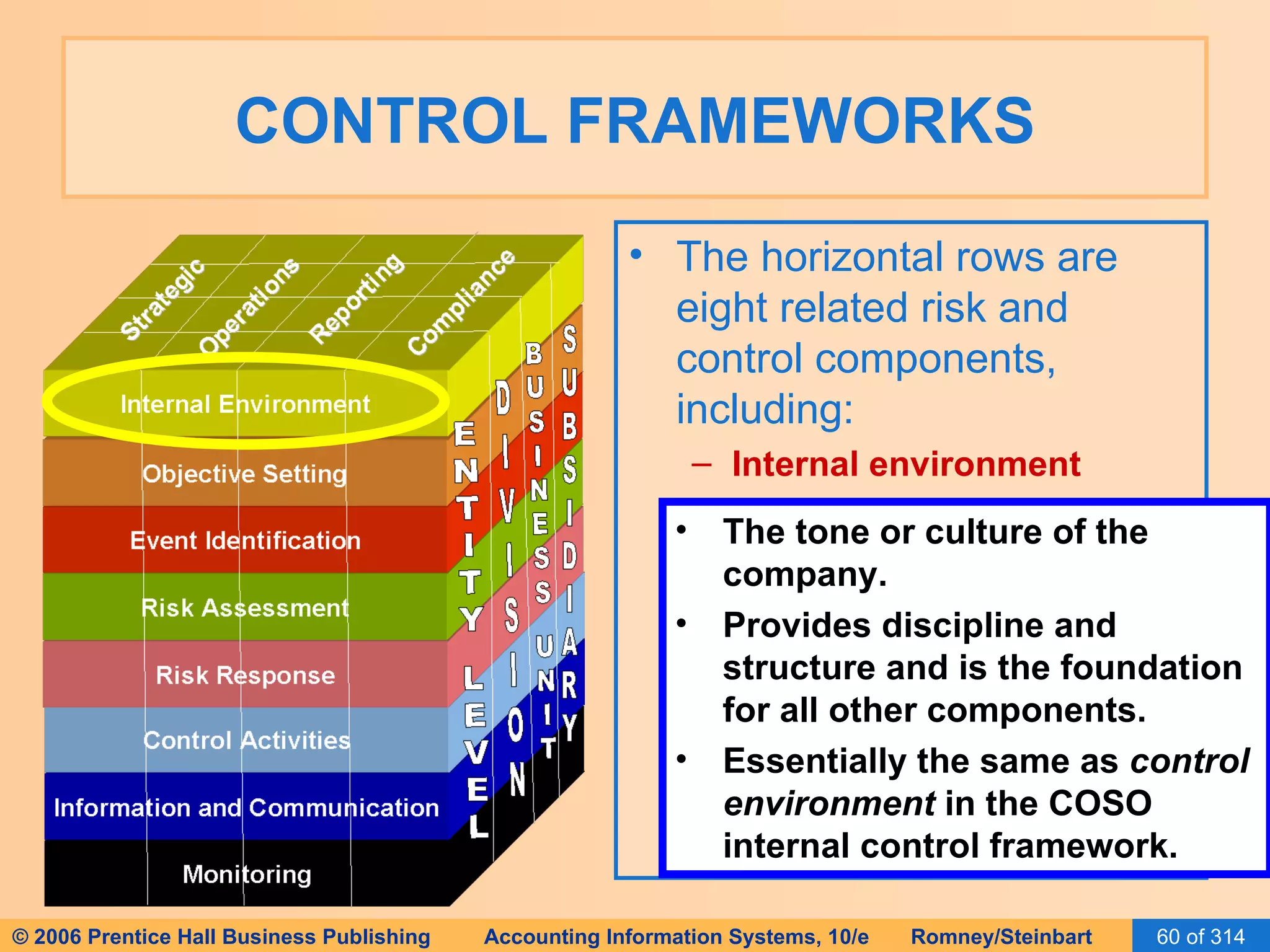

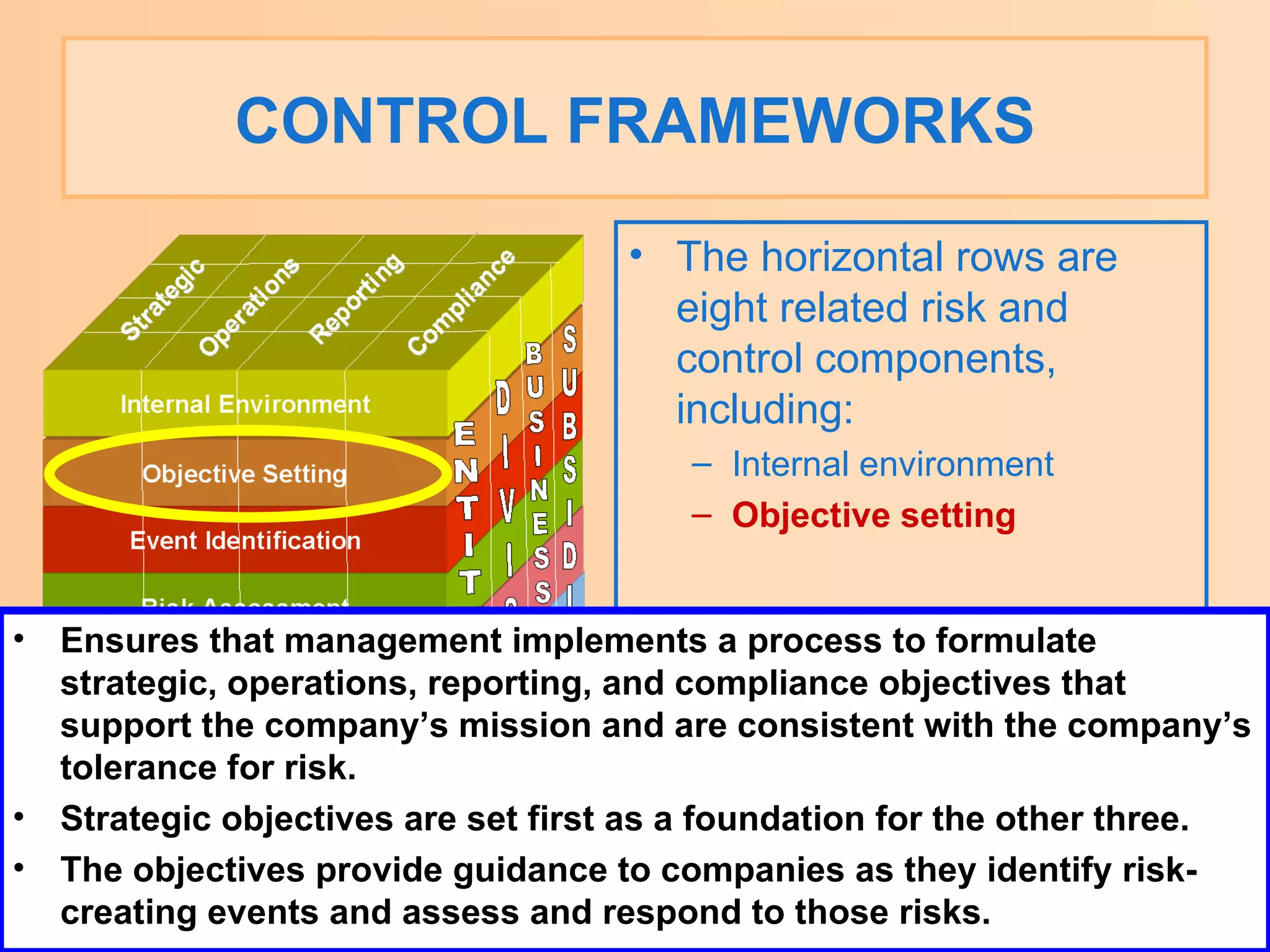

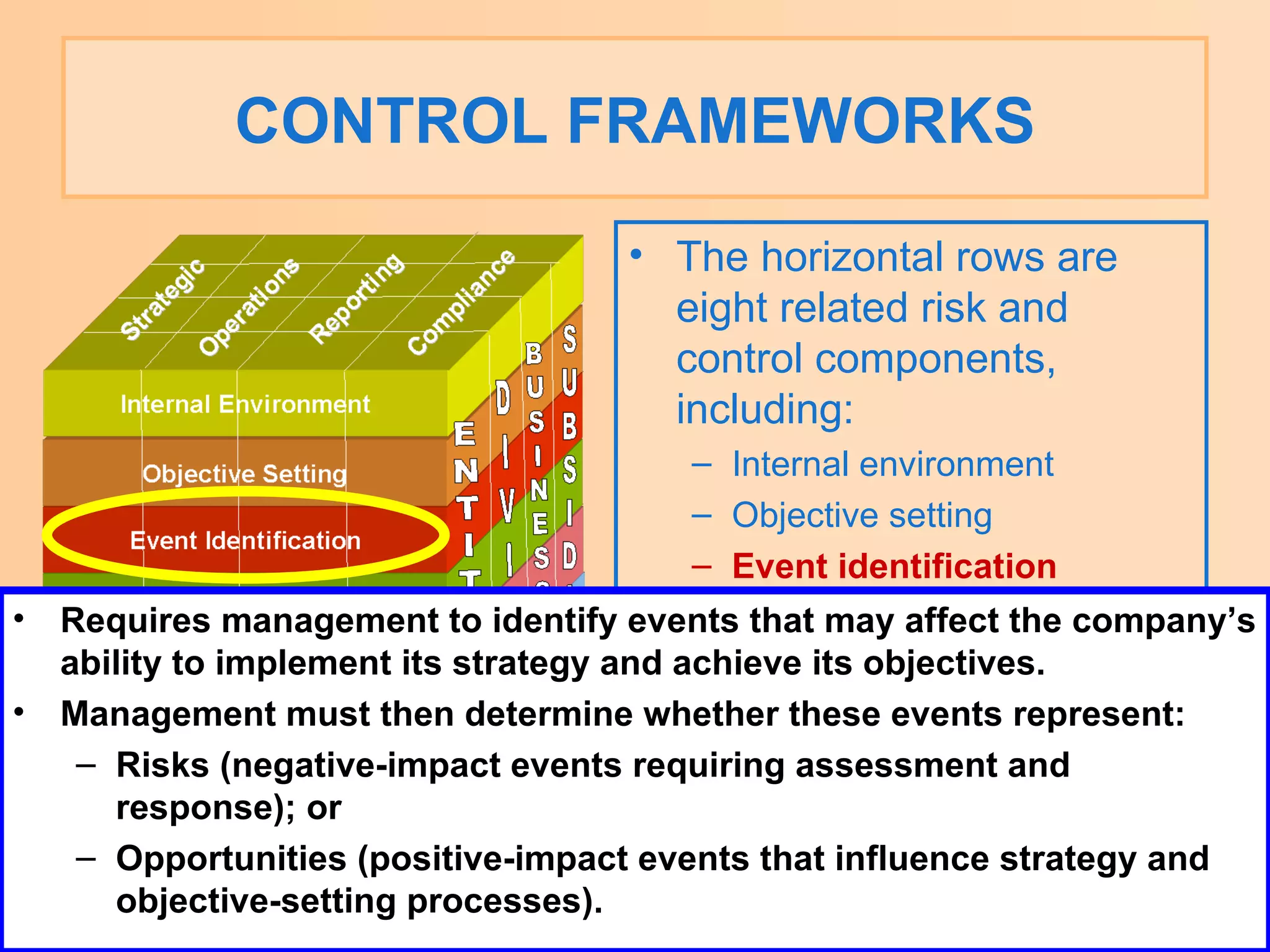

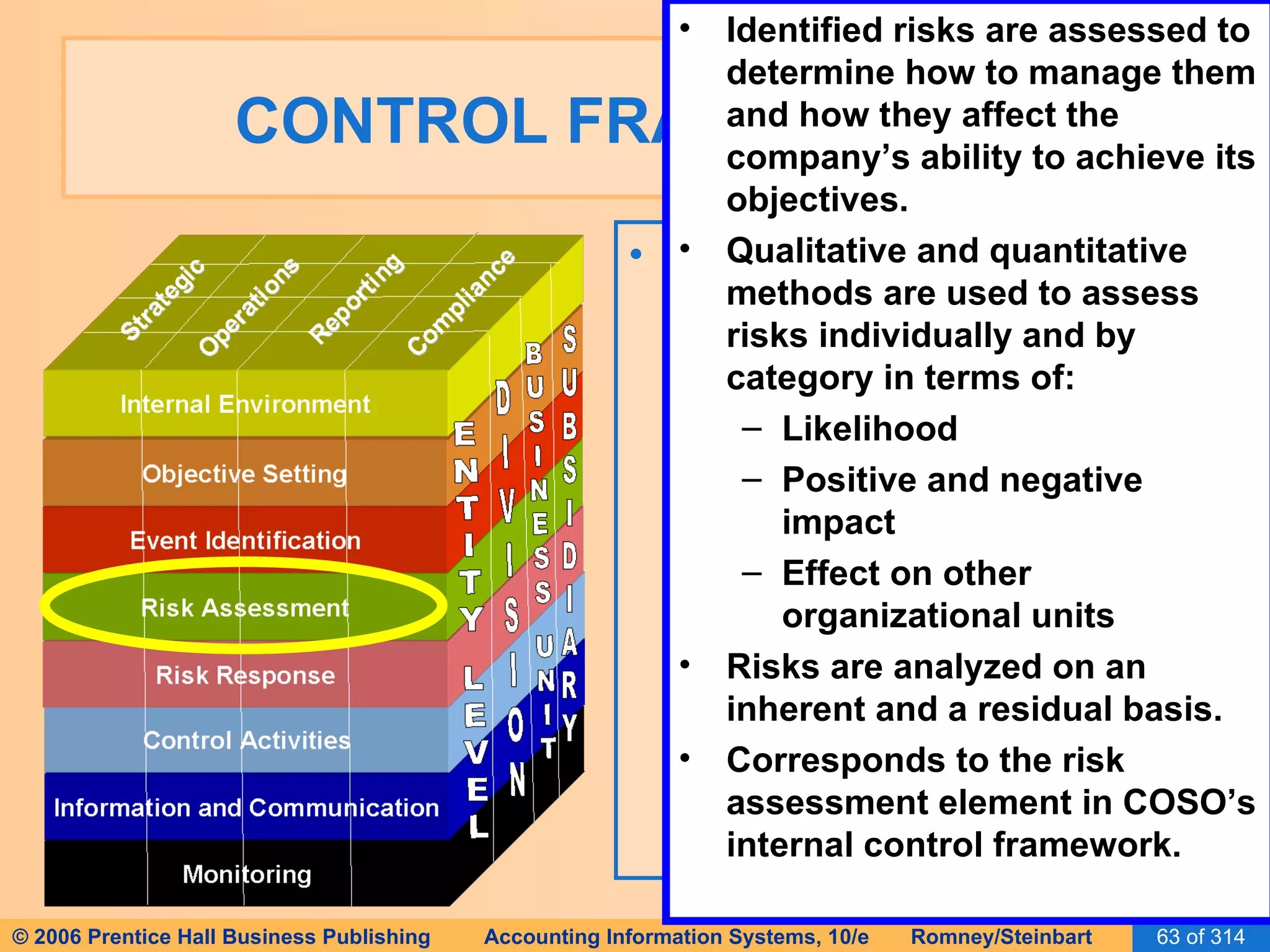

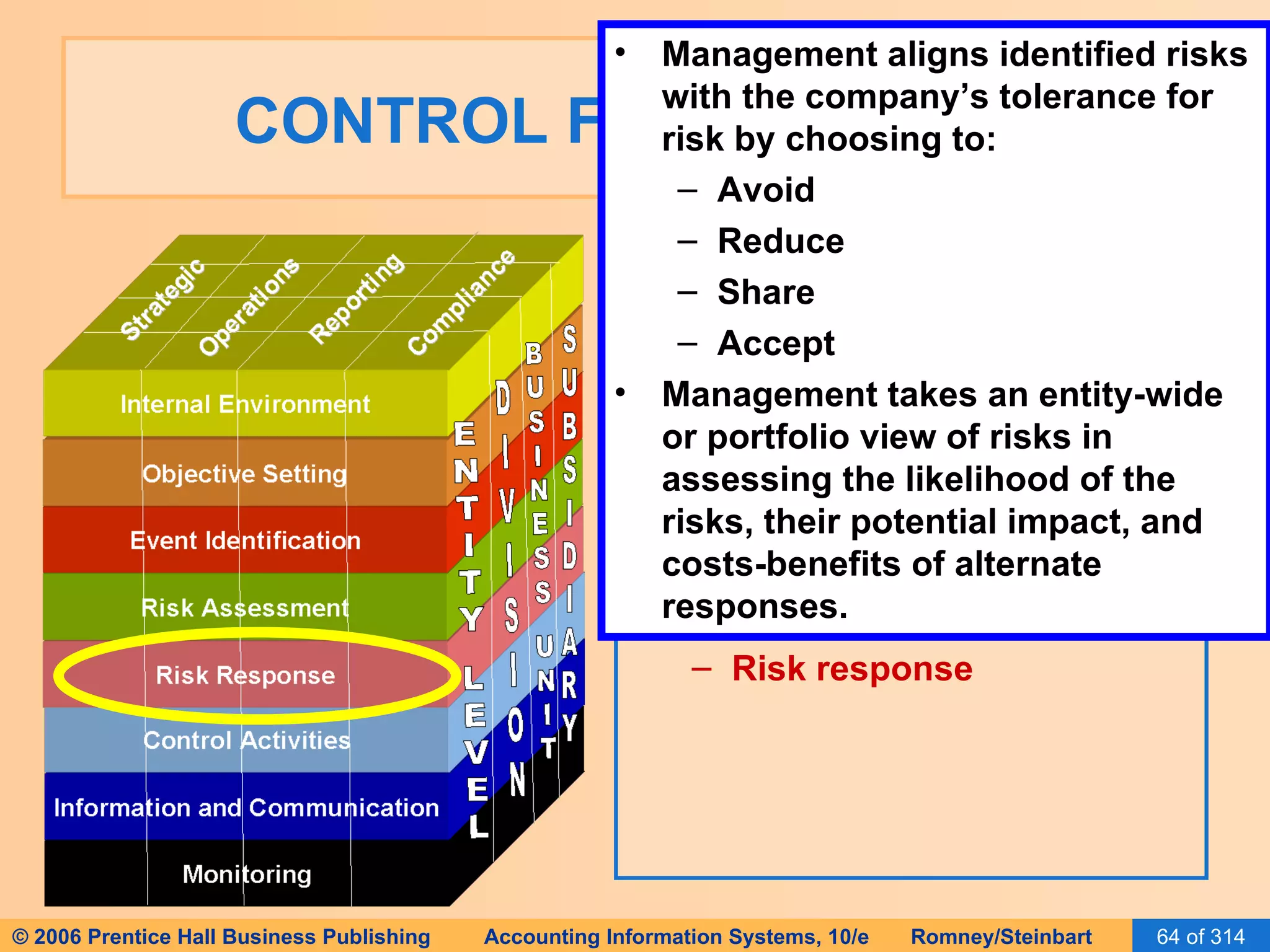

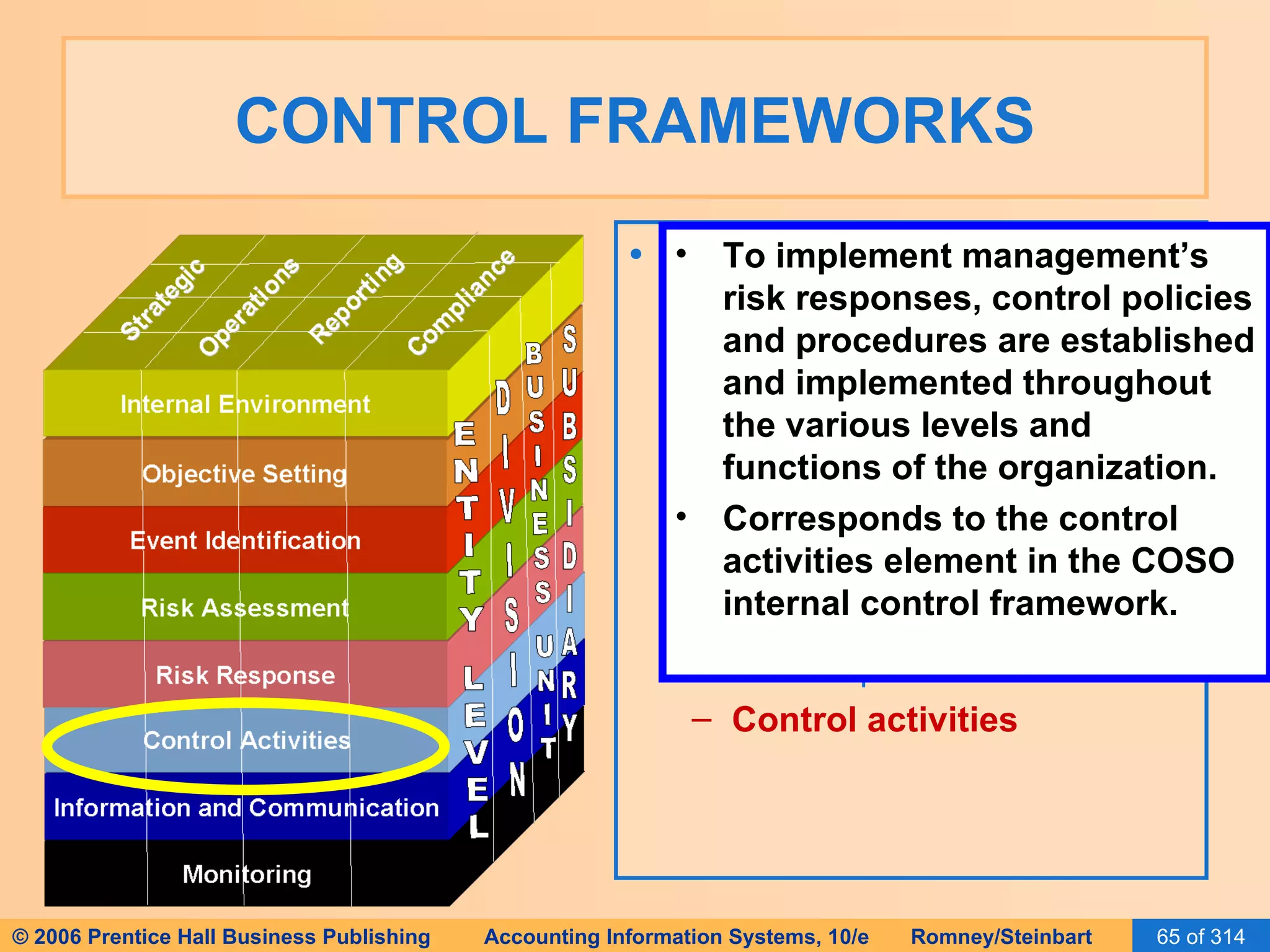

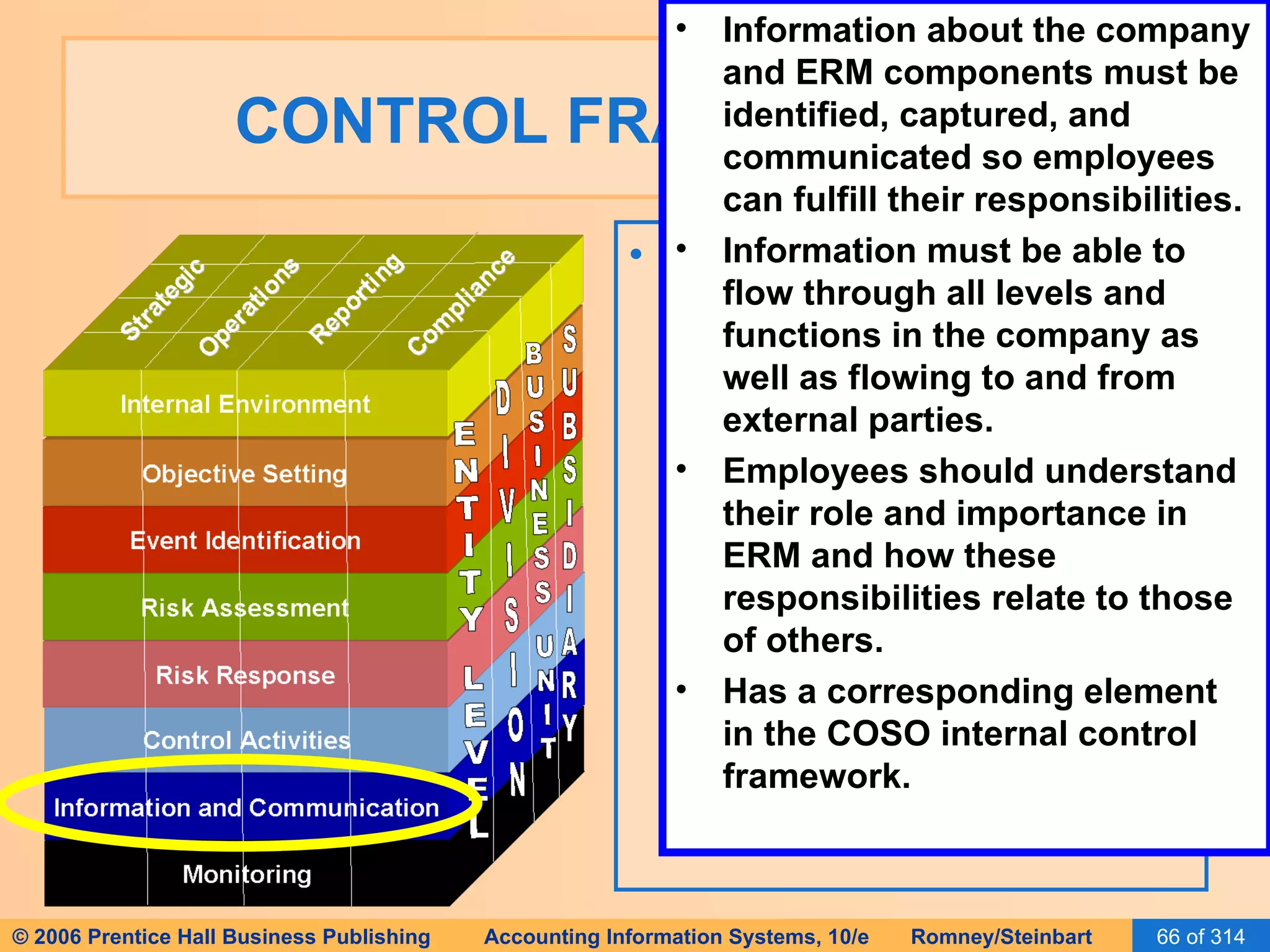

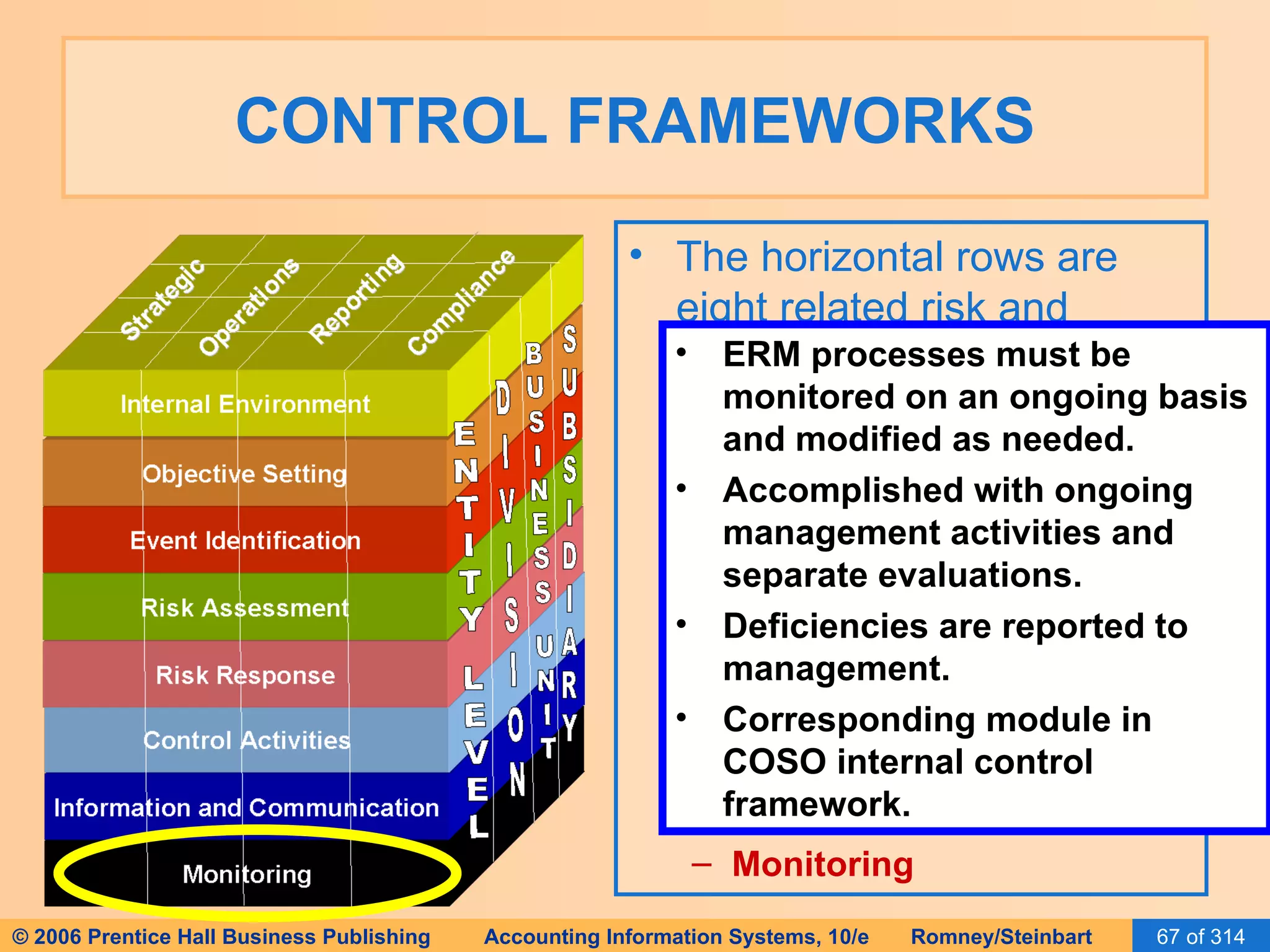

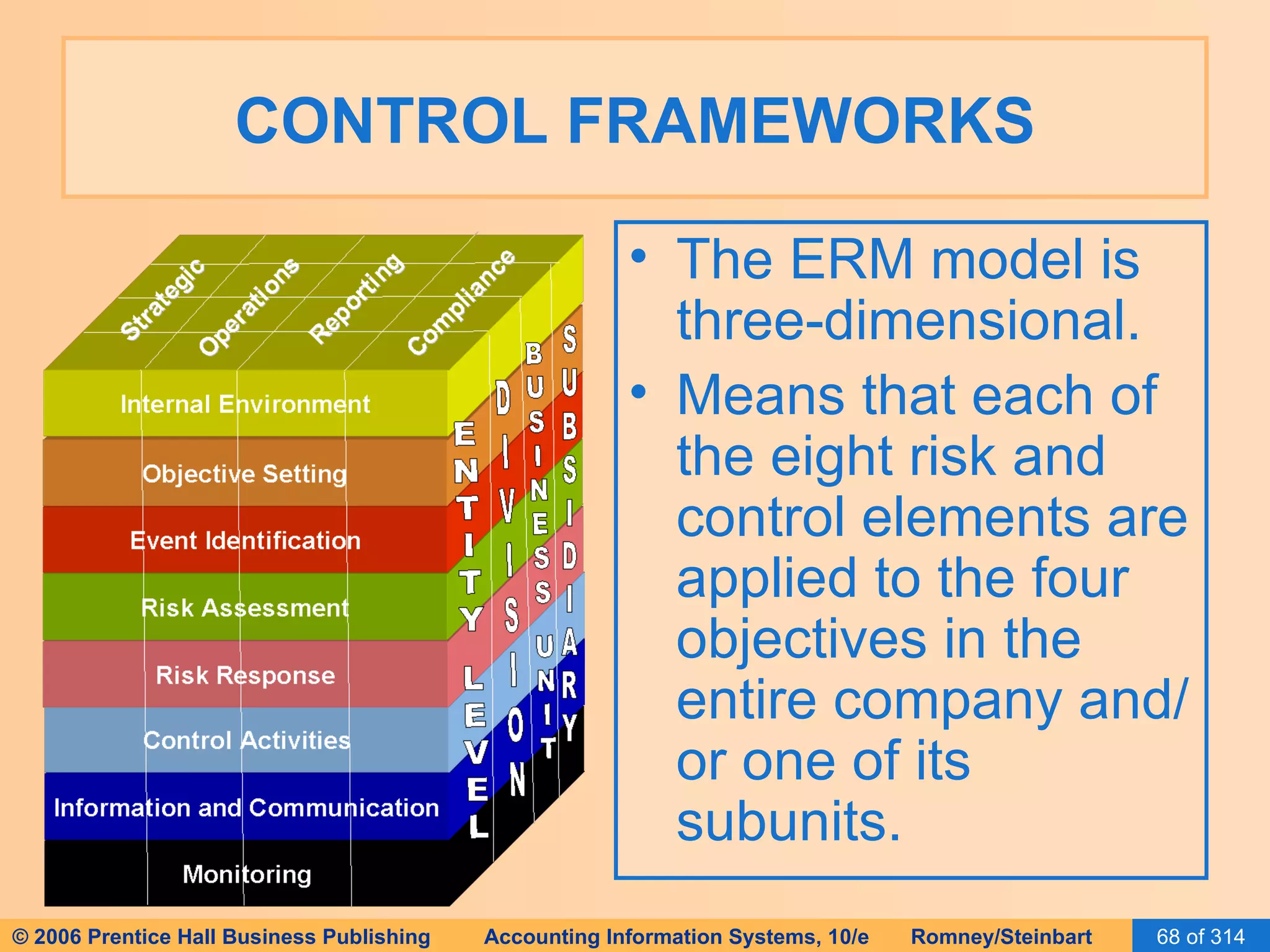

The document discusses internal control frameworks and concepts. It introduces three major control frameworks - COBIT, COSO, and COSO's Enterprise Risk Management framework. It describes the key components and objectives of internal control systems, including control environment, risk assessment, control activities, information and communication, and monitoring. The frameworks help companies develop effective internal control processes to achieve objectives and comply with laws and regulations.