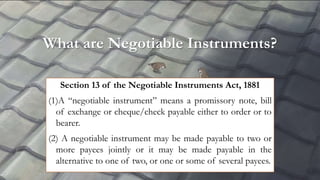

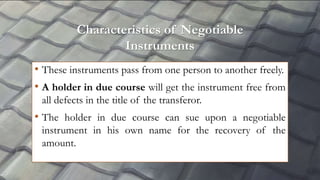

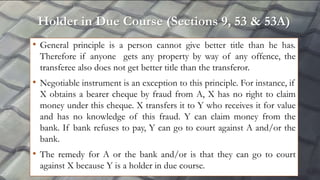

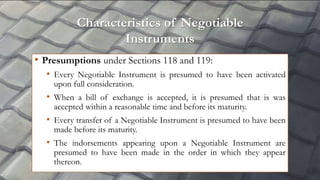

The document discusses the Law of Negotiable Instruments as defined by the Negotiable Instruments Act of 1881, which outlines promissory notes, bills of exchange, and cheques. It highlights the characteristics of negotiable instruments, such as their transferability and the rights of a holder in due course, who can recover amounts without defects from transferors. Key principles, presumptions, and exceptions to general transfer laws are also examined.