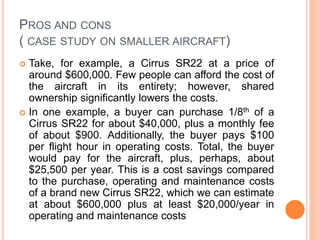

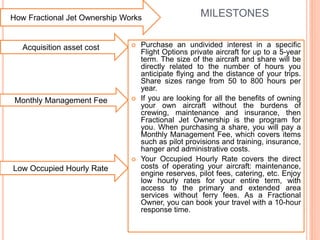

Fractional aircraft ownership allows individuals to purchase a share of an aircraft at a lower upfront cost than full ownership. Owners receive a fixed number of flight hours per year based on the size of their share and can use the aircraft jointly with other owners. While scheduling can be restrictive, fractional ownership significantly reduces costs compared to renting or full ownership. It provides aircraft access without the responsibilities of maintenance, insurance, and crew that full ownership requires.