More Related Content

Similar to AES_111403 (20)

AES_111403

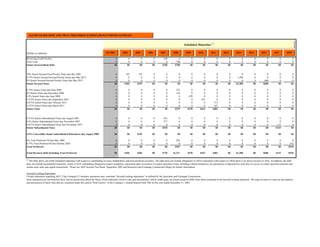

- 1. AES RECOURSE DEBT AND TRUST PREFERRED SCHEDULED MATURITIES SUMMARY

Scheduled Maturities (1)

Q4 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2027 2029

(Dollars in millions) Q4 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2027 2029

Revolving Credit Facility 0 0 0 0 250 0 0 0 0 0 0 0 0 0 0

Term Loan 0 0 0 0 0 700 0 0 0 0 0 0 0 0 0

Senior Secured Bank Debt $0 $0 $0 $0 $250 $700 $0 $0 $0 $0 $0 $0 $0 $0 $0

10% Senior Secured First Priority Notes due Dec 2005 0 103 155 0 0 0 0 0 0 0 0 0 0 0 0

8.75% Senior Secured Second Priority Notes due May 2013 0 0 0 0 0 0 0 0 0 0 1,200 0 0 0 0

9% Senior Secured Second Priority Notes due May 2015 0 0 0 0 0 0 0 0 0 0 0 0 600 0 0

Senior Secured Notes $0 $103 $155 $0 $0 $0 $0 $0 $0 $0 $1,200 $0 $600 $0 $0

8.75% Senior Notes due June 2008 0 0 0 0 0 223 0 0 0 0 0 0 0 0 0

8% Senior Notes due December 2008 0 0 0 0 0 156 0 0 0 0 0 0 0 0 0

9.5% Senior Notes due June 2009 0 0 0 0 0 0 470 0 0 0 0 0 0 0 0

9.375% Senior Notes due September 2010 0 0 0 0 0 0 0 423 0 0 0 0 0 0 0

8.875% Senior Notes due February 2011 0 0 0 0 0 0 0 0 313 0 0 0 0 0 0

8.375% Senior Notes due March 2011 0 0 0 0 0 0 0 0 167 0 0 0 0 0 0

Senior Notes $0 $0 $0 $0 $0 $379 $470 $423 $481 $0 $0 $0 $0 $0 $0

8.375% Senior Subordinated Notes due August 2007 0 0 0 0 243 0 0 0 0 0 0 0 0 0 0

8.5% Senior Subordinated Notes due November 2007 0 0 0 0 277 0 0 0 0 0 0 0 0 0 0

8.875% Senior Subordinated Notes due November 2027 0 0 0 0 0 0 0 0 0 0 0 0 0 115 0

Senior Subordinated Notes $0 $0 $0 $0 $520 $0 $0 $0 $0 $0 $0 $0 $0 $115 $0

4.5% Convertible Junior Subordinated Debentures due August 2005 $0 $0 $149 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

6% Trust Preferred VII due May 2008 0 0 0 0 0 292 0 0 0 0 0 0 0 0 0

6.75% Trust Preferred III due October 2029 0 0 0 0 0 0 0 0 0 0 0 0 0 0 518

Trust Preferred $0 $0 $0 $0 $0 $292 $0 $0 $0 $0 $0 $0 $0 $0 $518

Total Recourse Debt Including Trust Preferred $0 $103 $304 $0 $770 $1,371 $470 $423 $481 $0 $1,200 $0 $600 $115 $518

(1)

The table above sets forth scheduled maturities with respect to outstanding recourse indebtedness and trust preferred securities. The table does not include obligations of AES Corporation with respect to which there is no direct recourse to AES. In addition, the table

does not include unscheduled maturities. Some of AES' outstanding obligations require mandatory repayment upon occurrence of certain specified events, including without limitations, the generation of adjusted free cash flow in excess of certain specified amounts and

certain asset sales and capital transactions. Please see AES' Investor Fact Book, September 2003 and Securities and Exchange Commission filings for further information.

Forward Looking Statements

Certain statements regarding AES’ (quot;the Company'squot;) business operations may constitute “forward looking statements” as defined by the Securities and Exchange Commission.

Such statements are not historical facts, but are predictions about the future which inherently involve risks and uncertainties, which could cause our actual results to differ from those contained in the forward looking statement. We urge investors to read our descriptions

and discussions of these risks that are contained under the section “Risk Factors” in the Company’s Annual Report/Form 10K for the year ended December 31, 2002.

- 2. AES RECOURSE DEBT AND TRUST PREFERRED OUTSTANDING BALANCES SUMMARY

Balances (1)

Year End Balances (December 31)

as of

9/30/03 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2027 2029

(Dollars in millions) Jun-05 Jun-05

Revolving Credit Facility(2) $250 $250 $250 $250 $250 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Term Loan 700 700 700 700 700 700 0 0 0 0 0 0 0 0 0 0

Senior Secured Bank Debt $950 $950 $950 $950 $950 $700 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

10% Senior Secured First Priority Notes due Dec 2005 258 258 155 0 0 0 0 0 0 0 0 0 0 0 0 0

8.75% Senior Secured Second Priority Notes due May 2013 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 1,200 0 0 0 0 0

9% Senior Secured Second Priority Notes due May 2015 600 600 600 600 600 600 600 600 600 600 600 600 600 0 0 0

Senior Secured Notes $2,058 $2,058 $1,955 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $1,800 $600 $600 $0 $0 $0

8.75% Senior Notes due June 2008 223 223 223 223 223 223 0 0 0 0 0 0 0 0 0 0

8% Senior Notes due December 2008 156 156 156 156 156 156 0 0 0 0 0 0 0 0 0 0

9.5% Senior Notes due June 2009 470 470 470 470 470 470 470 0 0 0 0 0 0 0 0 0

9.375% Senior Notes due September 2010 423 423 423 423 423 423 423 423 0 0 0 0 0 0 0 0

8.875% Senior Notes due February 2011 313 313 313 313 313 313 313 313 313 0 0 0 0 0 0 0

8.375% Senior Notes due March 2011 (3) 167 167 167 167 167 167 167 167 167 0 0 0 0 0 0

Senior Notes $1,752 $1,752 $1,752 $1,752 $1,752 $1,752 $1,373 $903 $481 $0 $0 $0 $0 $0 $0 $0

8.375% Senior Subordinated Notes due August 2007 243 243 243 243 243 0 0 0 0 0 0 0 0 0 0 0

8.5% Senior Subordinated Notes due November 2007 277 277 277 277 277 0 0 0 0 0 0 0 0 0 0 0

8.875% Senior Subordinated Notes due November 2027 115 115 115 115 115 115 115 115 115 115 115 115 115 115 0 0

Senior Subordinated Notes $635 $635 $635 $635 $635 $115 $115 $115 $115 $115 $115 $115 $115 $115 $0 $0

4.5% Convertible Junior Subordinated Debentures due August 2005 149 149 149 0 0 0 0 0 0 0 0 0 0 0 0 0

6% Trust Preferred VII due May 2008 292 292 292 292 292 292 0 0 0 0 0 0 0 0 0 0

6.75% Trust Preferred III due October 2029 518 518 518 518 518 518 518 518 518 518 518 518 518 518 518 0

Trust Preferred $809 $809 $809 $809 $809 $809 $518 $518 $518 $518 $518 $518 $518 $518 $518 $0

Total Recourse Debt Including Trust Preferred (4) $6,354 $6,354 $6,251 $5,947 $5,947 $5,177 $3,806 $3,336 $2,913 $2,433 $2,433 $1,233 $1,233 $633 $518 $0

(1)

The table above sets forth the projected remaining debt balances with respect to AES' currently outstanding recourse indebtedness and trust preferred securities as of each date presented. The table assumes that: (i) AES incurs no other indebtedness and (ii) that only scheduled repayments are

made. While AES may incur other indebtedness and may make additional unscheduled repayments, it is not practicable to project the amount or timing of any such incurrence or repayments and accordingly no reconciliation is provided.

(2)

$250 million Letter of Credit Facility is reflected as fully drawn. On September 30, 2003, nothing was drawn and $77 million in letters of credit remained outstanding.

(3)

An exchange rate of £1.65030/US$1 for 9/30 2003 and beyond has been assumed for translating 8.375% Senior Notes maturing in February 2011.

(4)

This schedule does not include $14 million unamortized discount that is reflected in total recourse debt balance for 9/30/2003 in the AES consolidated balance sheet.

Forward Looking Statements

Certain statements regarding AES’ (quot;the Company'squot;) business operations may constitute “forward looking statements” as defined by the Securities and Exchange Commission

Such statements are not historical facts, but are predictions about the future which inherently involve risks and uncertainties, which could cause our actual results to differ from those contained in the forward looking statement. We urge investors to read our descriptions and discussions of these risks that are

contained under the section “Risk Factors” in the Company’s Annual Report/Form 10K for the year ended December 31, 2002.

- 3. AES RECOURSE DEBT AND TRUST PREFERRED OUTSTANDING BALANCES SUMMARY

$ in millions

Parent debt maturity profile at 12/31/02

1,800

1,600 26

1,400

1,200

1,000

460

800

1,499

600

850

400 518

754

750

665 599

149

200

231

155 125

103

0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Beyond

2015

Bank Loans 1st Priority Notes 2nd Priority Notes Senior Unsecured Senior Subordinated Junior Convertible TECONS

Parent debt maturity profile at 9/30/03

1,800

1,600

1,400

292

1,200

1,000

379

800

600 1,200

520

400 518

700 600

481

470

149 423

200

250

155 115

103

0

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Beyond

2015

Bank Loans 1st Priority Notes 2nd Priority Notes Senior Unsecured Senior Subordinated Junior Convertible TECONS