More Related Content

Similar to Bond immunization

Similar to Bond immunization (20)

Bond immunization

- 1. Bond Immunization

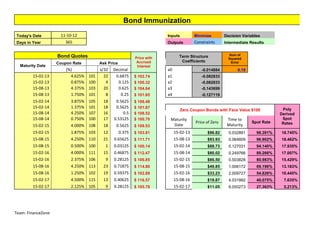

Today's Date 11-10-12 Inputs Minimize Decision Variables

Days in Year 365 Outputs Constraints Intermediate Results

Bond Quotes Sum of

Price with Term Structure Squared

Accrued Coefficients Error

Coupon Rate Ask Price

Maturity Date Interest

(%) x/32 Decimal a0 -0.014884 0.19

15-02-13 4.625% 101 22 0.6875 $ 102.74 a1 -0.082833

15-02-13 0.875% 100 4 0.125 $ 100.32 a2 -0.082833

15-08-13 4.375% 103 20 0.625 $ 104.64 a3 -0.143699

15-08-13 1.750% 101 8 0.25 $ 101.65 a4 -0.127119

15-02-14 3.875% 105 18 0.5625 $ 106.48

15-02-14 1.375% 101 18 0.5625 $ 101.87 Poly

Zero Coupon Bonds with Face Value $100

15-08-14 4.250% 107 16 0.5 $ 108.52 Derived

15-08-14 0.750% 100 17 0.53125 $ 100.70 Maturity Time to Spot

Price of Zero Spot Rate Rates

15-02-15 4.000% 108 18 0.5625 $ 109.53 Date Maturity

15-02-15 1.875% 103 12 0.375 $ 103.81 15-02-13 $96.82 0.032891 98.391% 18.745%

15-08-15 4.250% 110 21 0.65625 $ 111.71 15-08-13 $93.93 0.064609 96.902% 18.462%

15-08-15 0.500% 100 1 0.03125 $ 100.14 15-02-14 $88.73 0.127031 94.140% 17.935%

15-02-16 4.000% 111 15 0.46875 $ 112.47 15-08-14 $80.02 0.249766 89.266% 17.007%

15-02-16 2.375% 106 9 0.28125 $ 106.85 15-02-15 $66.50 0.503828 80.983% 15.429%

15-08-16 4.250% 113 23 0.71875 $ 114.80 15-08-15 $49.85 1.006172 69.196% 13.183%

15-08-16 1.250% 102 19 0.59375 $ 102.88 15-02-16 $33.23 2.009727 54.826% 10.445%

15-02-17 4.500% 115 13 0.40625 $ 116.57 15-08-16 $19.87 4.031992 40.075% 7.635%

15-02-17 2.125% 105 9 0.28125 $ 105.78 15-02-17 $11.05 8.050273 27.363% 5.213%

Team: FinanceZone

- 3. Cash Matching

Cash matching w/ Cash matching with

Cash Matching reinvestment at zero

rate

reinvestment (poly

spot rates)

Maturity Coupon Dirty Price Portfolio Portfolio Inputs Minimize

15-02-13 0.04625 $ 102.74 $ 101.08 $ 19.26 Outputs Constraints

15-02-13 0.00875 $ 100.32 $ 98.71 $ 18.81 Decision Variables

15-08-13 0.04375 $ 104.64 $ 101.39 $ 19.32 Intermediate Results

15-08-13 0.01750 $ 101.65 $ 98.50 $ 18.77

15-02-14 0.03875 $ 106.48 $ 100.24 $ 19.10

15-02-14 0.01375 $ 101.87 $ 95.90 $ 18.27

15-08-14 0.04250 $ 108.52 $ 96.87 $ 18.46

15-08-14 0.00750 $ 100.70 $ 89.89 $ 17.13

15-02-15 0.04000 $ 109.53 $ 88.70 $ 16.90 <===== Decision Variables

15-02-15 0.01875 $ 103.81 $ 84.07 $ 16.02

15-08-15 0.04250 $ 111.71 $ 77.30 $ 14.73

15-08-15 0.00500 $ 100.14 $ 69.30 $ 13.20

15-02-16 0.04000 $ 112.47 $ 61.66 $ 11.75

15-02-16 0.02375 $ 106.85 $ 58.58 $ 11.16

15-08-16 0.04250 $ 114.80 $ 46.00 $ 8.76

15-08-16 0.01250 $ 102.88 $ 41.23 $ 7.85

15-02-17 0.04500 $ 116.57 $ 31.90 $ 31.90

15-02-17 0.02125 $ 105.78 $ 28.95 $ 5.51

Total Cost 144428.7294 30526.16687 <===== Objective Function (Minimize)

CF from Portfolio CF from Portfolio

Date Obligation

15-02-13 10000 < $ 9,800.21 9961.94

15-08-13 5000 < $ 4,800.11 4961.92

15-02-14 40000 < $ 39,803.86 39962.63

15-08-14 7000 < $ 6,813.24 6964.42

15-02-15 80000 < $ 79,827.23 79967.08 <===== Cash Flow Constraints

15-08-15 12000 < $ 11,853.41 11972.07

15-02-16 50000 < $ 49,879.76 49977.09

15-08-16 6000 < $ 5,912.77 5983.38

15-02-17 15000 < $ 14,939.16 14962.59

Team: FinanceZone

- 4. Duration Front End

Duration Optimization Maturity Coupon Dirty Price Portfolio

Inputs Minimize 15-02-13 0.04625 $ 102.74 0

Outputs Constraints 15-02-13 0.00875 $ 100.32 0

Decision Variables 15-08-13 0.04375 $ 104.64 0

Intermediate Results 15-08-13 0.0175 $ 101.65 0

15-02-14 0.03875 $ 106.48 0

Date Obligation 15-02-14 0.01375 $ 101.87 0

15-02-13 10000 15-08-14 0.0425 $ 108.52 0

15-08-13 5000 15-08-14 0.0075 $ 100.70 0

15-02-14 40000 15-02-15 0.04 $ 109.53 0

15-08-14 7000 15-02-15 0.01875 $ 103.81 0

15-02-15 80000 15-08-15 0.0425 $ 111.71 0

15-08-15 12000 15-08-15 0.005 $ 100.14 0

15-02-16 50000 15-02-16 0.04 $ 112.47 0

15-08-16 6000 15-02-16 0.02375 $ 106.85 0

15-02-17 15000 15-08-16 0.0425 $ 114.80 0

15-08-16 0.0125 $ 102.88 0

15-02-17 0.045 $ 116.57 0

15-02-17 0.02125 $ 105.78 0

Objective 0

Constraint Portfolio = Obligation

PV PV = 5000

Constraints ======> dPV/da0 PV-1 = 33000

dPV/da1 PV-2 = -73000

dPV/da2 PV-3 = 68000

dPV/da3 PV-4 = -38000

dPV/da4 PV-4 = -9000

Team:FinanceZone

- 5. Results Table a0 a0-a1 a0-a2 a0-a3 a0-a4

Maturity Coupon Dirty Price Portfolio Portfolio Portfolio Portfolio Portfolio

15-02-13 0.04625 $ 102.74 $ 21,448.36 $ 1,029.12 $ 1,029.12 $ 286.35 $ 377.20

15-02-13 0.00875 $ 100.32 $ 3,962.43 $ 190.12 $ 190.12 $ 52.90 $ 69.69

15-08-13 0.04375 $ 104.64 $ 20,664.31 $ 991.50 $ 991.50 $ 275.88 $ 363.42

15-08-13 0.0175 $ 101.65 $ 8,029.56 $ 385.27 $ 385.27 $ 107.20 $ 141.21

15-02-14 0.03875 $ 106.48 $ 18,624.40 $ 893.63 $ 893.63 $ 248.65 $ 327.54

15-02-14 0.01375 $ 101.87 $ 6,323.06 $ 303.39 $ 303.39 $ 101.05 $ 111.20

15-08-14 0.0425 $ 108.52 $ 20,819.07 $ 998.93 $ 998.93 $ 277.95 $ 366.14

15-08-14 0.0075 $ 100.70 $ 3,409.18 $ 163.58 $ 163.58 $ 45.52 $ 59.96

15-02-15 0.04 $ 109.53 $ 19,777.05 $ 948.93 $ 948.93 $ 264.04 $ 347.81

15-02-15 0.01875 $ 103.81 $ 8,786.06 $ 421.57 $ 421.57 $ 117.30 $ 154.52

15-08-15 0.0425 $ 111.71 $ 21,430.07 $ 1,028.25 $ 1,028.25 $ 286.11 $ 376.88

15-08-15 0.005 $ 100.14 $ 2,260.23 $ 108.45 $ 108.45 $ 30.18 $ 39.75

15-02-16 0.04 $ 112.47 $ 20,306.66 $ 974.34 $ 974.34 $ 271.11 $ 357.13

15-02-16 0.02375 $ 106.85 $ 11,454.69 $ 549.61 $ 549.61 $ 152.93 $ 201.45

15-08-16 0.0425 $ 114.80 $ 22,023.09 $ 1,056.70 $ 1,056.70 $ 294.03 $ 387.31

15-08-16 0.0125 $ 102.88 $ 5,804.99 $ 278.53 $ 278.53 $ 77.50 $ 102.09

15-02-17 0.045 $ 116.57 $ 23,678.32 $ 1,136.12 $ 1,136.12 $ 316.12 $ 416.42

15-02-17 0.02125 $ 105.78 $ 10,146.85 $ 486.86 $ 486.86 $ 135.47 $ 178.45

Objective $ 248,948.39 $11,944.90 $ 11,944.90 $ 3,340.28 $ 4,378.16

Team:FinanceZone