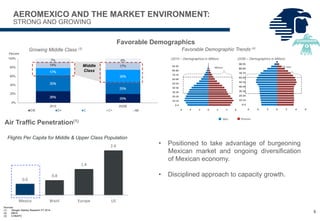

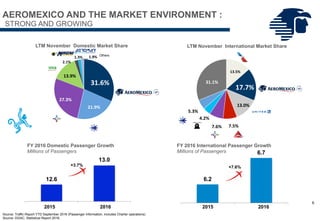

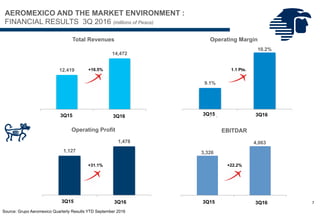

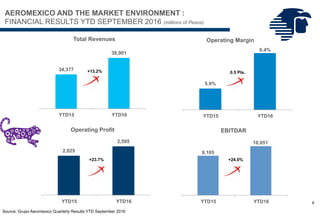

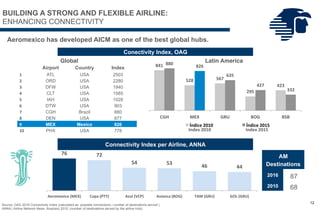

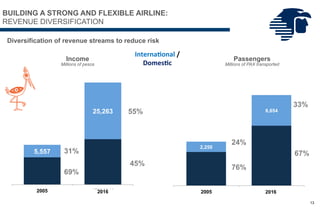

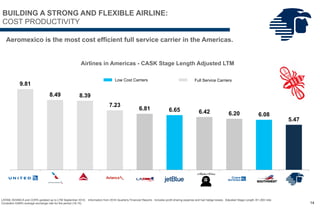

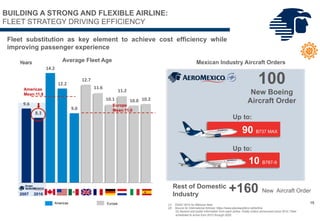

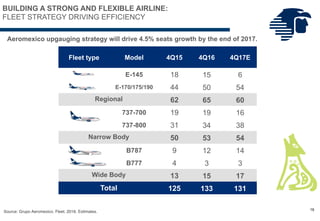

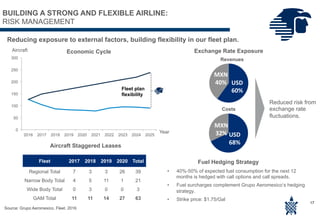

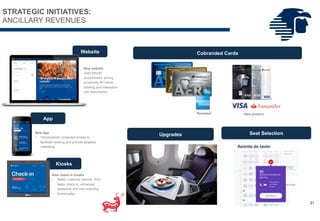

The document is an investor relations presentation for Aeromexico outlining its market environment, initiatives to build a strong and flexible airline, and strategic initiatives. It notes that Aeromexico is Mexico's only full-service carrier operating a hub in Mexico City with over 80 destinations. It highlights the airline's financial results, cost efficiency, fleet strategy, and risk management practices. It also discusses strategic partnerships with Delta and plans for Mexico City's new airport.