The document describes an industry-driven training program for MBA graduates to improve their employability. The key points are:

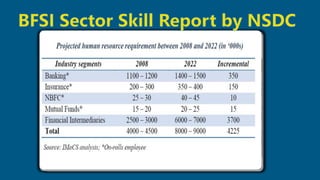

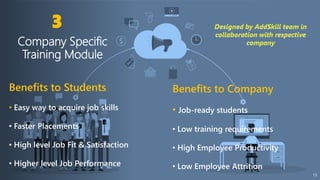

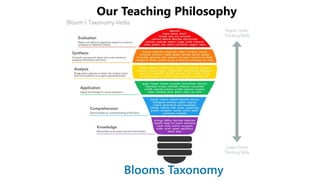

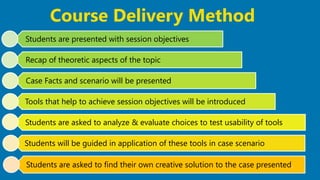

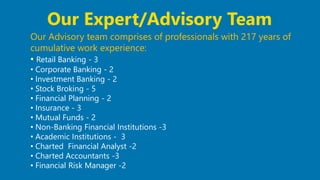

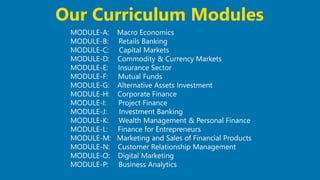

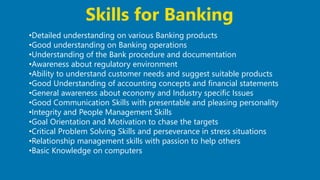

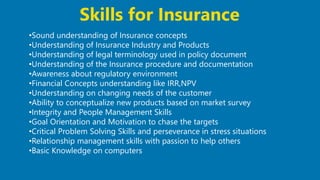

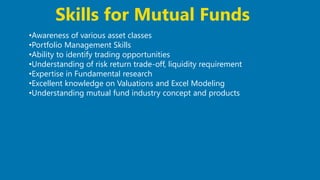

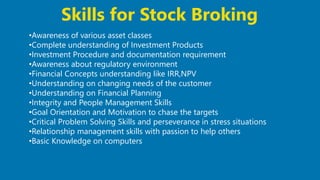

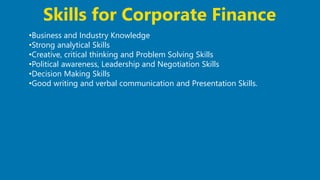

1. The program provides industry-driven curriculum, internships with industry professionals, and industry links for placements. The curriculum is designed based on industry requirements to provide hands-on experience.

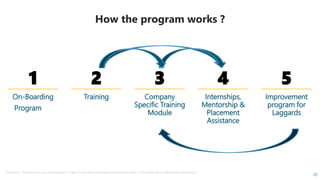

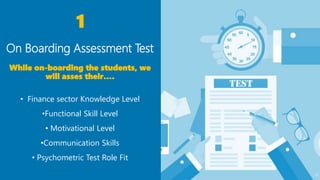

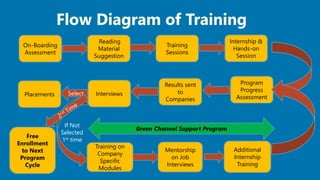

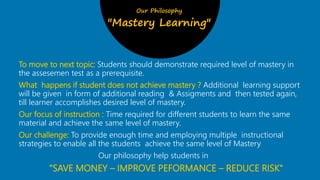

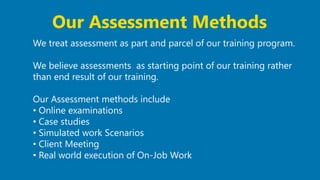

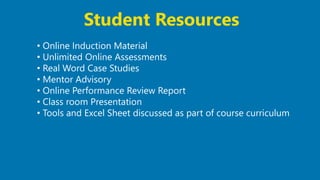

2. Students go through an onboarding assessment and then training modules specific to different industries. They receive internships, mentorship, and placement assistance. Additional support is given to students who need improvement.

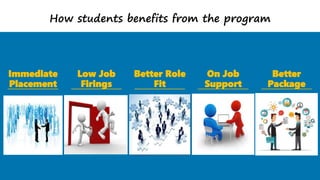

3. Benefits include acquiring in-demand job skills, faster placements, higher job satisfaction and performance. Companies benefit from qualified job-ready candidates with low training needs.