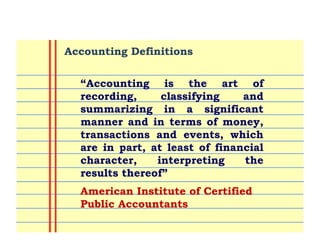

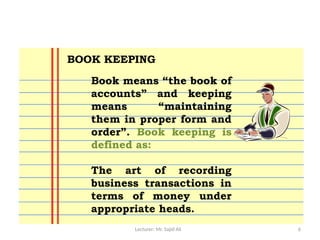

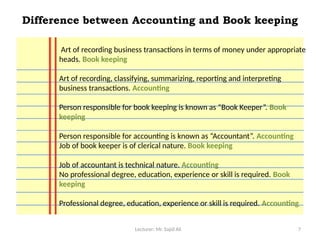

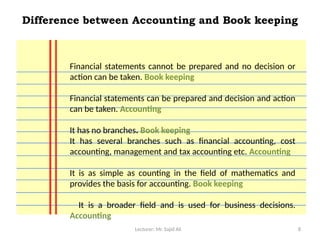

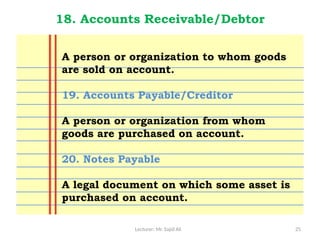

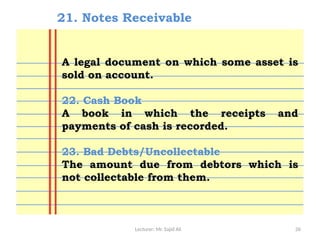

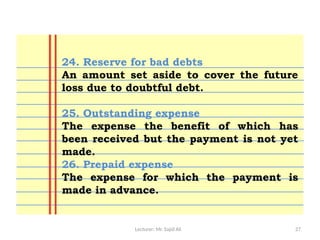

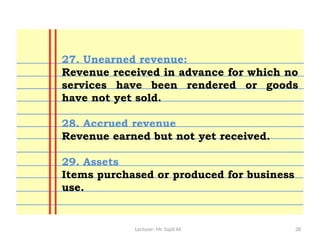

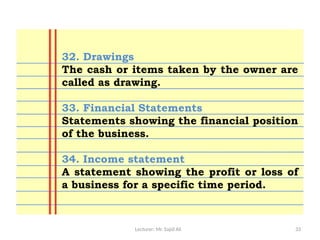

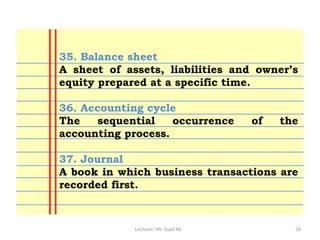

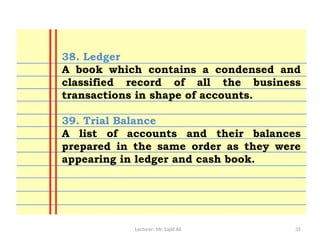

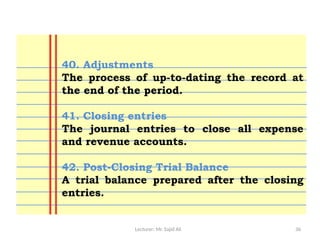

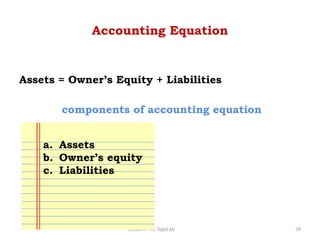

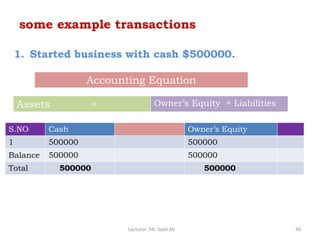

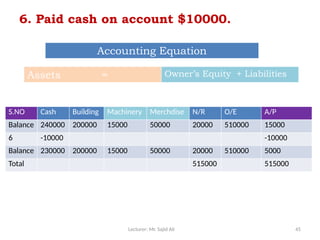

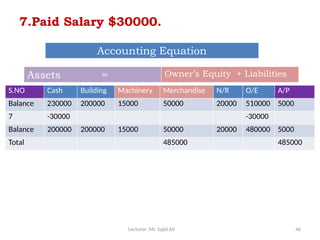

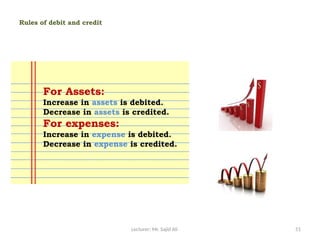

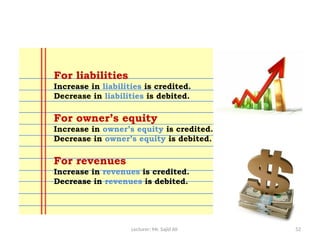

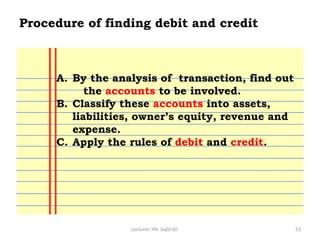

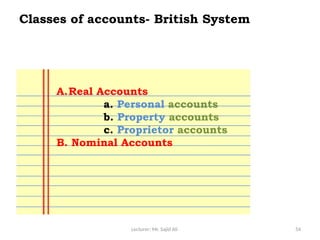

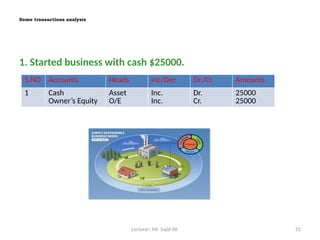

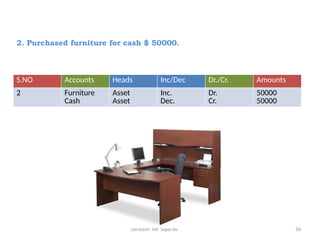

The document serves as an introductory lecture on principles of accounting, covering definitions, principles, and key concepts relevant to the field. It differentiates between accounting and bookkeeping, outlines various branches of accounting, and details fundamental accounting terminologies and practices. Additionally, the document explains the accounting cycle, fundamental accounting equations, and various types of financial statements.