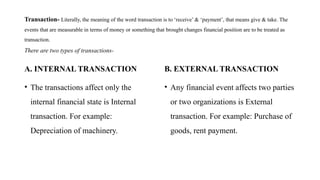

The document discusses the concept of transactions in accounting, defining them as measurable financial events that affect an entity's financial position, categorized into internal and external transactions. It highlights the accounting equation and how transactions impact assets, liabilities, and equity. Furthermore, it lists supporting documents that serve as evidence for business transactions.