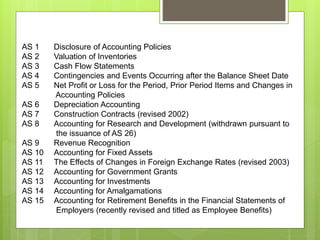

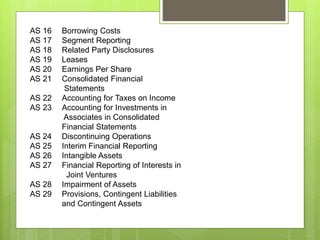

The document outlines the accounting standards in India. The Indian Chartered Accountants of India (ICAI) established the Accounting Standard Board (ASB) in 1977 to develop accounting standards. The ASB has since developed 29 accounting standards covering topics such as disclosure of accounting policies, valuation of inventories, cash flow statements, revenue recognition, fixed assets, foreign exchange rates, investments, amalgamations, employee benefits, borrowing costs, segment reporting, related party disclosures, leases, earnings per share, consolidated financial statements, taxes on income, discontinuing operations, interim financial reporting, intangible assets, interests in joint ventures, and impairment of assets. The document was compiled by Mr. Japan Shah of JMS Advisory