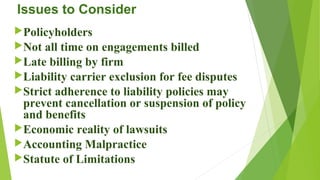

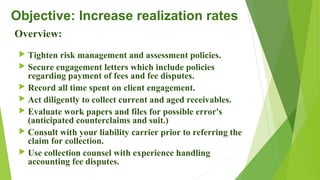

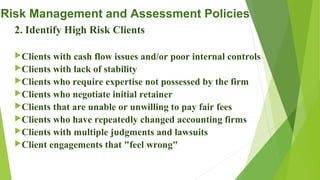

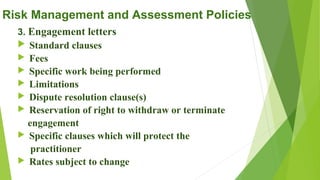

The document discusses ways for an accounting firm to improve their realization rates, which are the percentage of billed fees that are actually collected, by tightening risk management policies, using engagement letters that outline payment policies, diligently recording all time spent on clients, actively pursuing collections, and consulting liability insurers before taking legal action over unpaid fees.