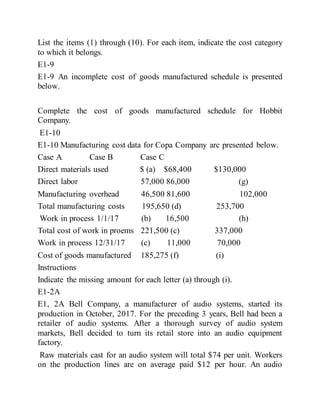

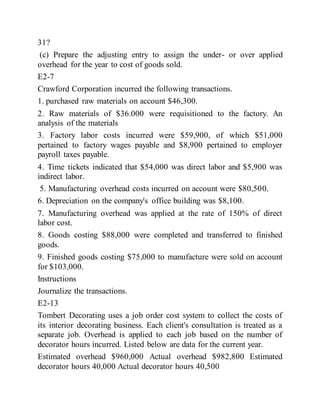

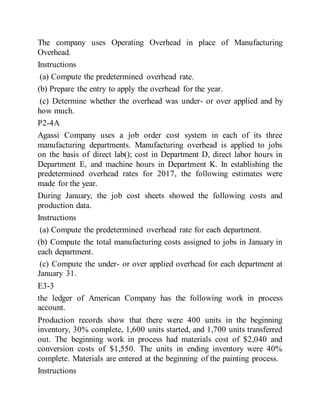

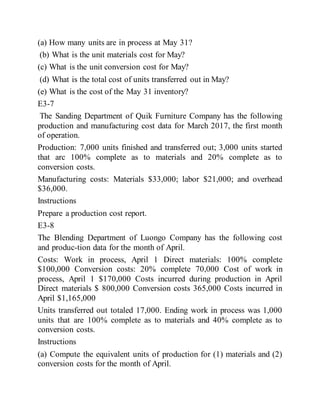

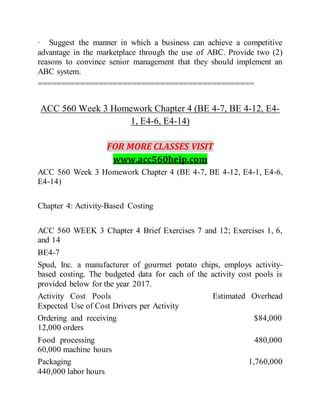

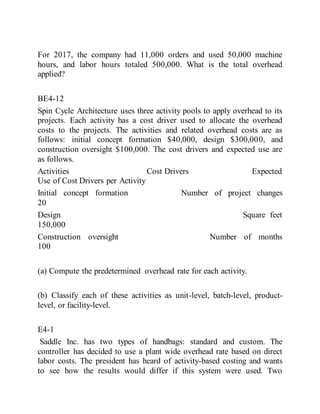

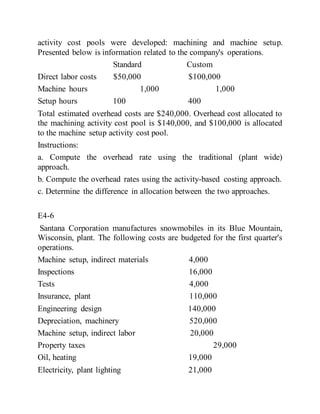

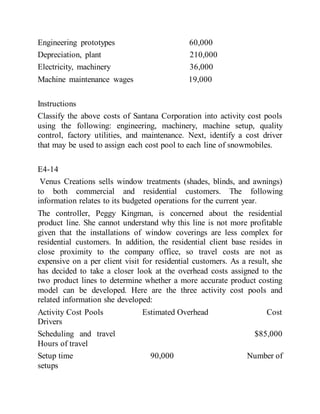

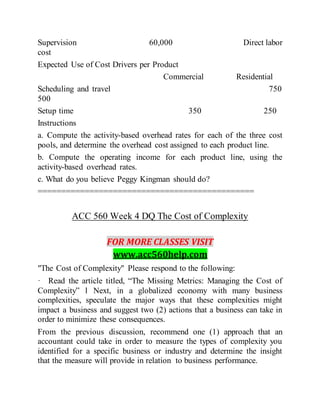

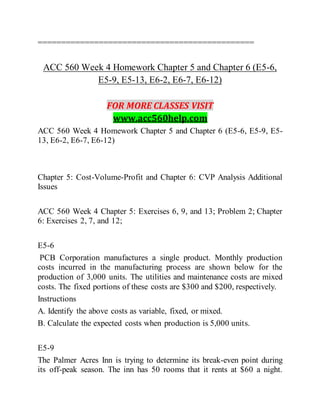

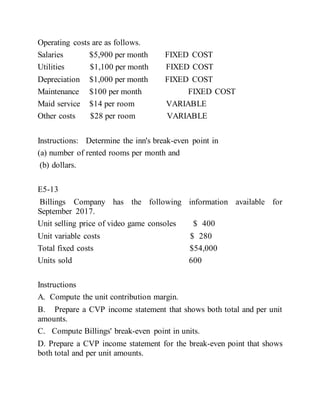

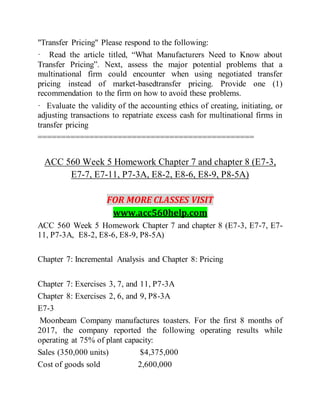

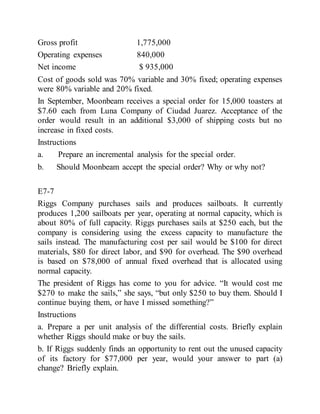

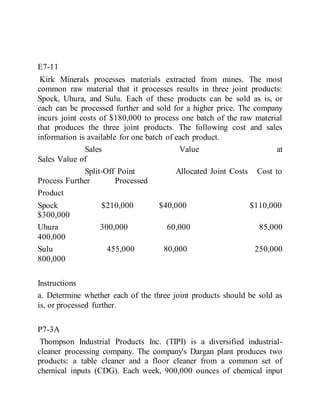

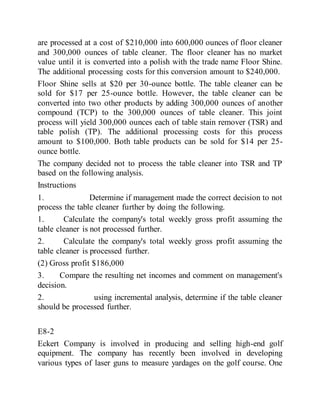

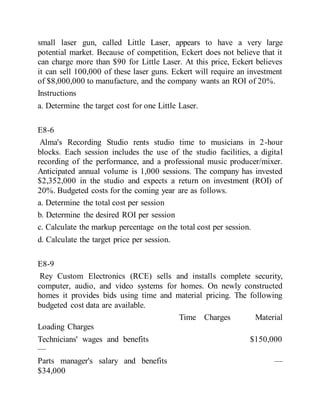

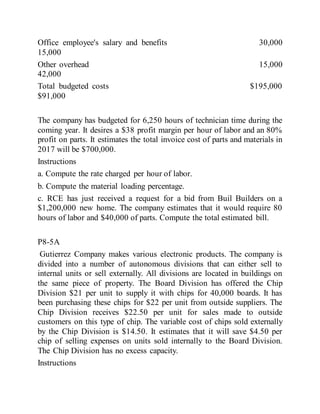

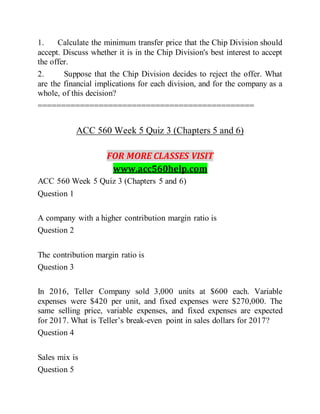

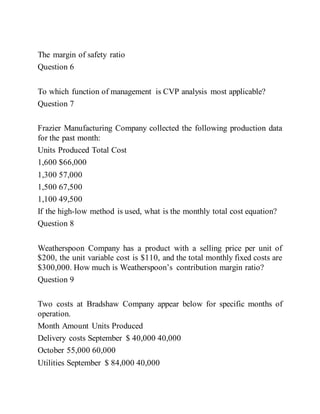

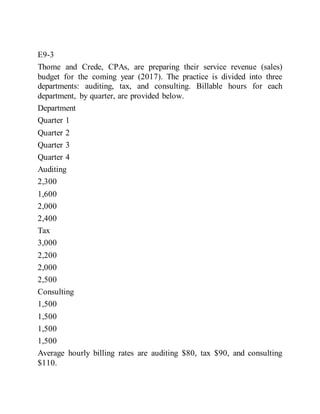

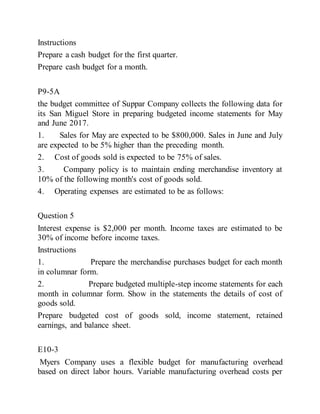

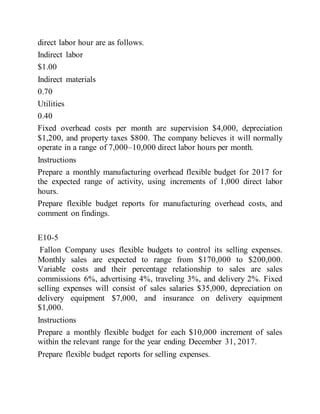

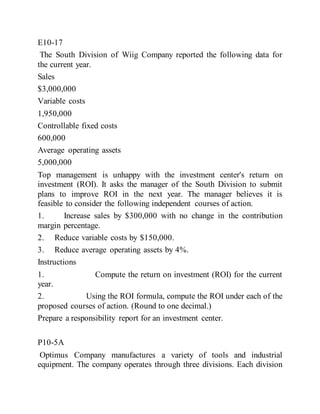

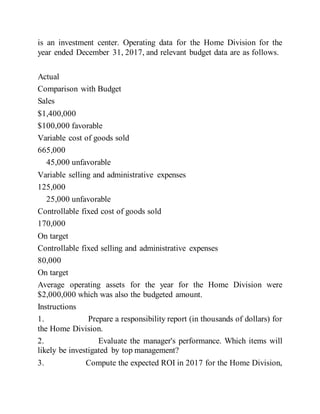

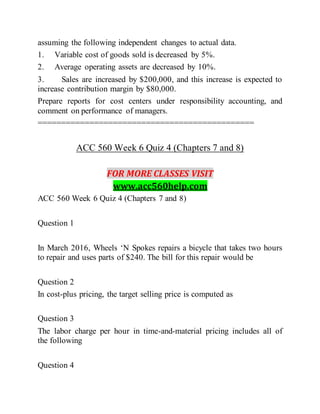

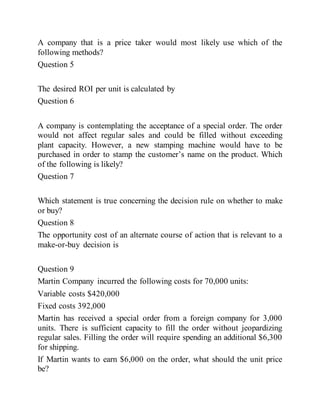

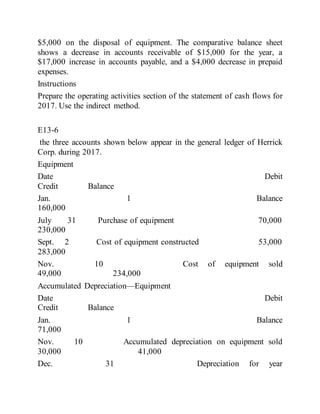

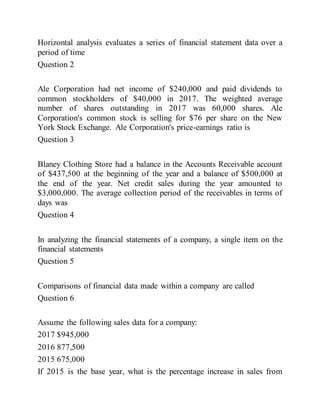

This document provides homework problems from an accounting course. It includes multiple choice and problem questions related to job order costing, process costing, and the calculation of manufacturing overhead rates. Students are asked to calculate overhead application rates, journalize production-related transactions, compute manufacturing costs, and prepare production cost reports. The problems cover various cost accounting concepts and require applying formulas to data provided.