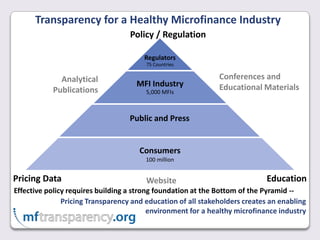

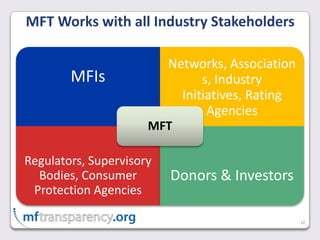

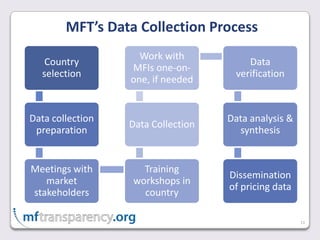

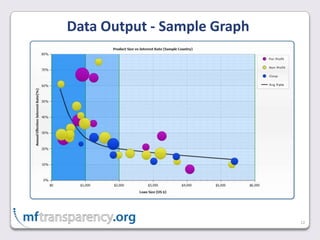

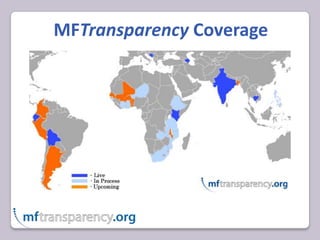

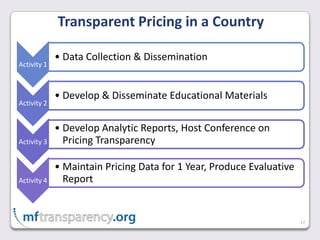

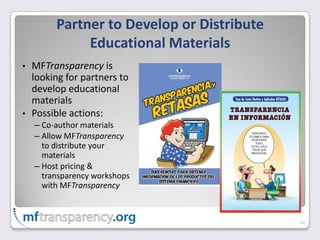

This document discusses MFTransparency, an organization that promotes transparent pricing in the microfinance industry. It has a team of over 20 staff members and works with partners in nearly 30 countries. MFTransparency collects pricing data from over 300 microfinance institutions on over 1,000 loan products used by 41 million clients. It publishes this data on its website and provides technical assistance to help institutions improve practices and disclosure. The goal is to create a healthier industry through open information and education of all stakeholders.