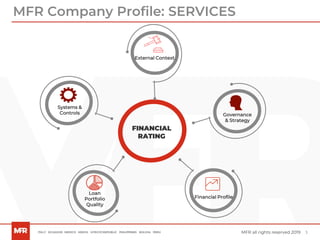

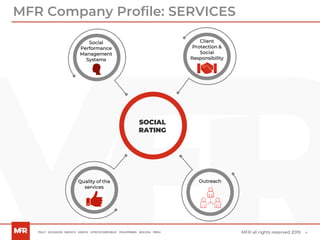

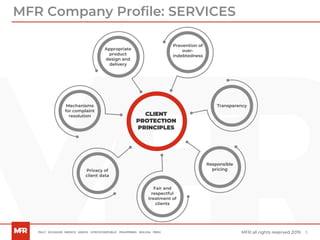

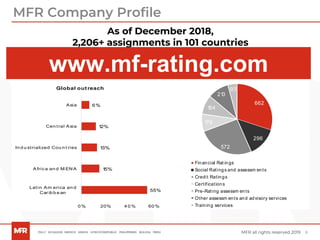

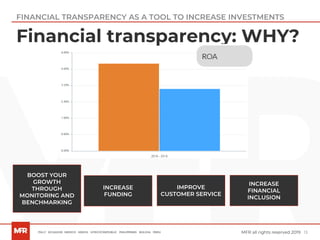

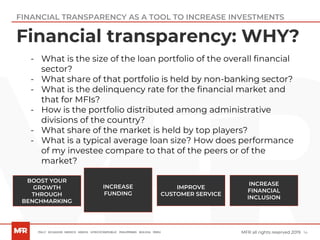

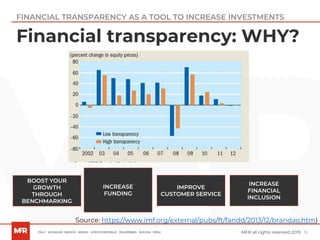

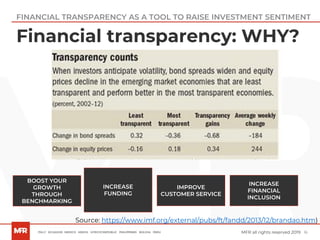

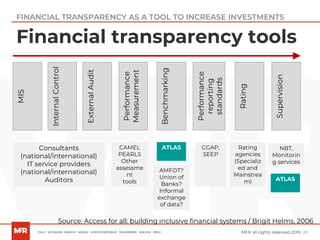

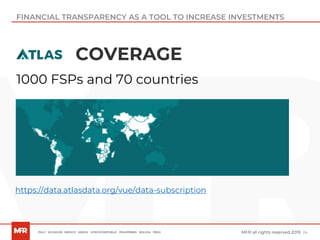

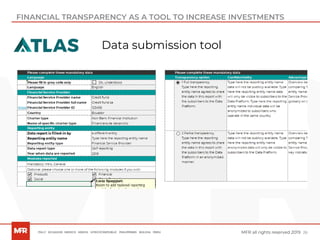

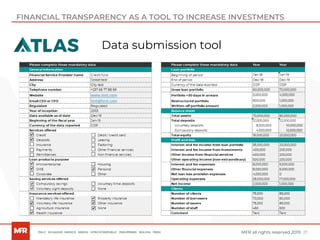

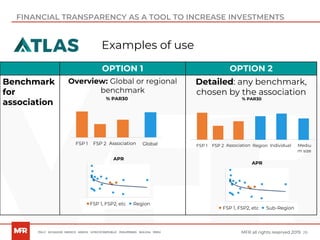

This document discusses how financial transparency can increase investments. It argues that transparency allows organizations to benchmark their performance, improve customer service, increase funding, and boost growth. Transparency tools include management information systems, external audits, ratings, and performance reporting standards. While transparency costs resources, it can reduce costs over time by increasing competition. The document outlines how a financial transparency data platform collects standardized data from over 1,000 financial service providers in 70 countries to allow benchmarking.