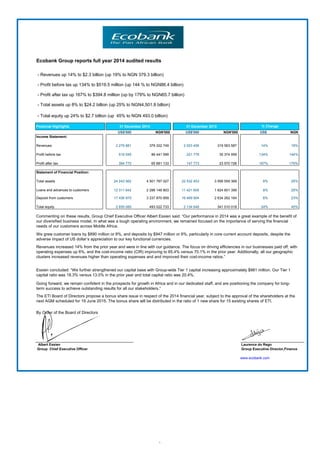

Revenues for Ecobank Transnational Incorporated increased 14% to $2.3 billion for the year ended December 31, 2014, while profit before tax rose 134% to $519.5 million. Total assets also grew 8% to $24.2 billion. The results demonstrate the benefits of Ecobank's diversified business model across sub-Saharan Africa, as the company increased loans and deposits while improving efficiency.