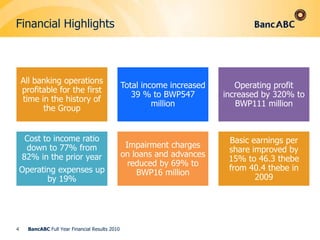

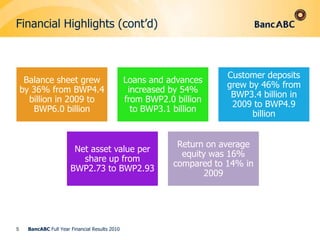

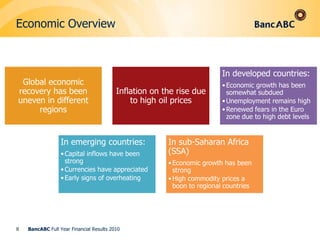

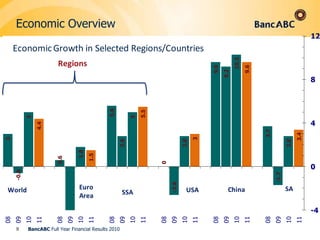

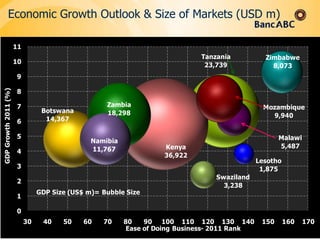

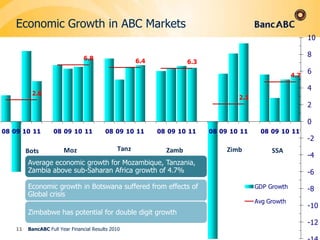

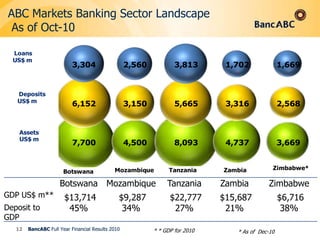

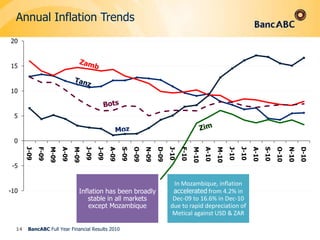

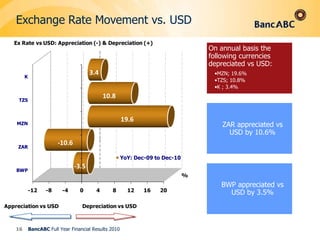

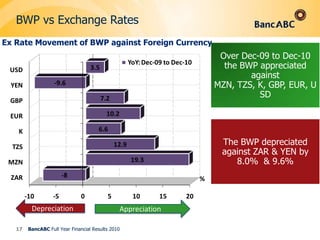

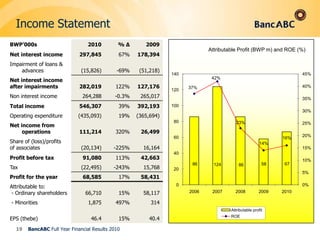

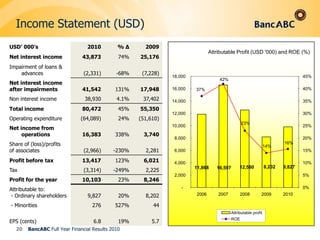

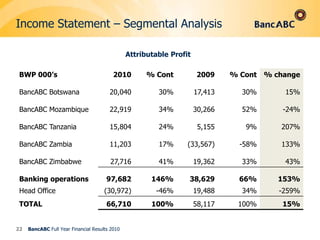

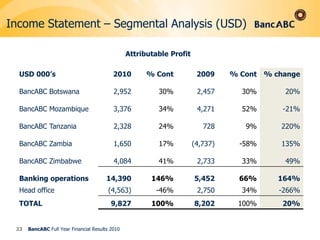

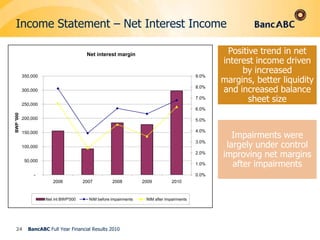

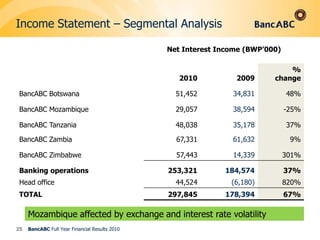

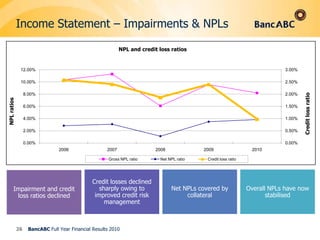

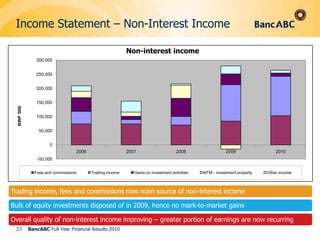

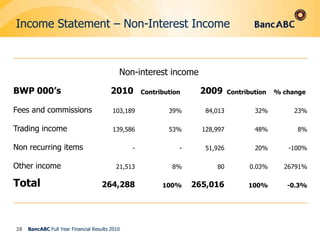

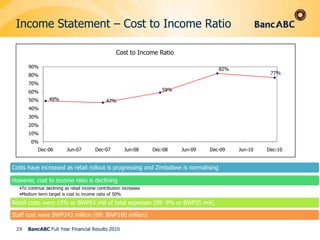

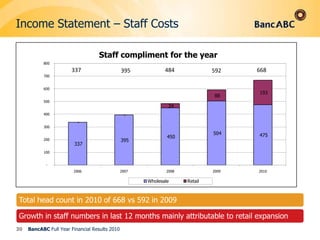

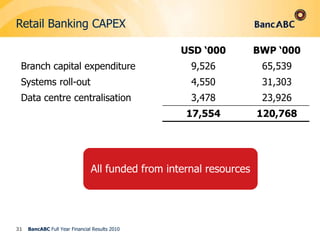

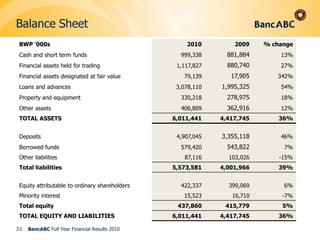

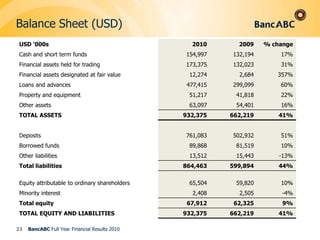

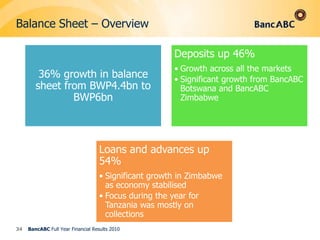

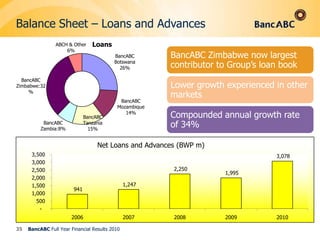

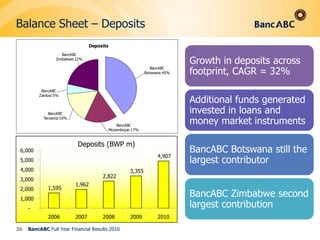

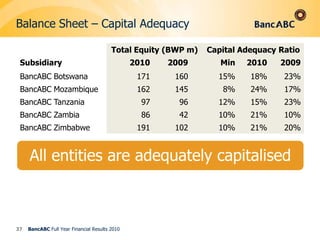

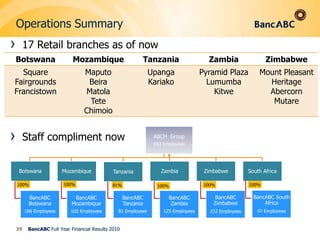

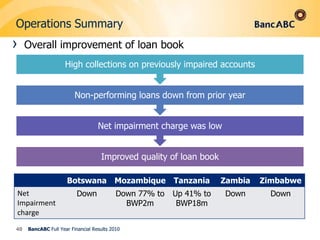

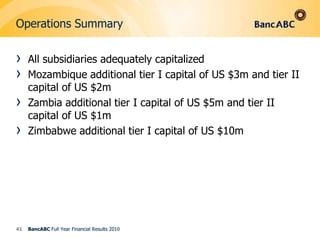

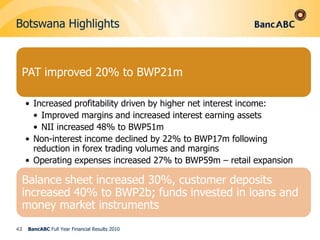

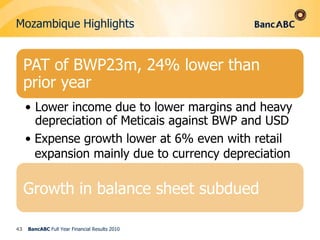

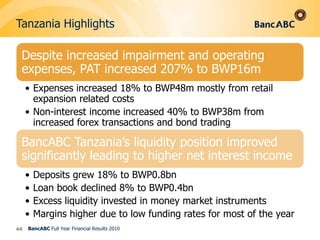

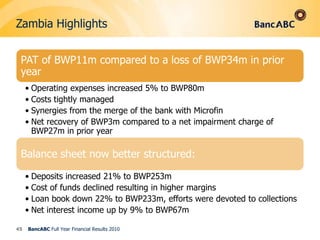

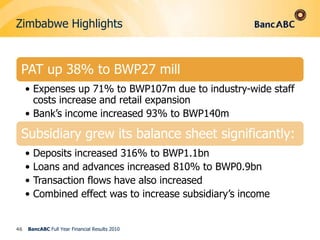

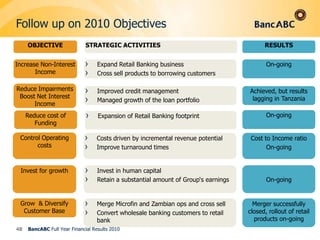

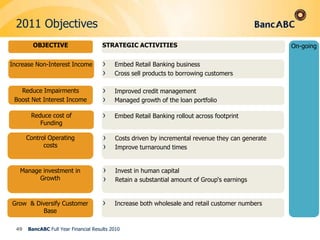

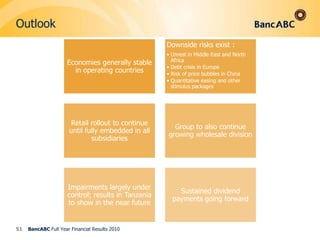

This document summarizes the full year 2010 financial results of BancABC. Key highlights include increased profits, margins, and balance sheet size. The bank saw positive growth in net interest income driven by improved margins and liquidity. Impairments were under control. By country, Botswana and Zimbabwe saw growth while Mozambique was affected by exchange rate volatility. The presentation outlines the bank's strategic focus on expanding retail banking, increasing non-interest income, reducing costs, and investing for continued growth across its operations in southern Africa in 2011.