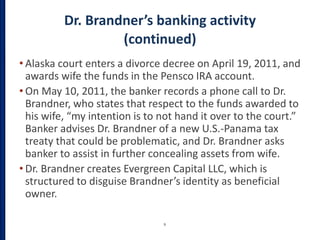

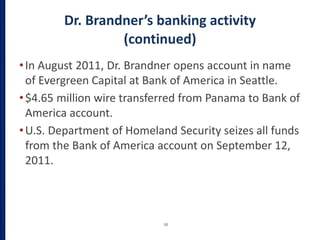

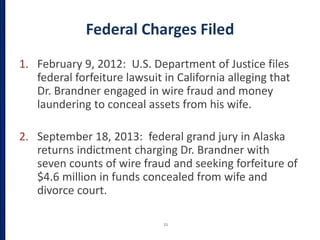

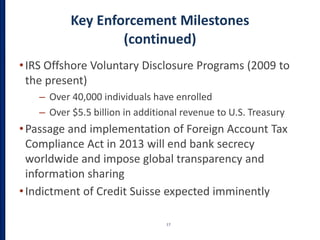

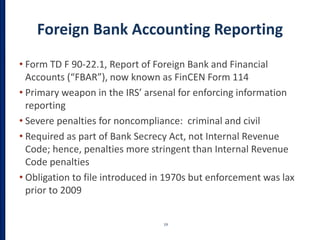

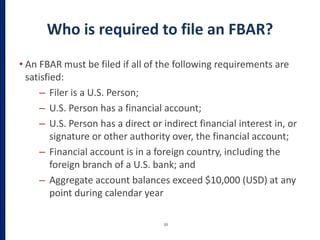

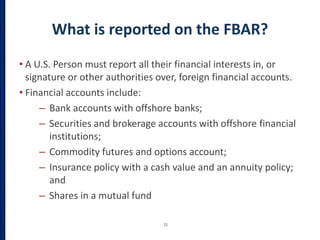

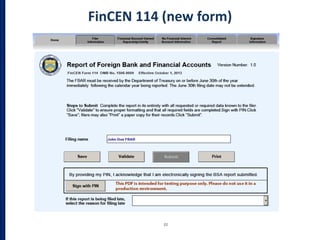

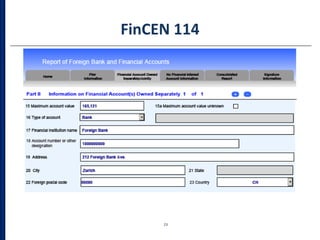

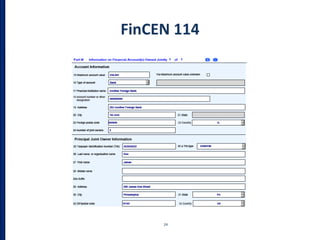

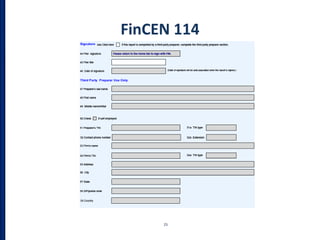

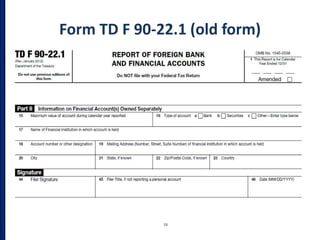

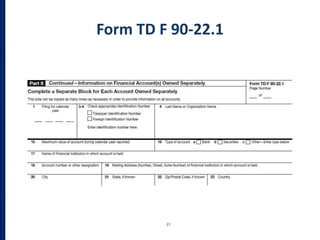

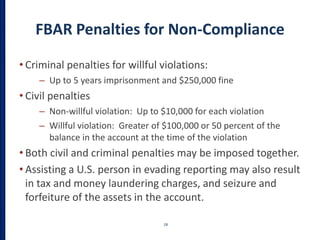

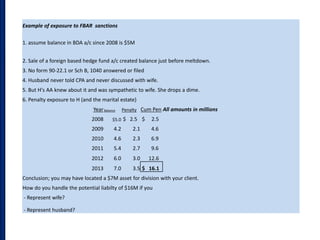

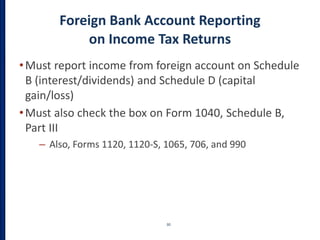

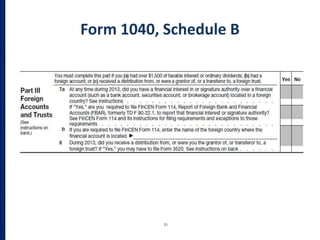

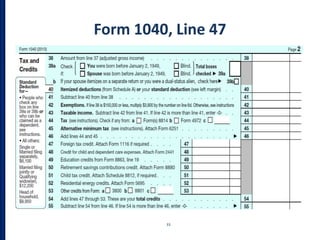

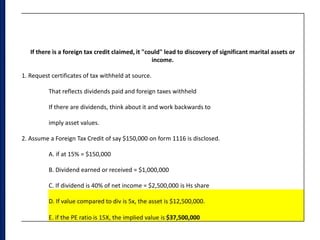

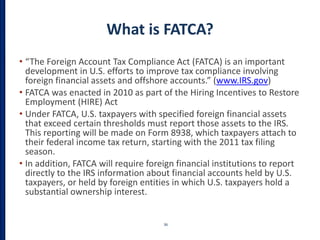

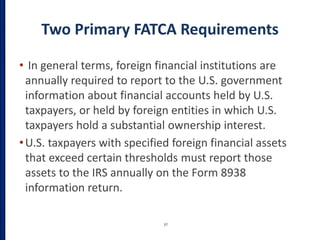

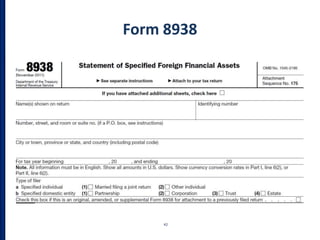

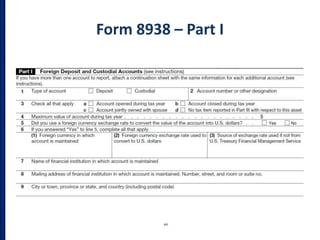

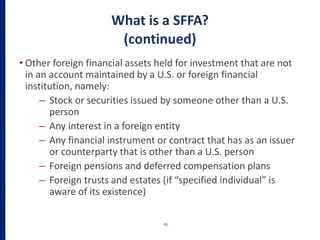

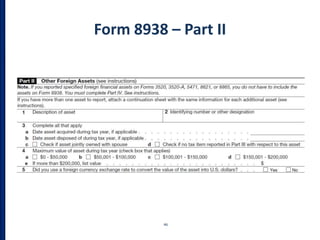

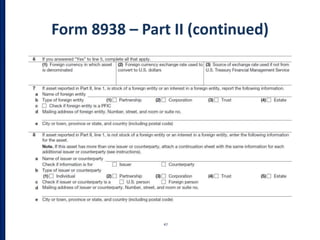

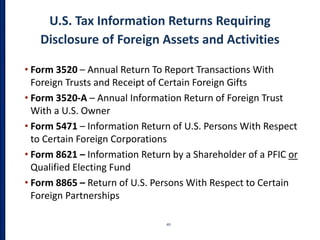

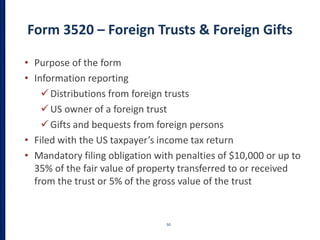

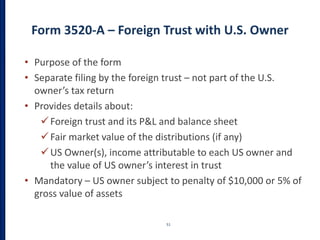

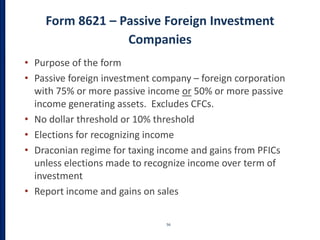

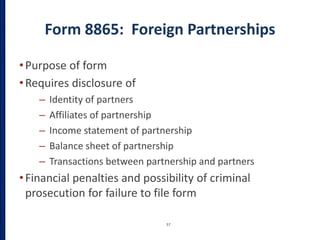

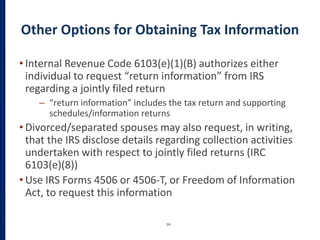

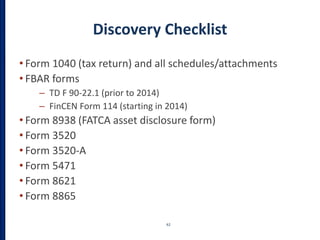

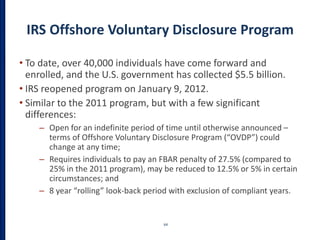

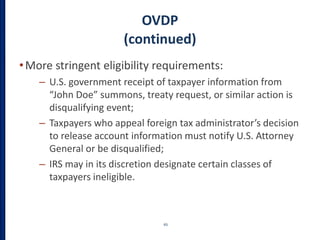

The document discusses how U.S. taxpayers can locate undisclosed offshore bank accounts by leveraging U.S. tax reporting requirements, highlighting the need for compliance due to severe penalties and legal consequences for non-disclosure. It details the case of Dr. Michael Brandner, who attempted to conceal assets during a divorce, illustrating the IRS's increasing focus on combating offshore tax evasion. The document also outlines the requirements of the Foreign Bank Account Reporting (FBAR) and the Foreign Account Tax Compliance Act (FATCA), emphasizing the need for transparent reporting by U.S. taxpayers and foreign financial institutions.