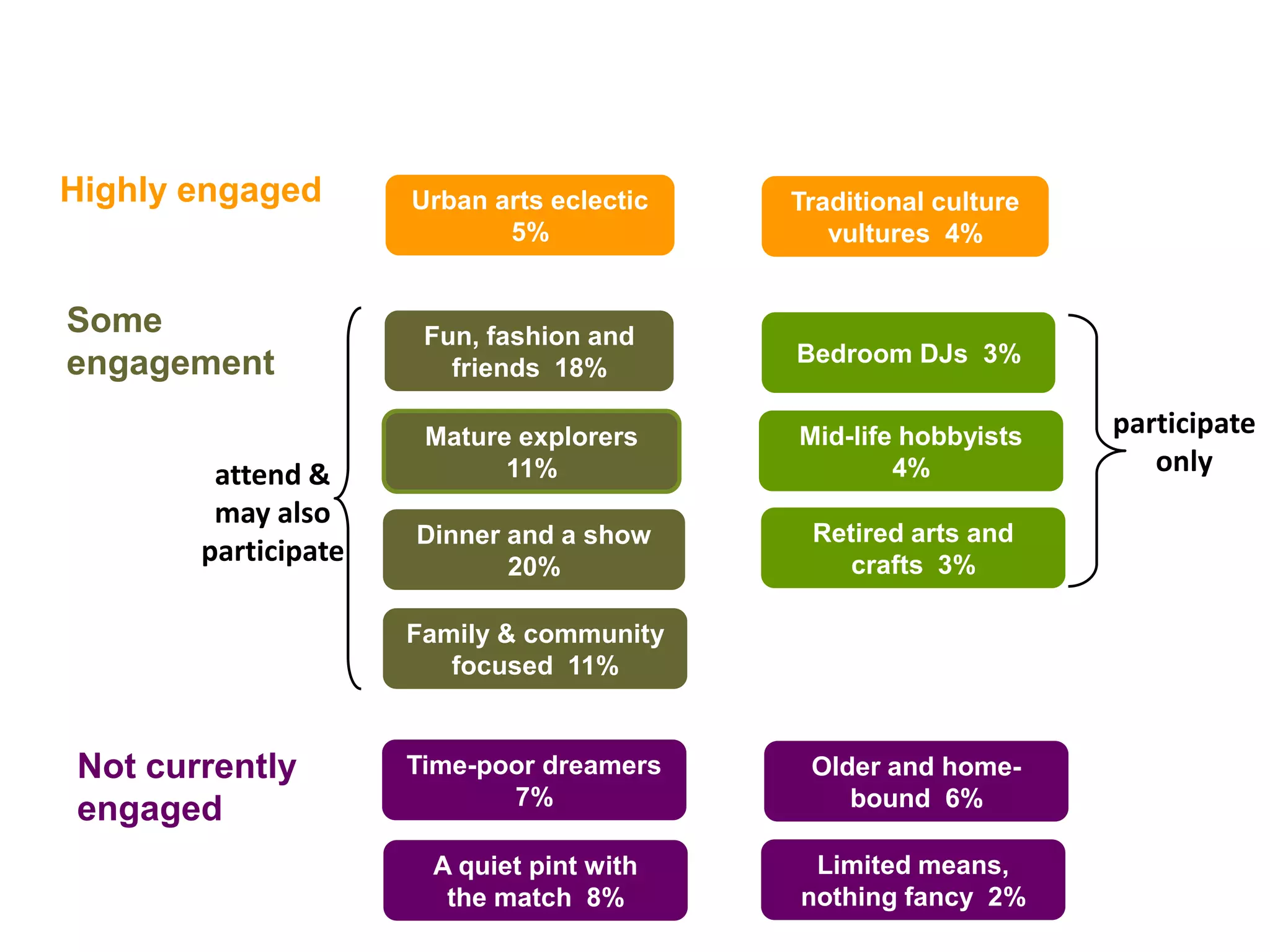

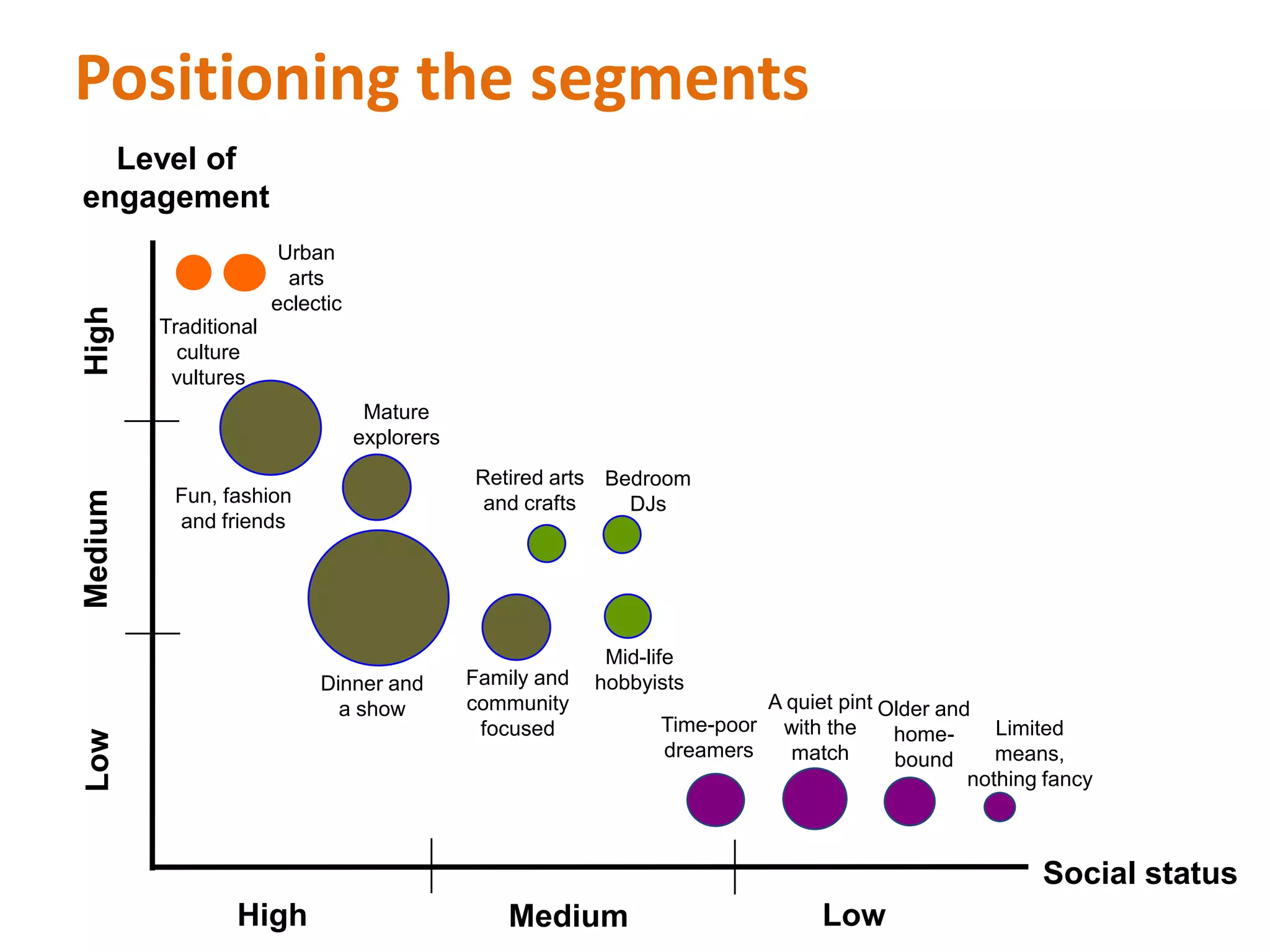

This document discusses audience development strategies through partnerships. It outlines two main priorities for audience development: retention of current audiences and growth of new audiences. It discusses segmentation of audiences to identify distinct types to target. Case studies on the Arts Nation and Big Picture projects are provided that partnered with various organizations to engage specific audience segments through localized programming and marketing. Successful partnerships require shared goals, clear communication, leadership, and understanding roles. Key challenges can include finding common language among partners and sustaining momentum of activities.