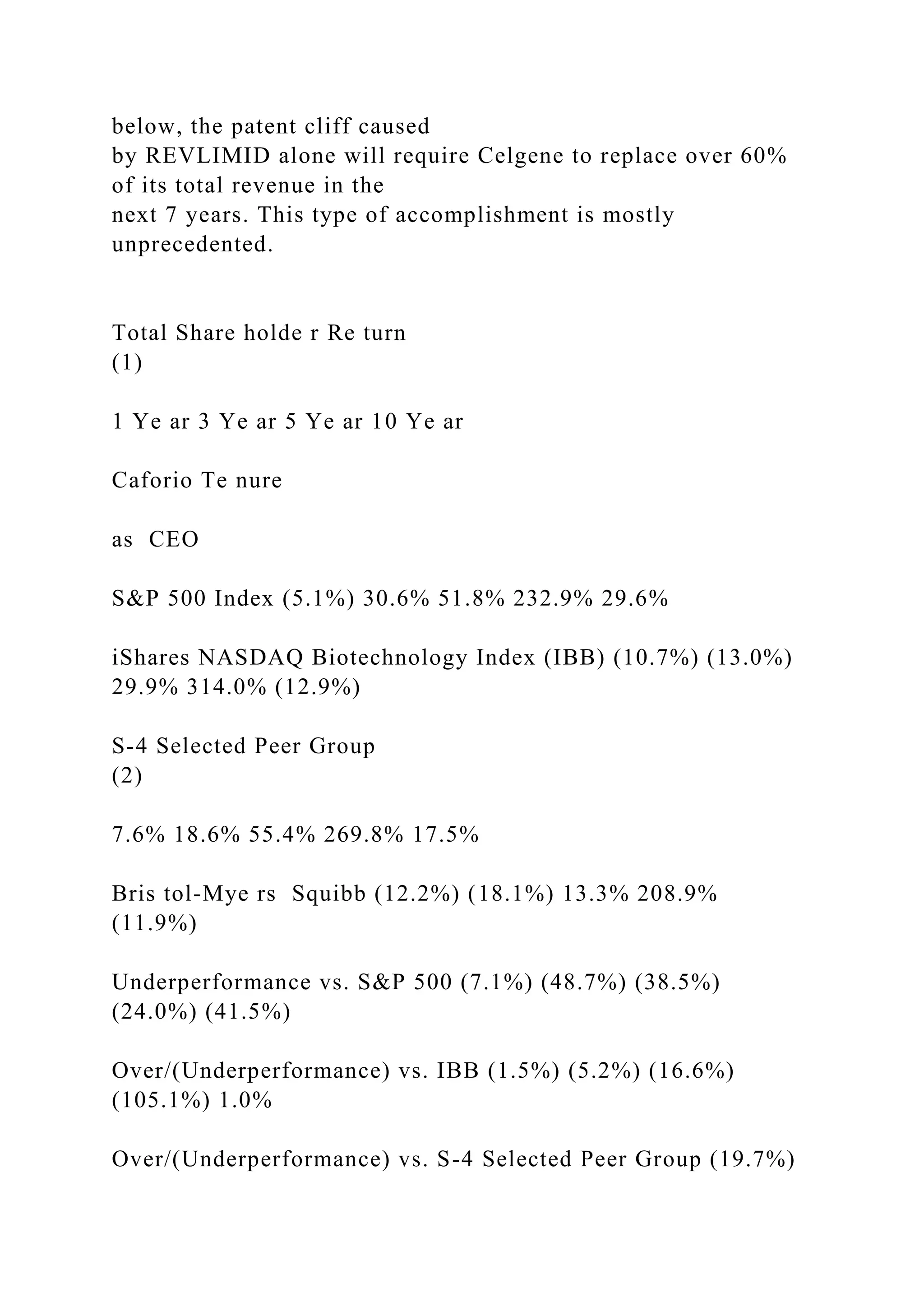

- Starboard Value LP, a Bristol-Myers Squibb shareholder, believes the proposed acquisition of Celgene is poorly conceived and not in the best interest of shareholders.

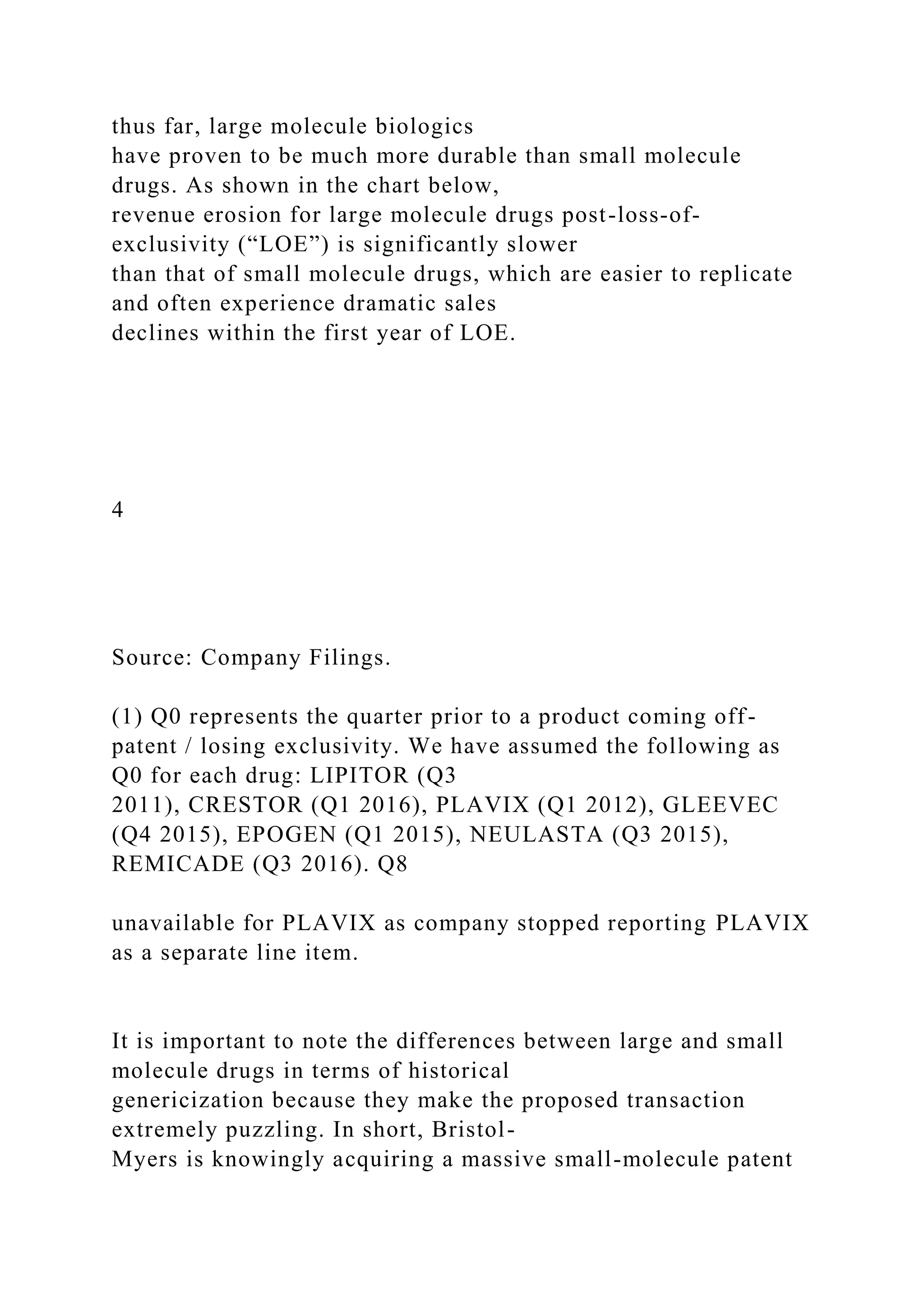

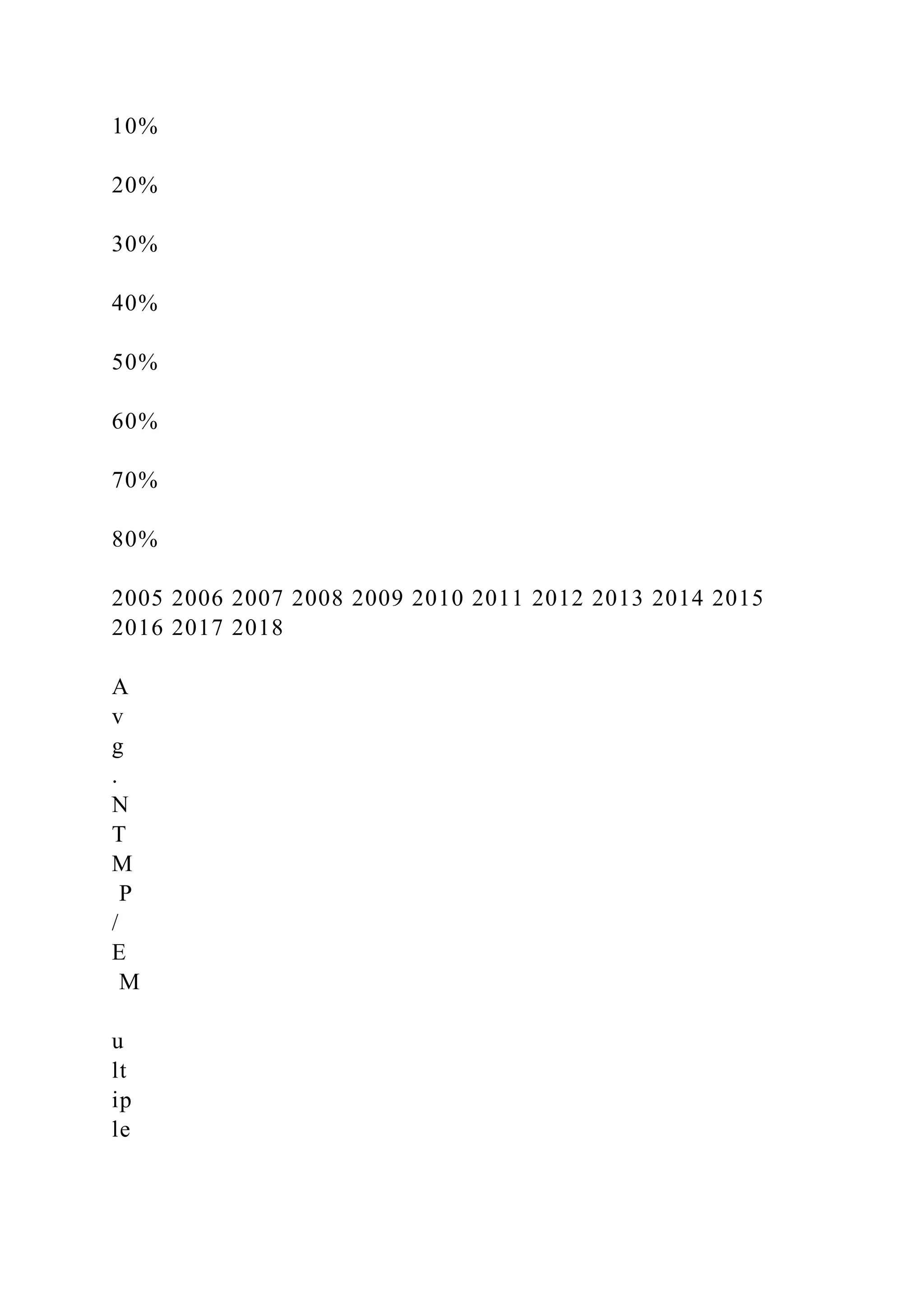

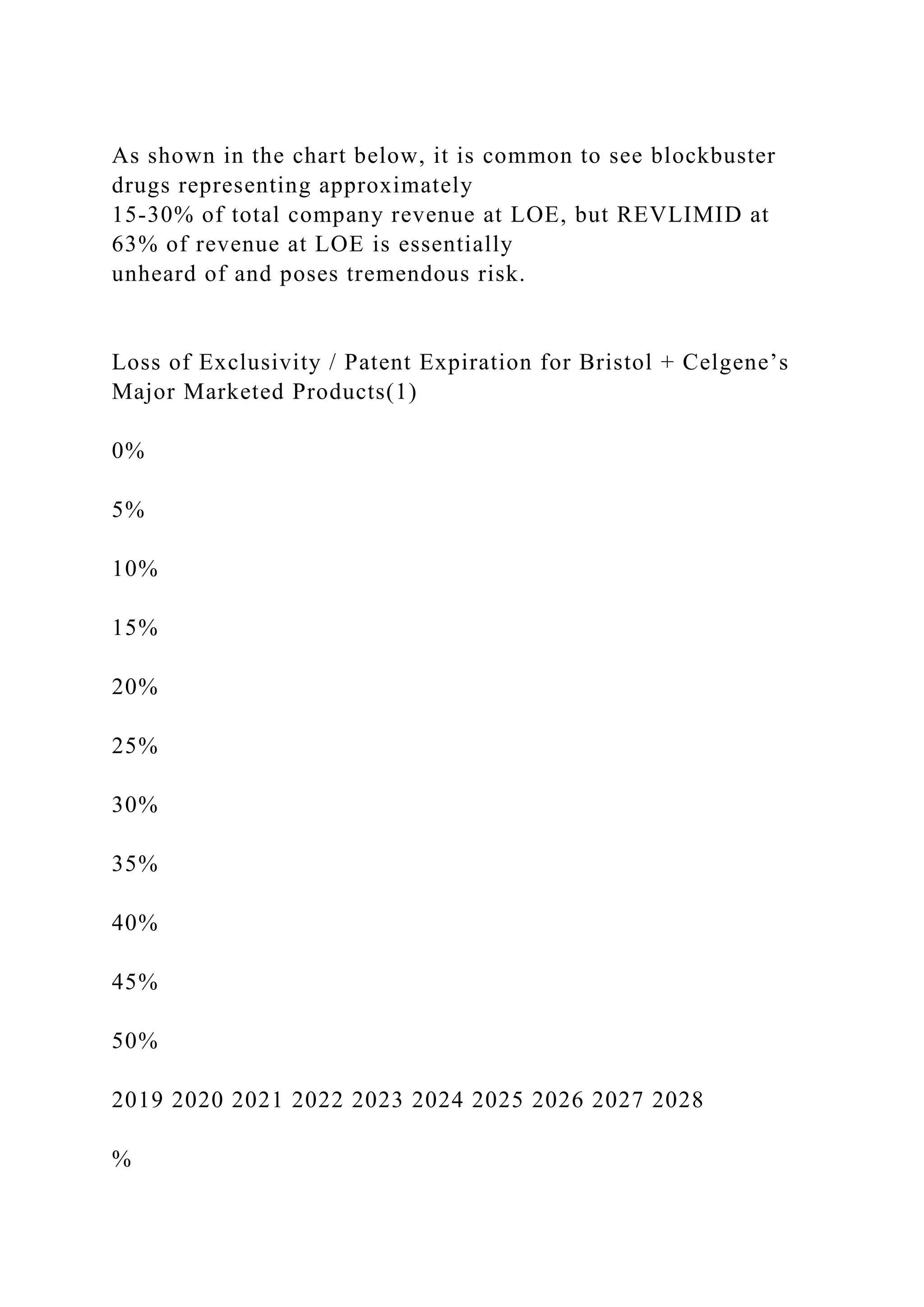

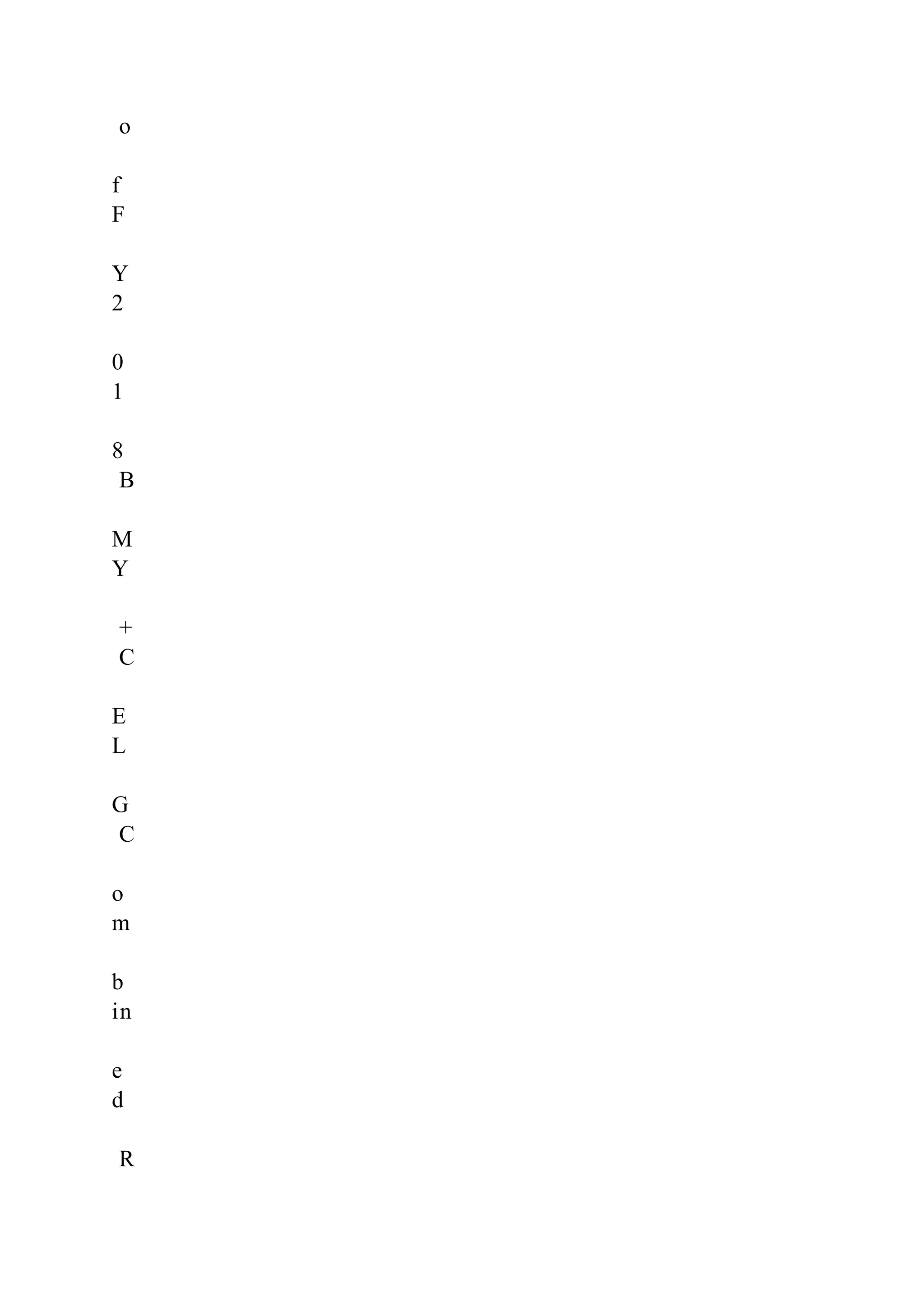

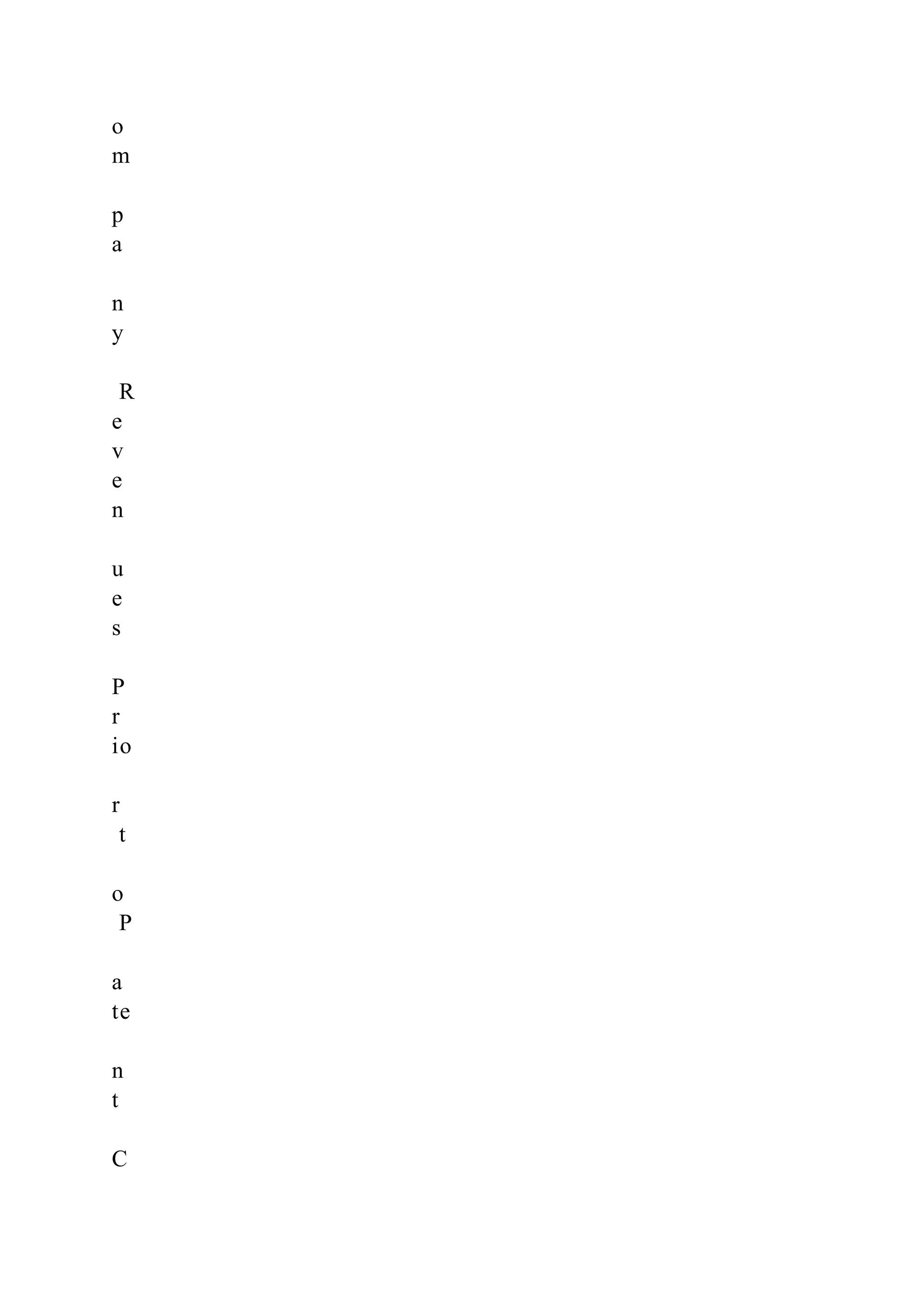

- Bristol-Myers is acquiring one of the largest patent cliffs in pharmaceutical history as Celgene's drug Revlimid, which accounts for over 60% of Celgene's revenue, faces patent expiration.

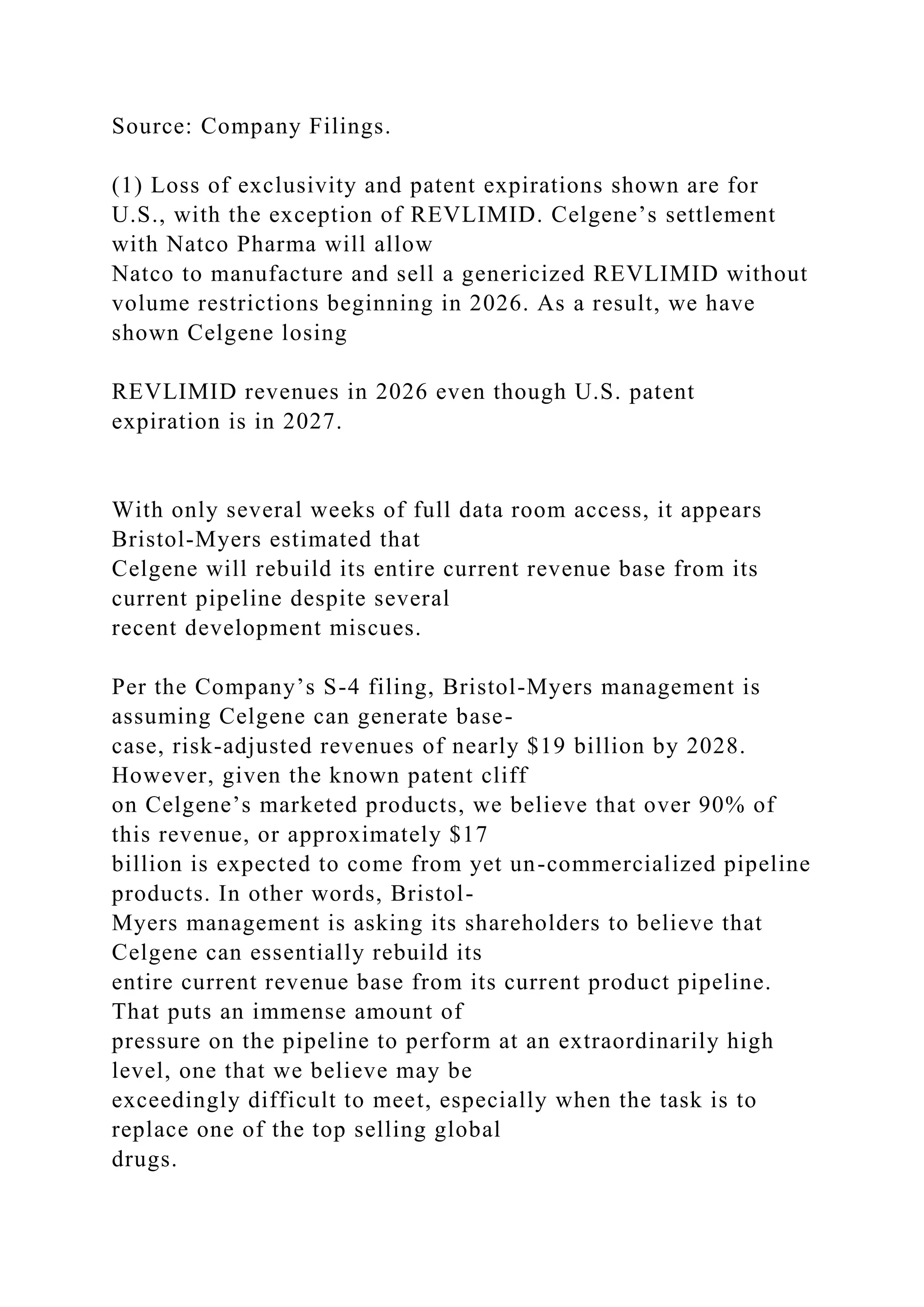

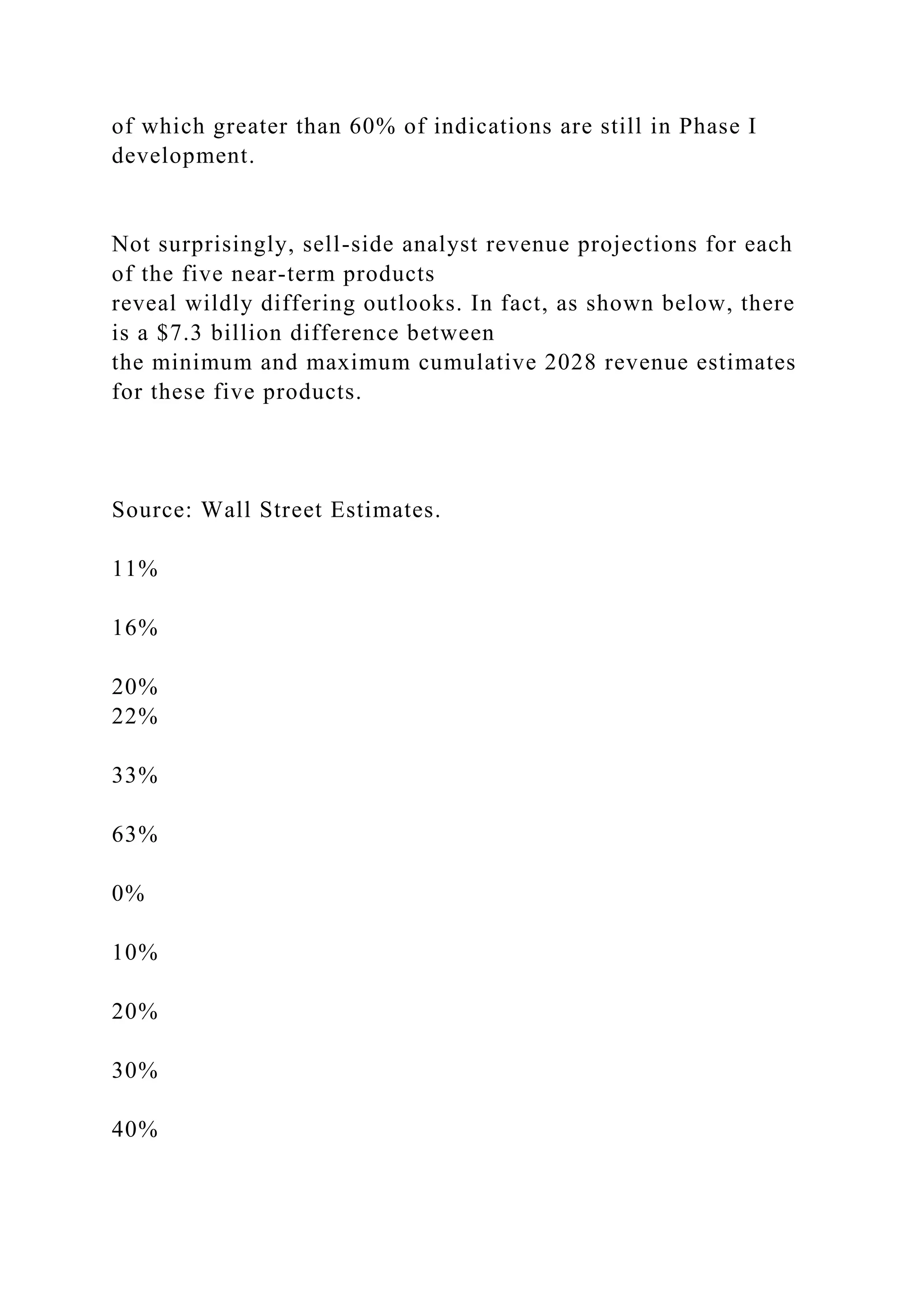

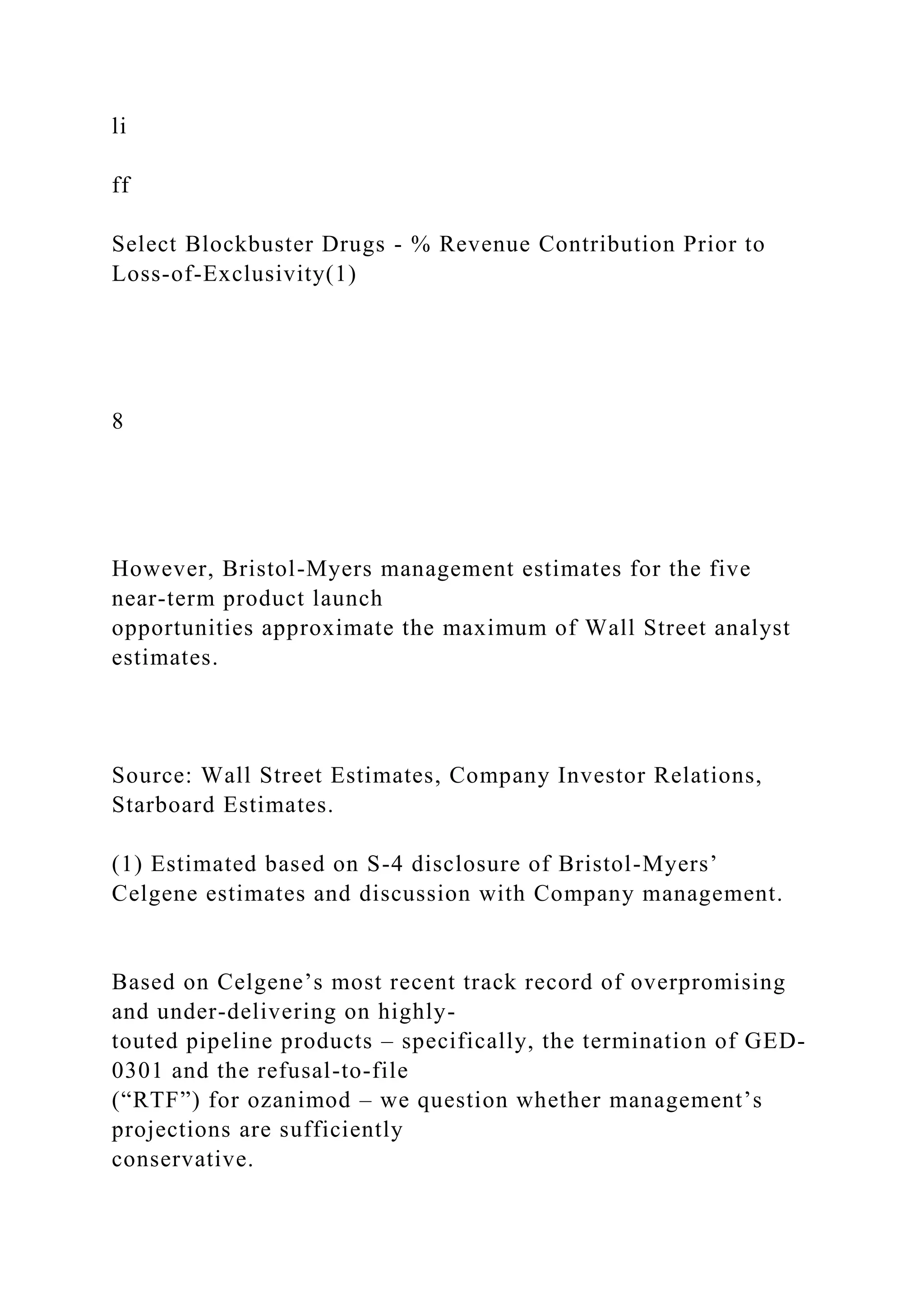

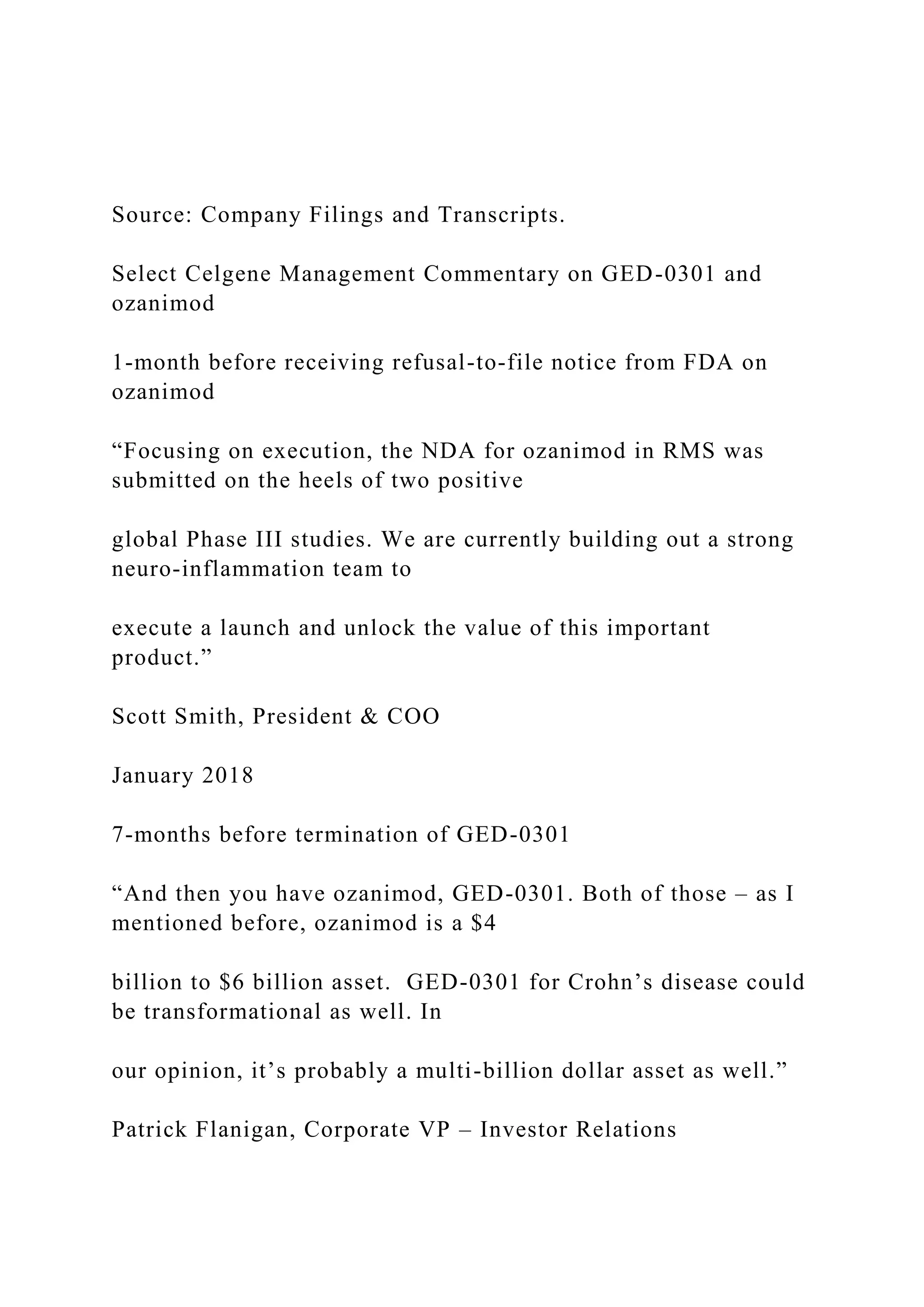

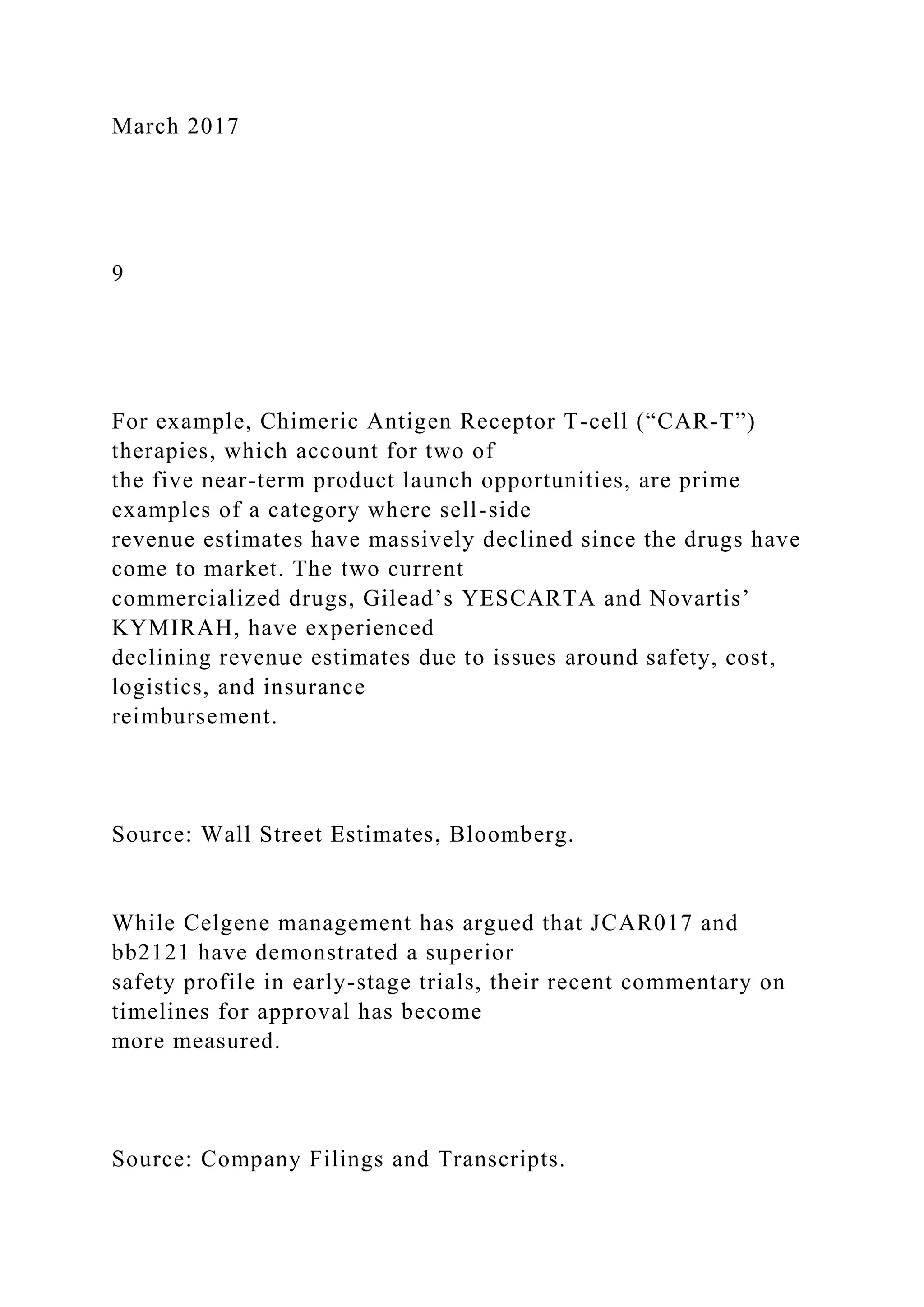

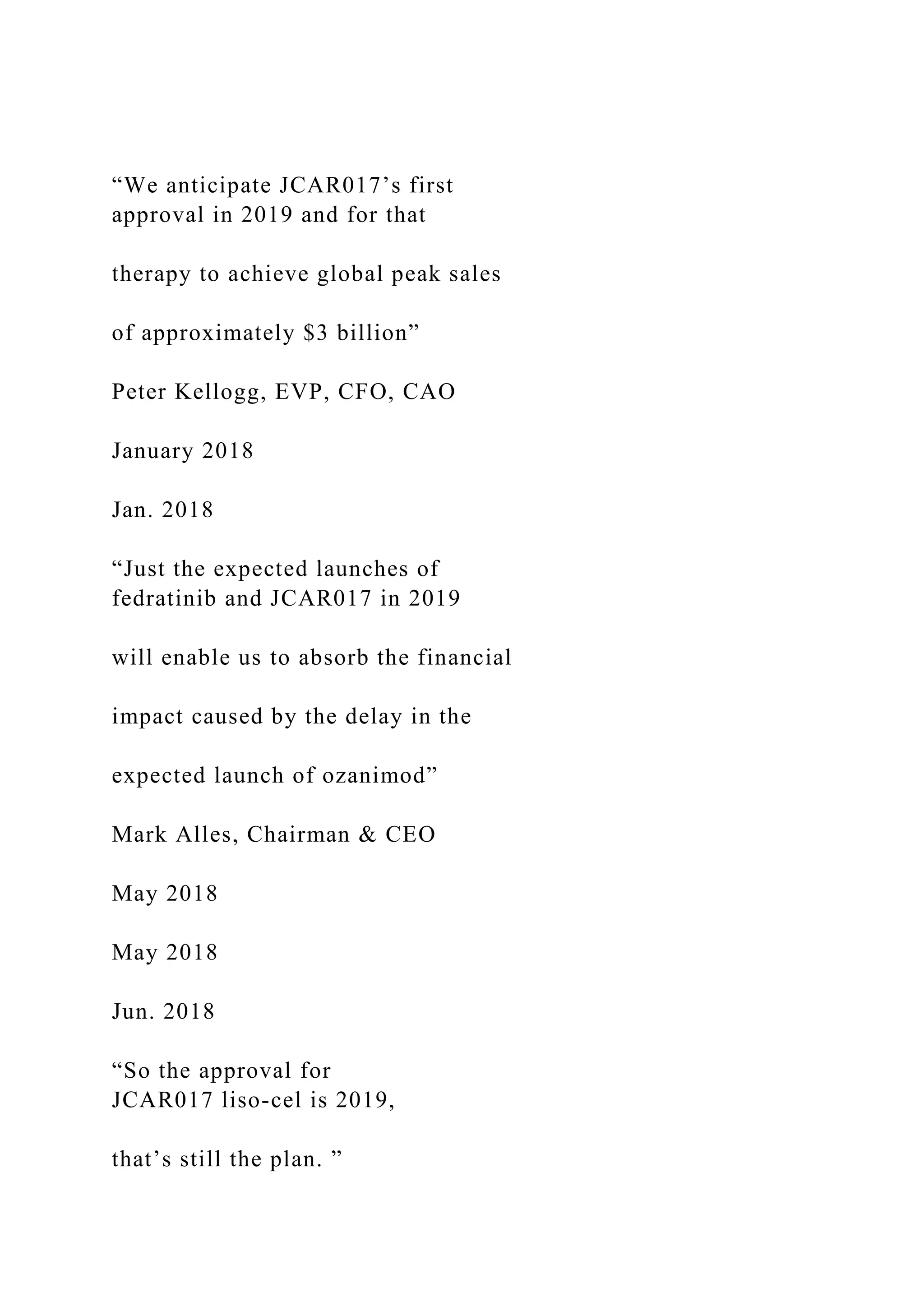

- Bristol-Myers' projections that Celgene will rebuild its entire $19 billion revenue base from its pipeline by 2028 are aggressive given Celgene's recent development setbacks and the difficulty of replacing a blockbuster drug like Revlimid.