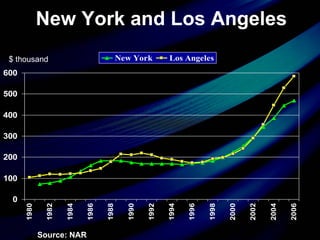

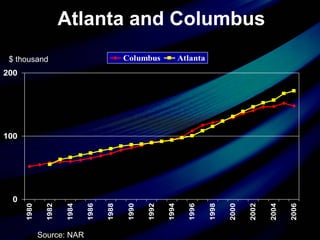

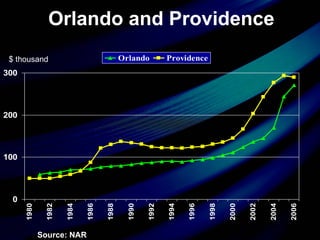

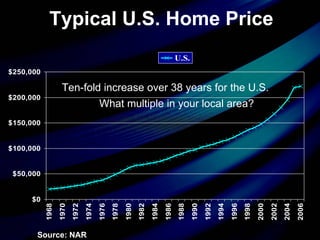

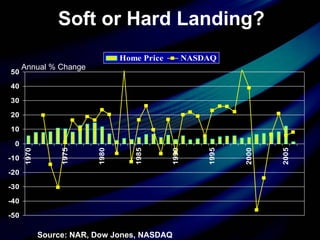

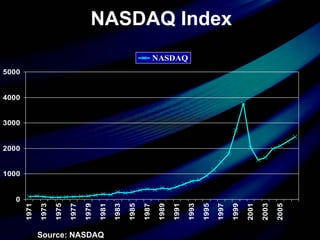

This document summarizes a presentation given by Lawrence Yun at the NAR Midyear Meetings on May 17, 2007. The presentation discusses trends in local real estate markets and forecasts, showing data on housing prices, sales, construction jobs, mortgage rates and delinquencies, and economic indicators in different cities and regions. It also lists the top markets for growth and global livable cities. The key message is that the housing market needs to be analyzed at the local level as conditions vary significantly between areas.