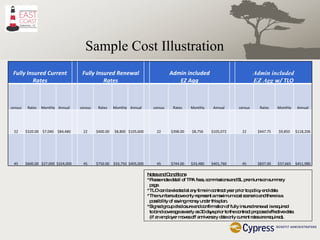

The document outlines the 'EZ AGG' special aggregate only funding product, which is a self-funded health plan alternative for employers with 25 to 250 employees, providing advantages like improved cash flow, cost savings, and increased control over plan design. Key features include immediate advance options for claims, customizable service features, and an opportunity for smaller employers to transition to self-funding with minimal risk. The document also details cost components and necessary information for binding coverage.

![Special Aggregate Only Funding Product “ EZ Agg” Justin P. Horn Regional Sales Manager 402-740-1757 [email_address]](https://image.slidesharecdn.com/EZAggpres-123611131801-phpapp02/85/Unique-Group-Health-Plan-1-320.jpg)