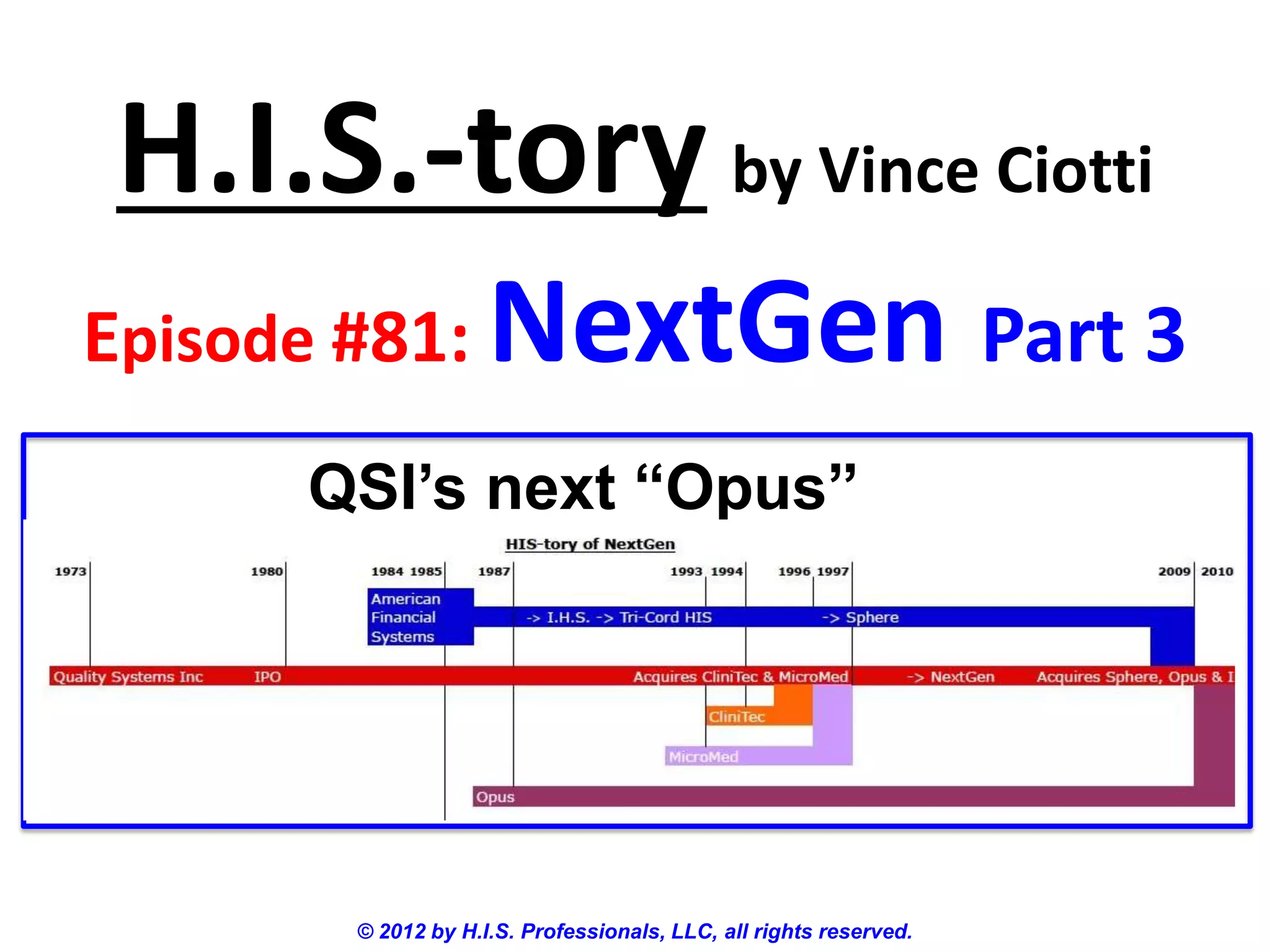

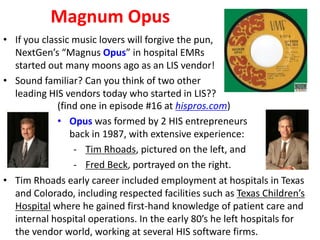

1) Opus was formed in 1987 by two HIS entrepreneurs, Tim Rhoads and Fred Beck, as an LIS vendor but later expanded into clinical systems.

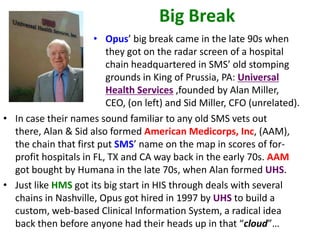

2) Opus got its big break in the late 1990s when it was hired by Universal Health Services, a large hospital chain, to build a custom EHR system for its 20+ hospitals.

3) In 2010, Opus was acquired by NextGen Healthcare as part of NextGen's strategy to expand into a full-suite hospital information system offering.