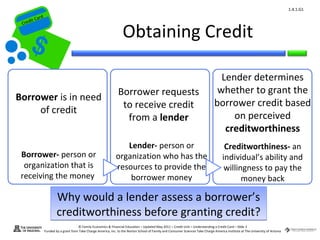

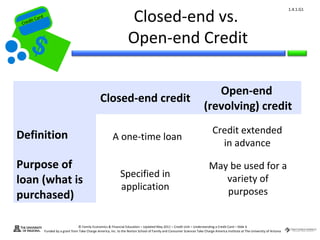

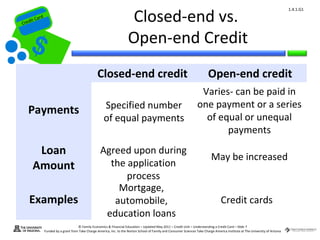

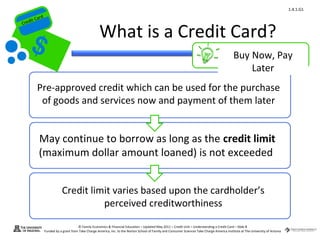

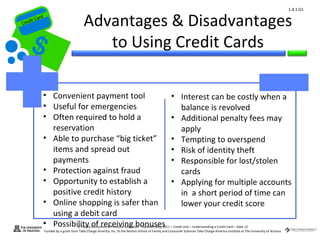

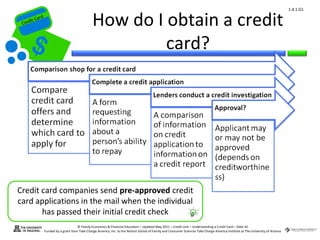

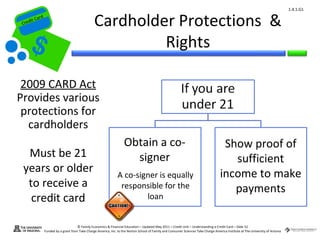

1) The document explains what credit is and different forms of credit like credit cards and loans. It discusses how creditworthiness is assessed when obtaining credit.

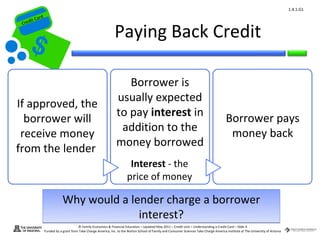

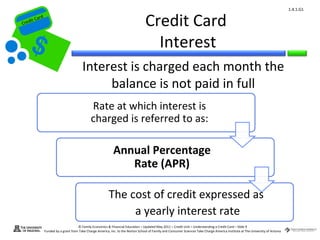

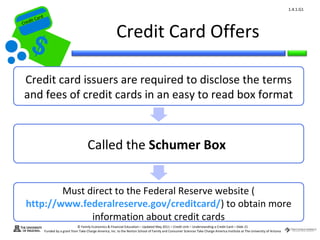

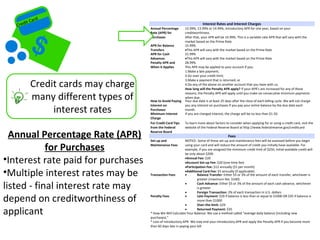

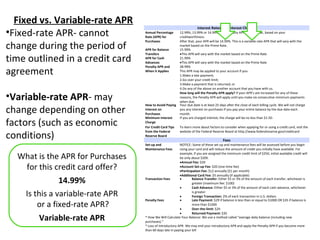

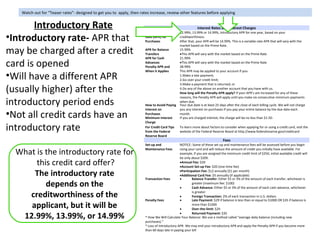

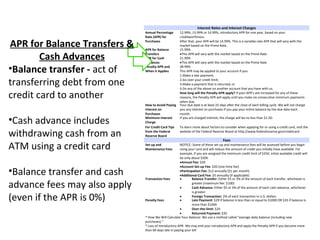

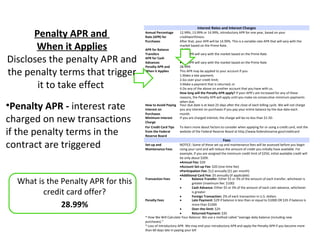

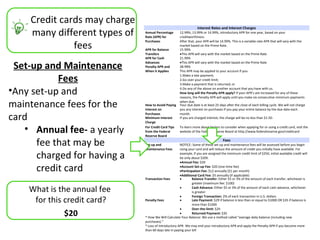

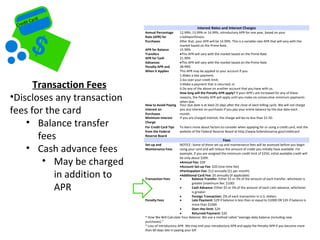

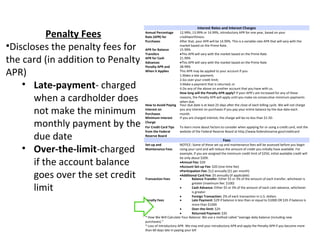

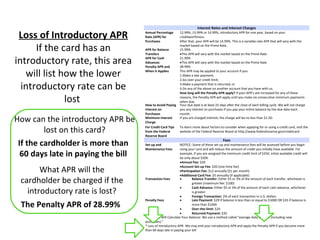

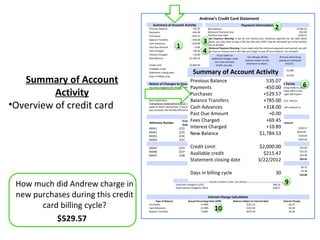

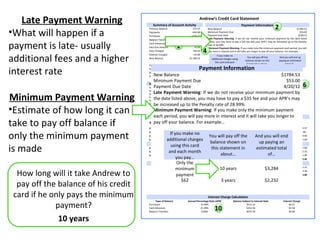

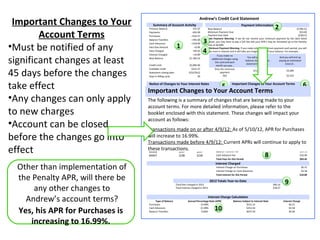

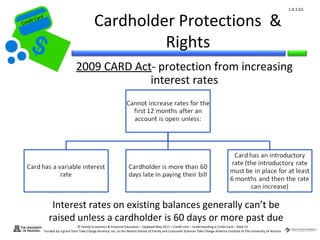

2) It describes key credit card terms like annual percentage rate (APR), minimum payments, and interest charges. Making only minimum payments results in higher long-term costs due to interest.

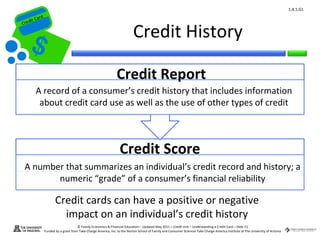

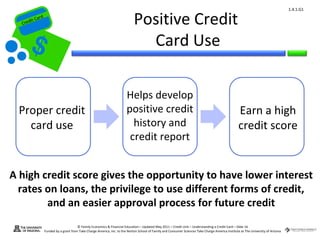

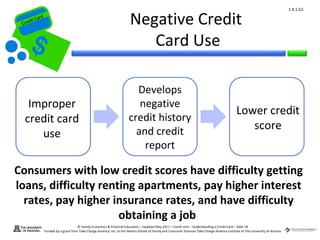

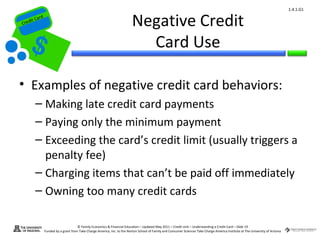

3) The document outlines positive credit behaviors like paying balances in full each month and negative behaviors like late payments that hurt one's credit score. Maintaining good credit is important for future financial opportunities.