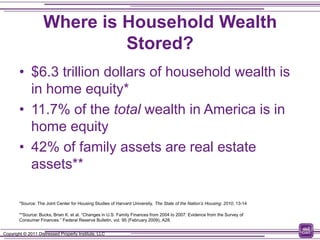

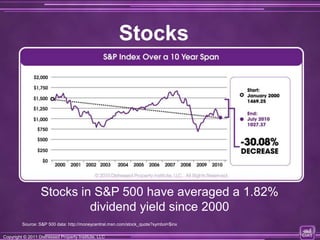

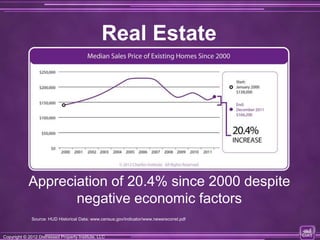

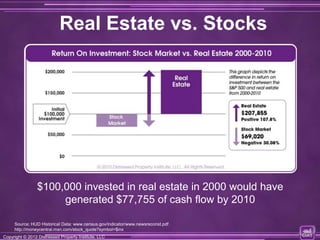

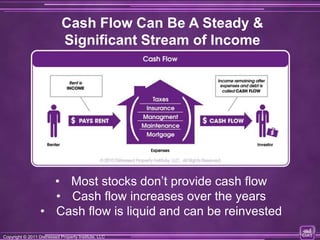

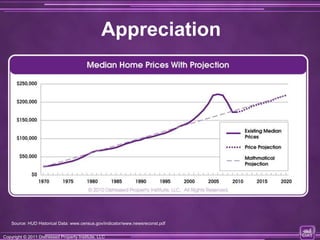

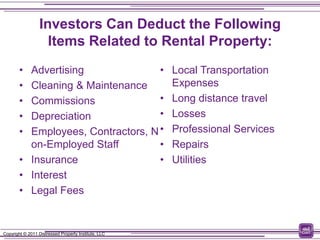

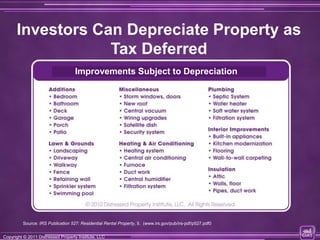

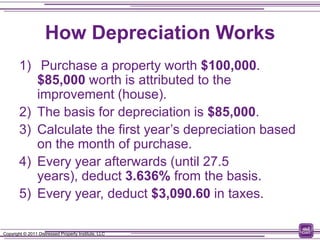

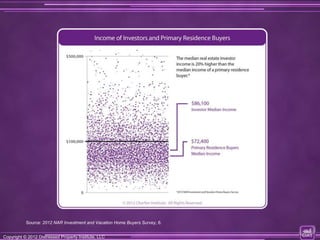

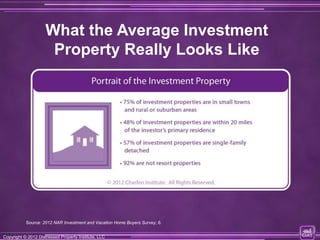

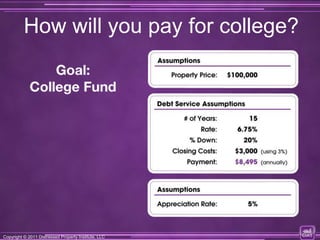

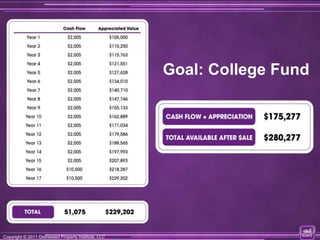

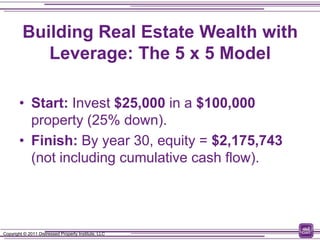

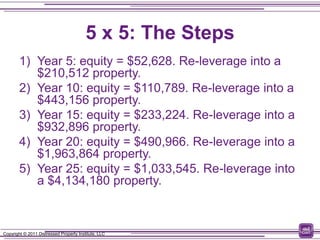

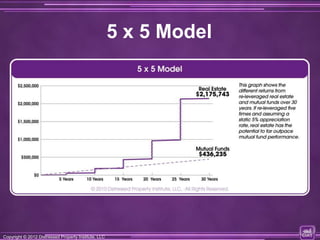

This presentation by Mark Rusnak, a licensed associate broker, aims to educate about residential real estate investments, covering growth potential, benefits, myths, and optimization strategies. It emphasizes the importance of cash flow, appreciation, leverage, and tax benefits in real estate compared to other investment assets. The document also debunks common myths surrounding real estate investing, illustrating that it is accessible to a broader audience than commonly perceived.