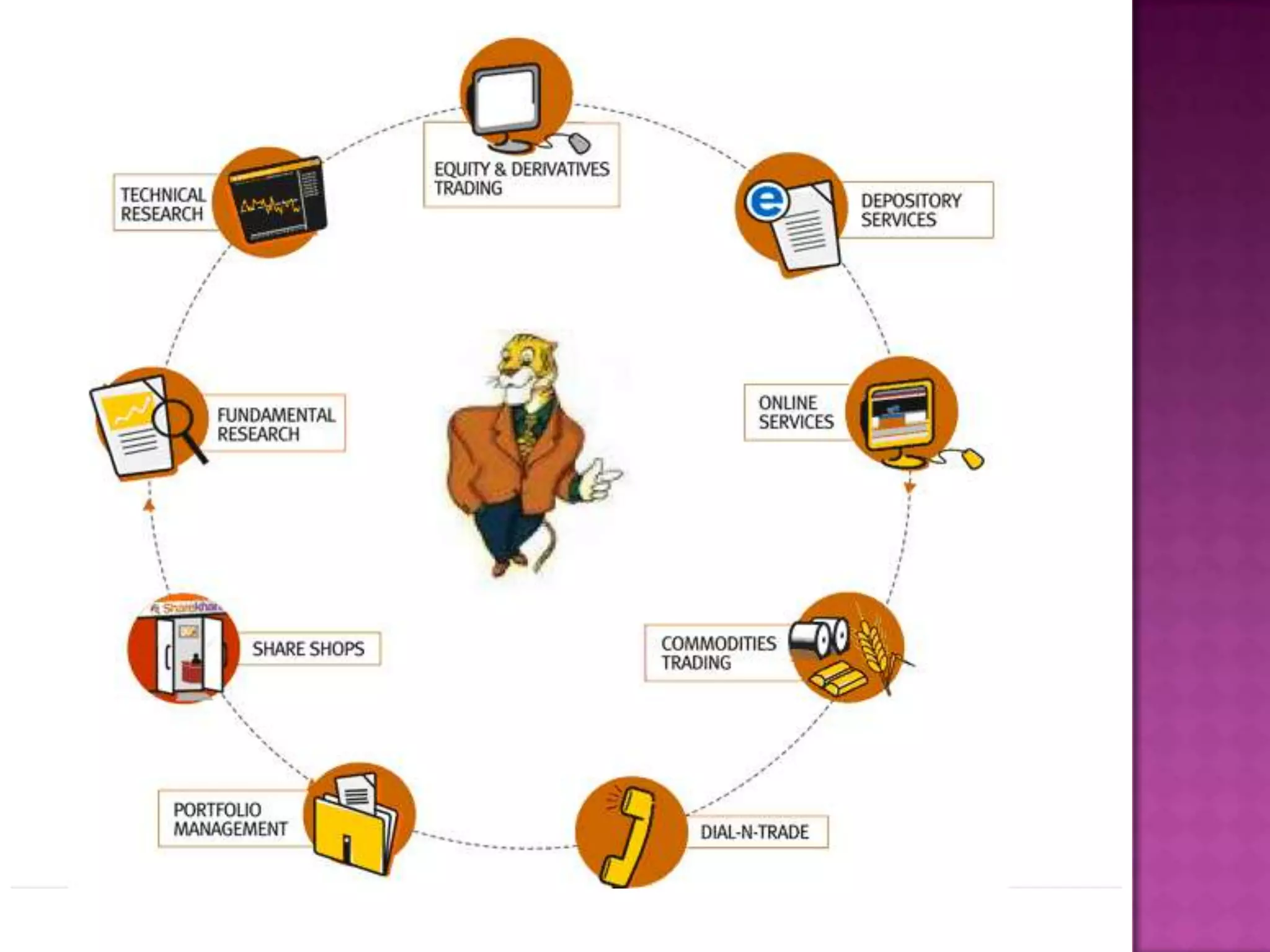

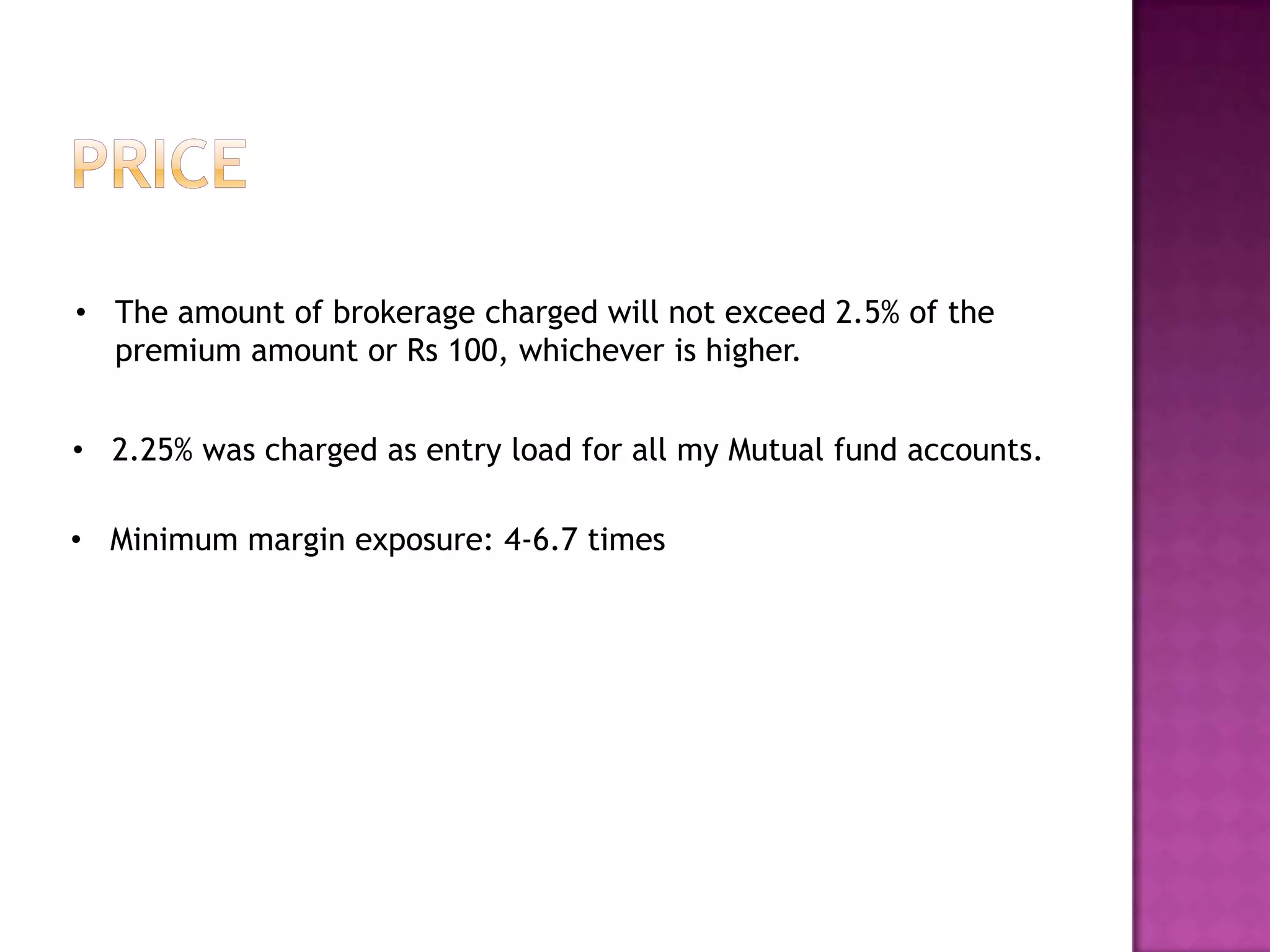

Sharekhan Ltd. provides various financial products and services including buying and selling stocks online and offline, derivatives trading, mutual funds, commodities, IPOs, portfolio management, insurance, fixed deposits, and advisory services. It offers two types of online share trading accounts - Classic and Trade Tiger. Sharekhan uses advertising, direct marketing, telemarketing, online promotion, and social media to promote its brand and attract customers. It has an extensive network of retail shops, franchise owners, brokers, and sales agents for coverage and reaching customers across India and globally through its website.