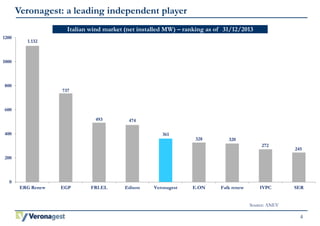

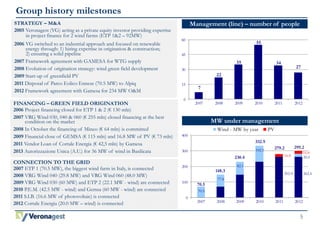

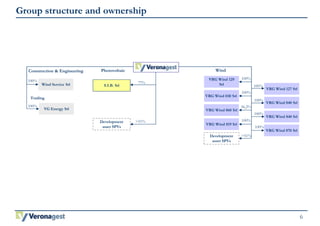

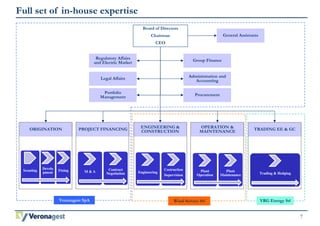

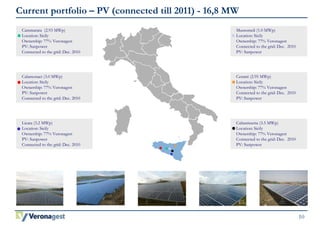

Veronagest Group is an independent renewable energy company based in Italy. It has a current portfolio of 282.4 MW of wind projects and 16.8 MW of solar PV projects located across Italy. The company has a full range of in-house expertise across the renewable energy project lifecycle from development and origination to construction, operation, and maintenance. It aims to further grow its portfolio through new greenfield development and acquisitions.