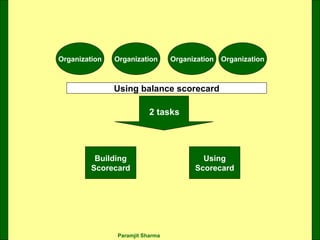

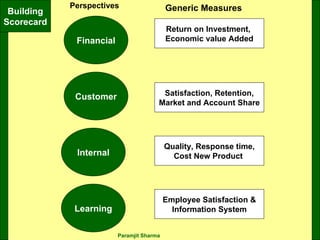

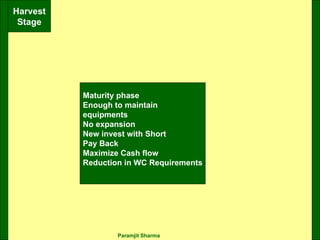

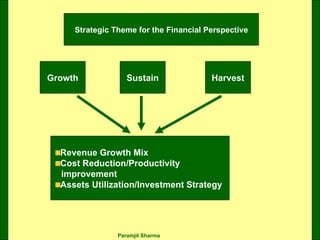

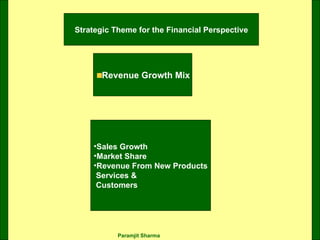

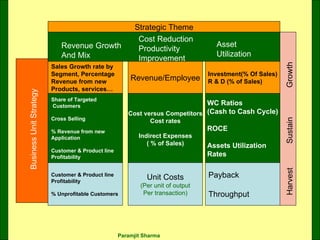

The document discusses using a balance scorecard to measure business strategy. It describes building a scorecard with four perspectives: financial, customer, internal processes, and learning and growth. For the financial perspective, it outlines strategic themes for different stages of a business unit's lifecycle - growth, sustain, and harvest. These themes include revenue growth and mix, cost reduction/productivity improvement, and asset utilization/investment strategy. Generic measures are provided for each theme.