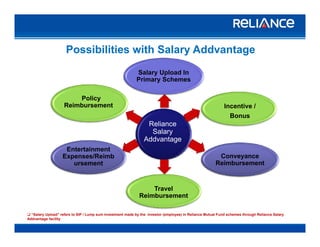

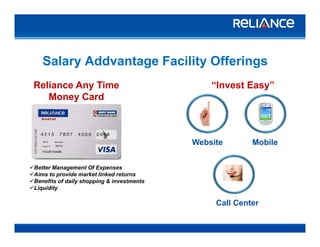

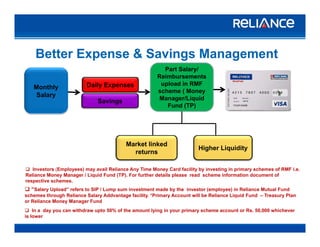

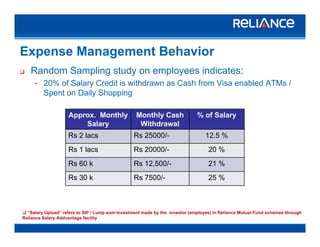

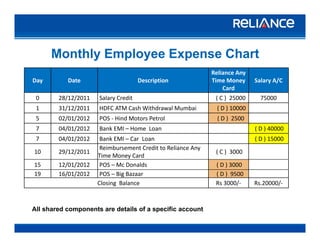

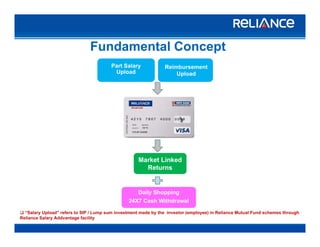

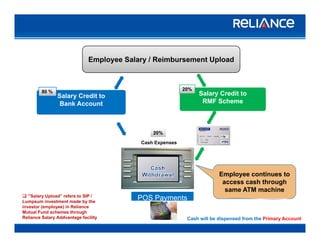

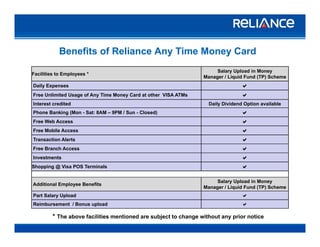

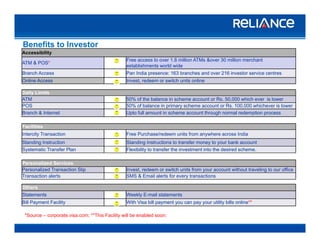

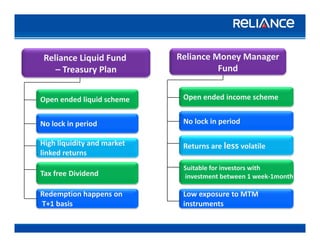

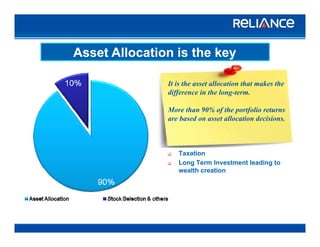

This document describes Reliance Capital Asset Management Ltd's Salary Addvantage program which allows employees to invest parts of their salary and reimbursements in Reliance mutual fund schemes. The program offers a Reliance Any Time Money Card for making daily expenses and withdrawals linked to the primary investment schemes of Reliance Money Manager Fund and Reliance Liquid Fund - Treasury Plan. Benefits include market-linked returns, liquidity for expenses, and better savings and expense management.