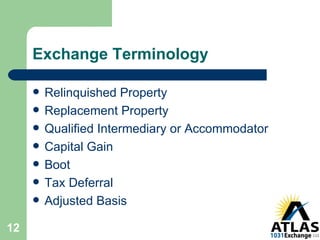

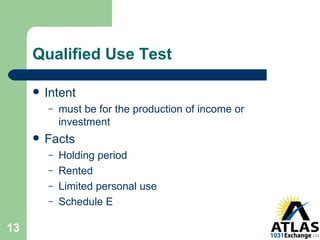

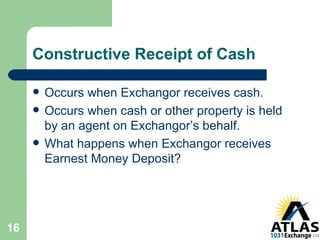

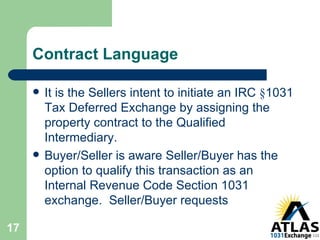

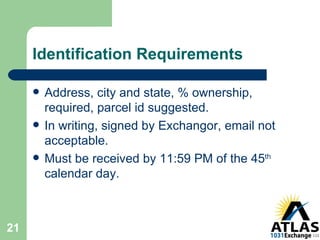

This document provides an overview of Internal Revenue Code Section 1031 exchanges, which allow taxpayers to defer capital gains tax when selling investment or business property and reinvesting the proceeds into similar "like-kind" property. Key points covered include what qualifies for a 1031 exchange, requirements and timelines, exchange terminology, strategies for forward and reverse exchanges, benefits for realtors and taxpayers, and common misconceptions about 1031 exchanges.