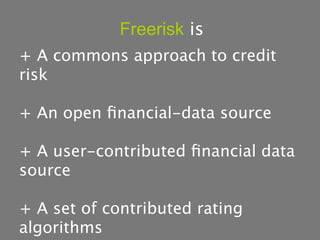

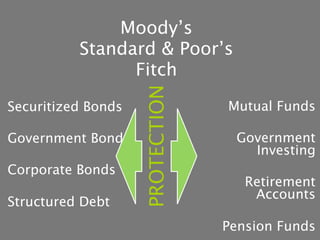

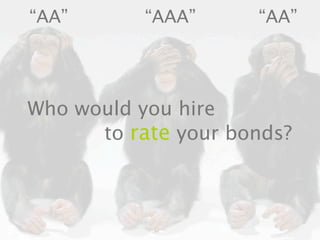

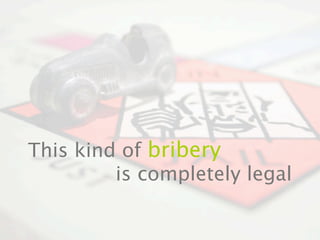

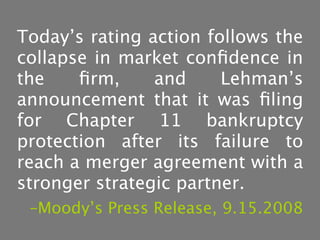

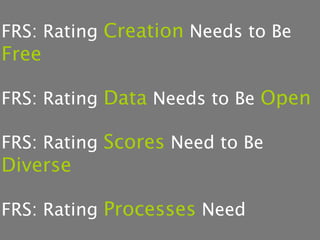

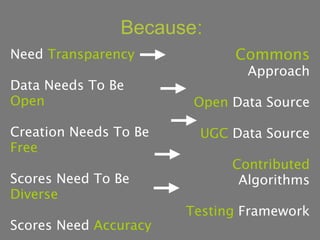

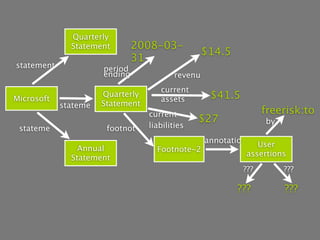

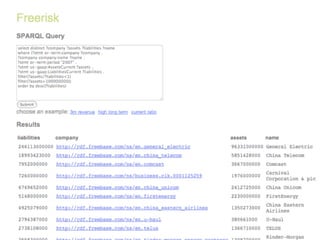

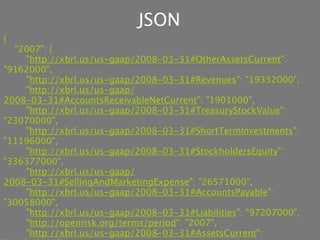

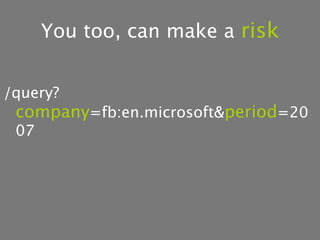

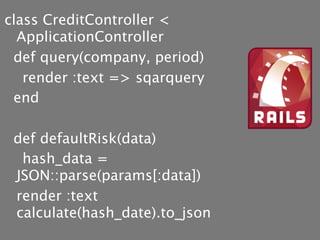

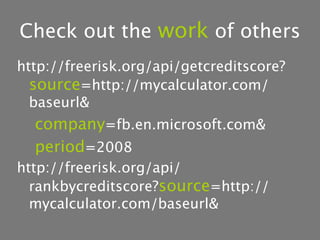

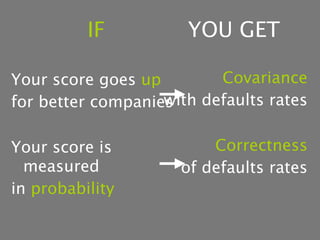

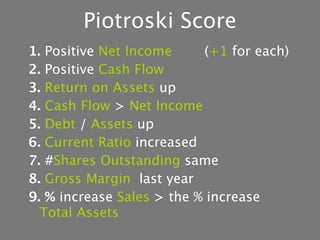

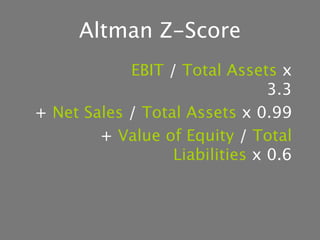

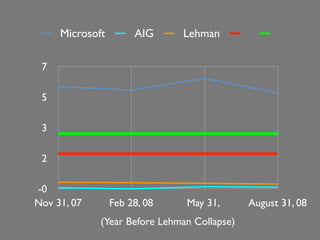

This document discusses the need for open and transparent credit rating systems as an alternative to the existing "Big Three" credit rating agencies (Moody's, S&P, Fitch). It proposes Freerisk, a commons approach to credit risk that utilizes open financial data sources and user-contributed rating algorithms. The document outlines some issues with the current opaque and conflicted system and argues that Freerisk could help create a more accurate and diverse assessment of risk through greater transparency, data sharing, and algorithmic contributions.