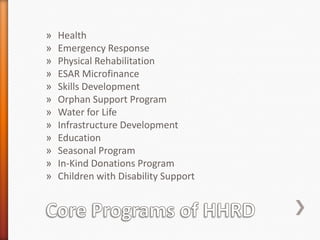

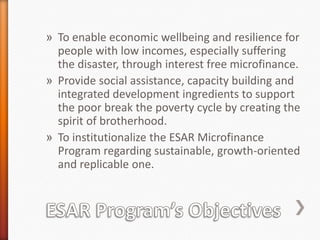

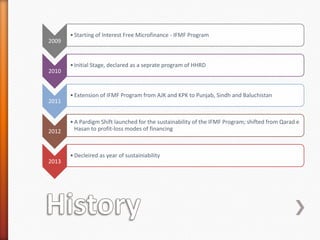

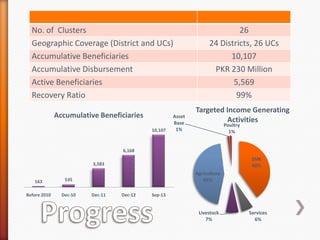

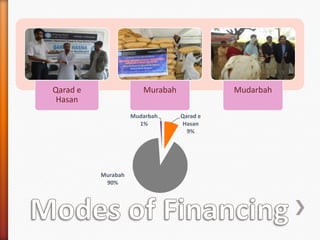

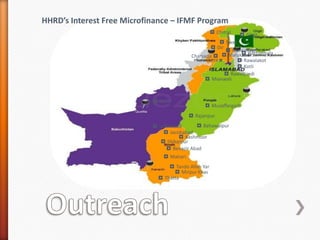

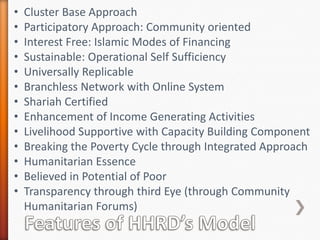

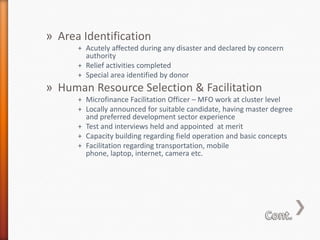

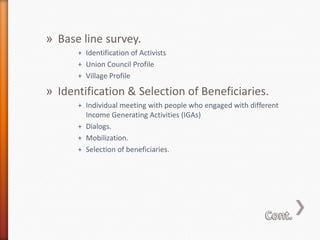

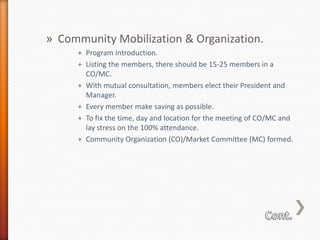

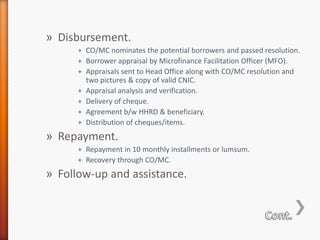

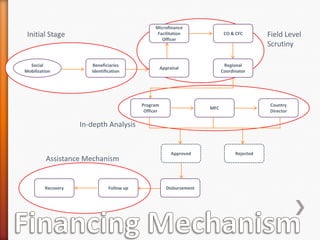

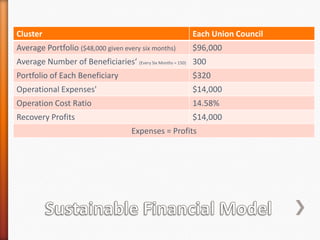

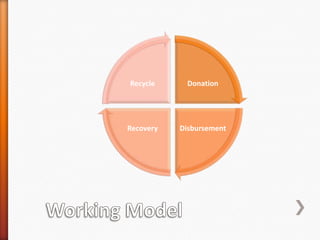

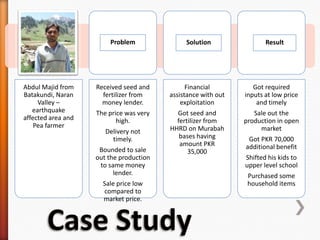

Helping Hand for Relief and Development (HHRD) is a non-profit organization committed to serving humanity through various relief and development programs. Its flagship program is an interest-free microfinance program that aims to alleviate poverty by providing loans and capacity building to help low-income individuals engage in livelihood and income-generating activities. The summary provides key details about HHRD's microfinance program operations across Pakistan, its financing mechanisms, beneficiaries served, and impact in empowering communities and improving lives.