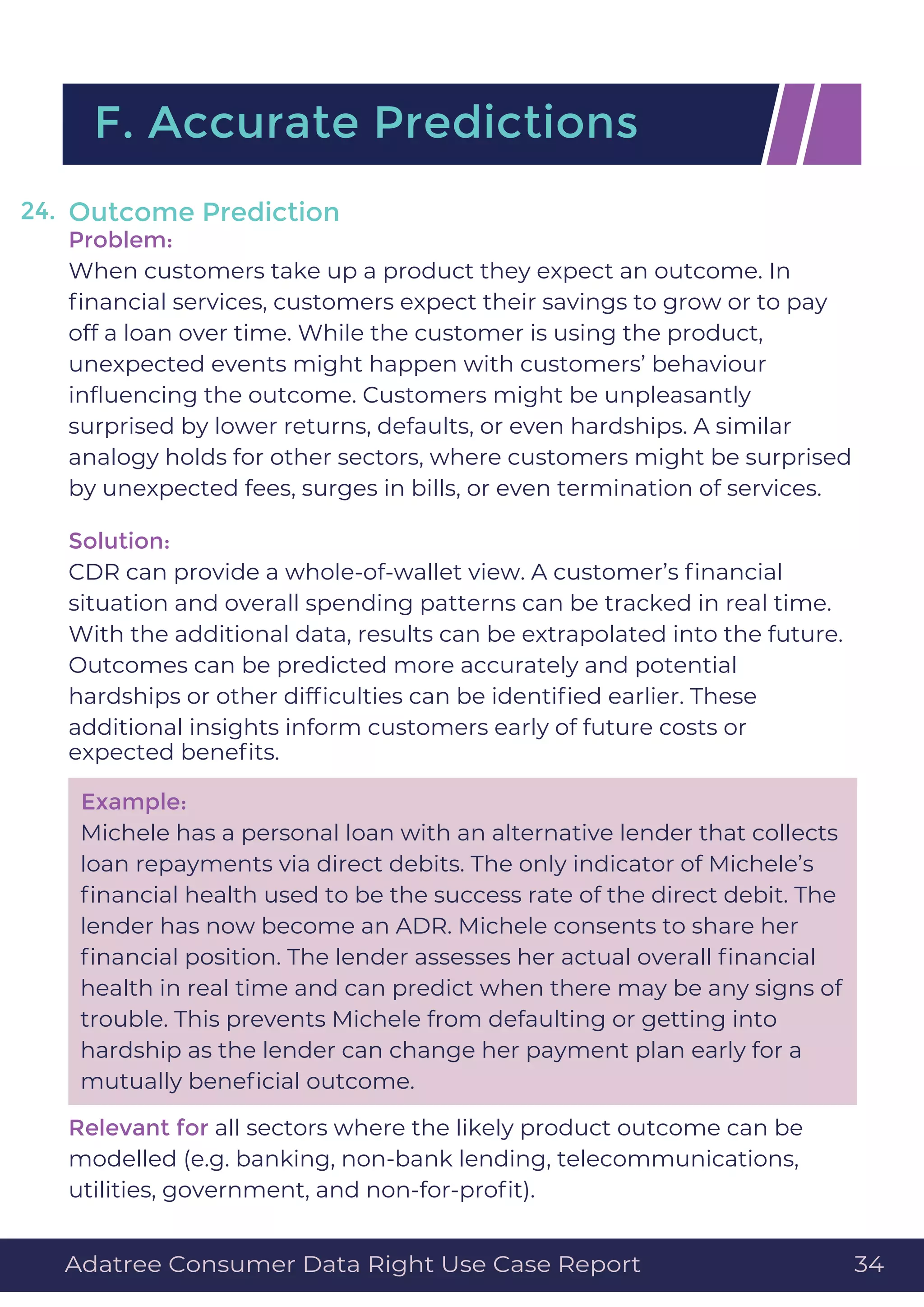

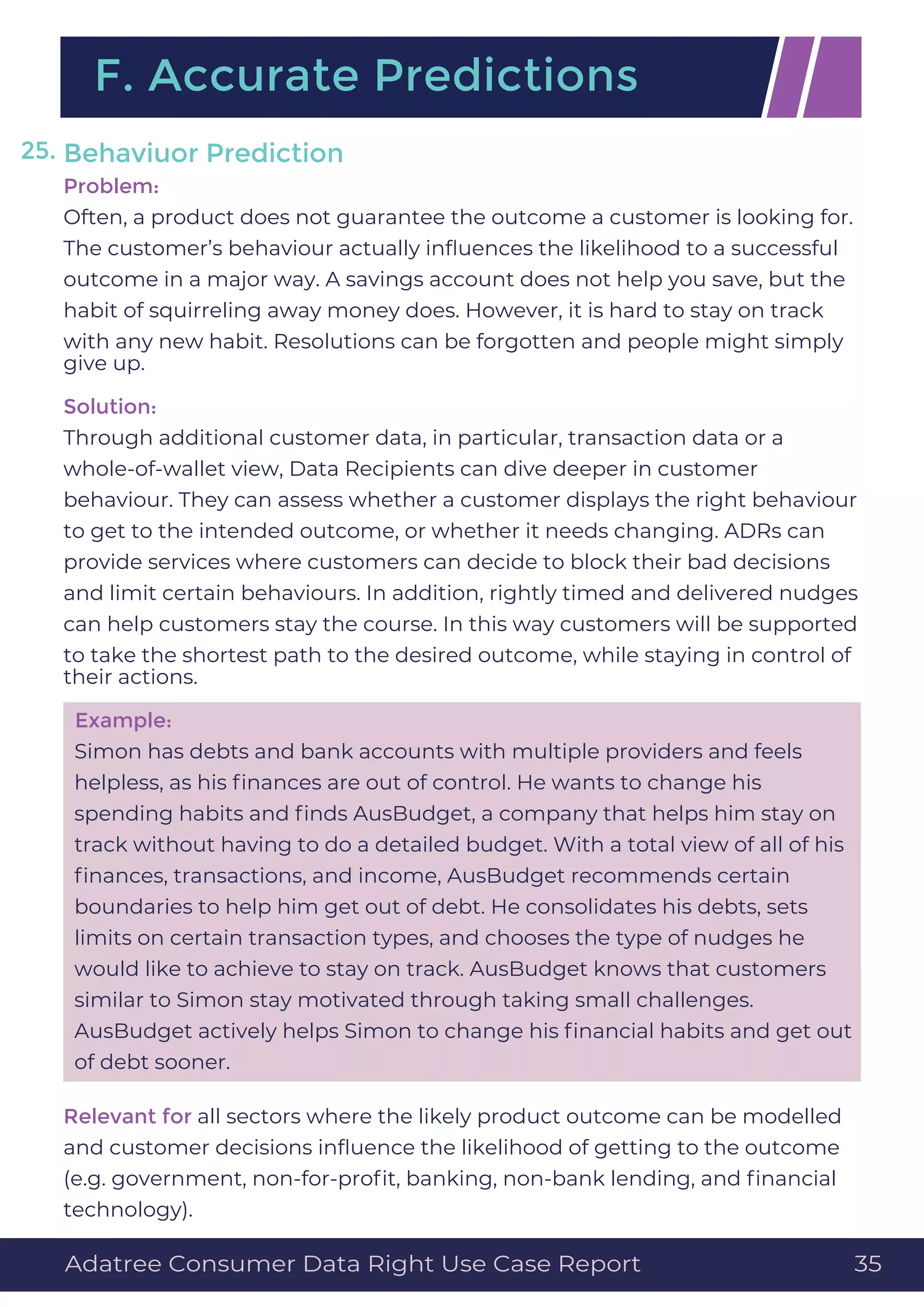

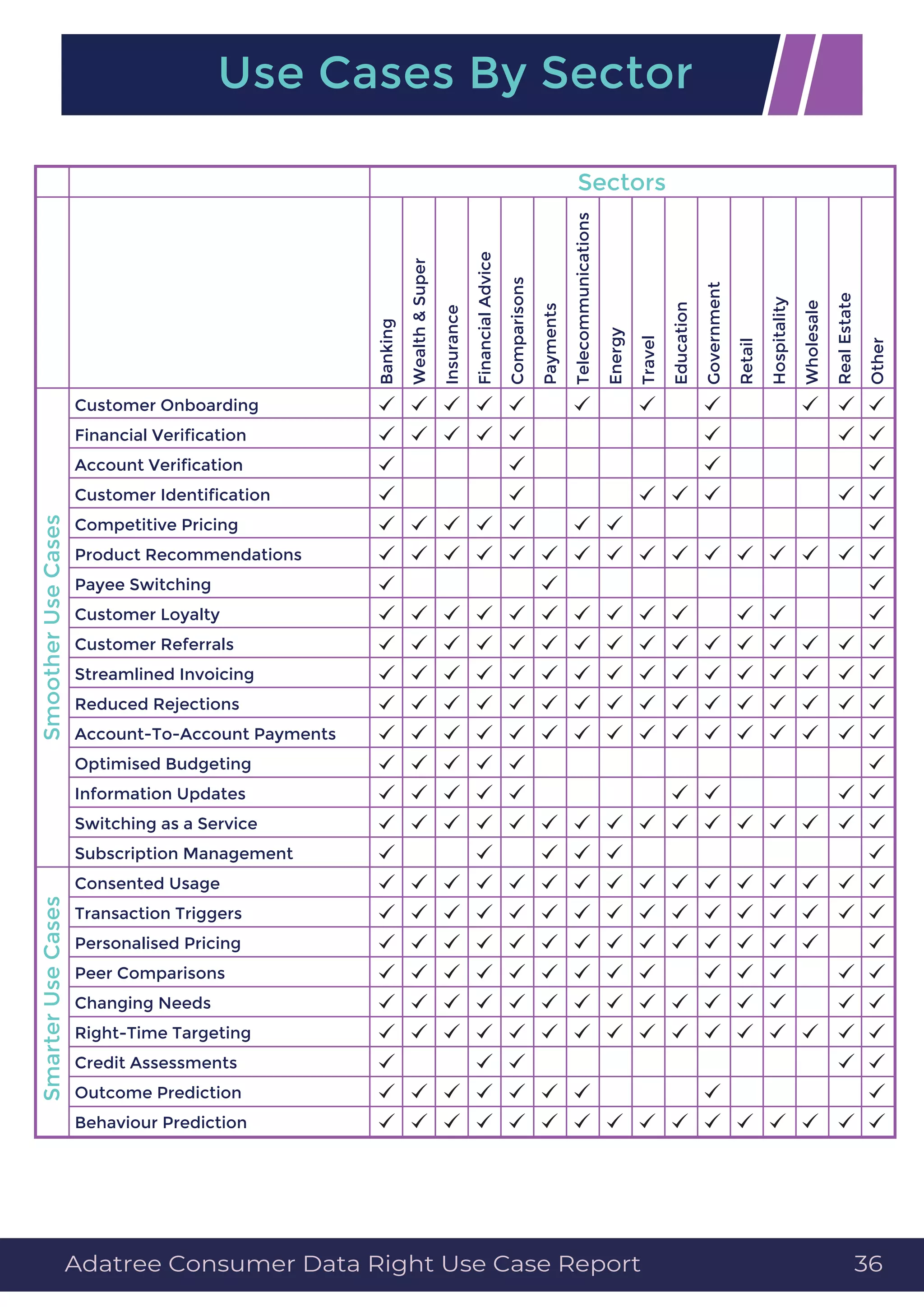

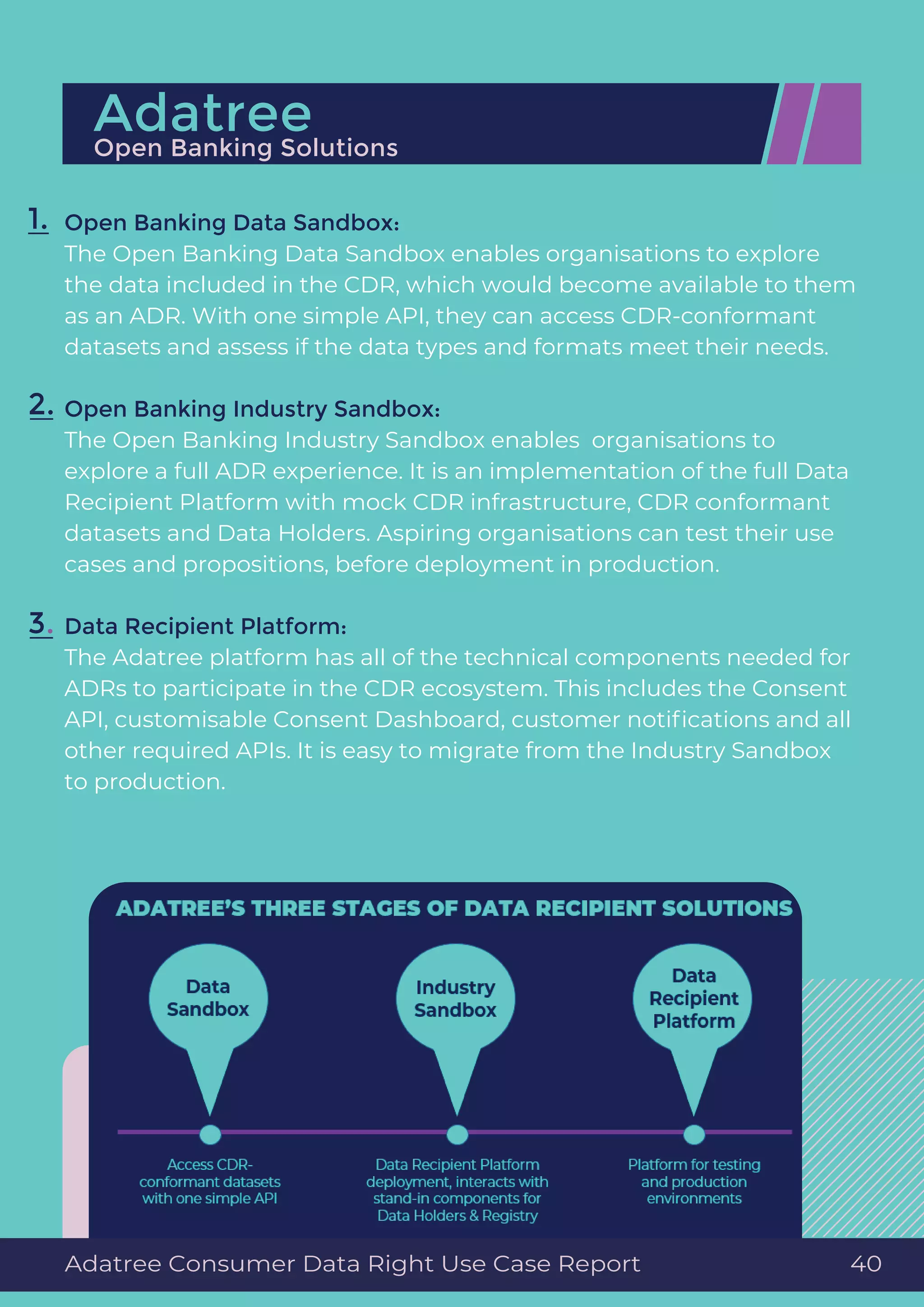

This document outlines 25 potential use cases for how organizations can use consumer data accessed through Australia's Consumer Data Right (CDR) framework, also known as Open Banking. It discusses how the CDR allows consumers to share their personal data with trusted organizations. This drives innovation and competition by allowing recipient organizations to incorporate consumer, product, account, and transaction data into their own product and service offerings. The document then categorizes 25 specific use cases into two categories: "Smoother" use cases that improve customer experiences through automation and streamlining, and "Smarter" use cases that enable personalization and improved predictions. Each use case is described in 1-2 sentences to illustrate how organizations can leverage CDR data to benefit both customers