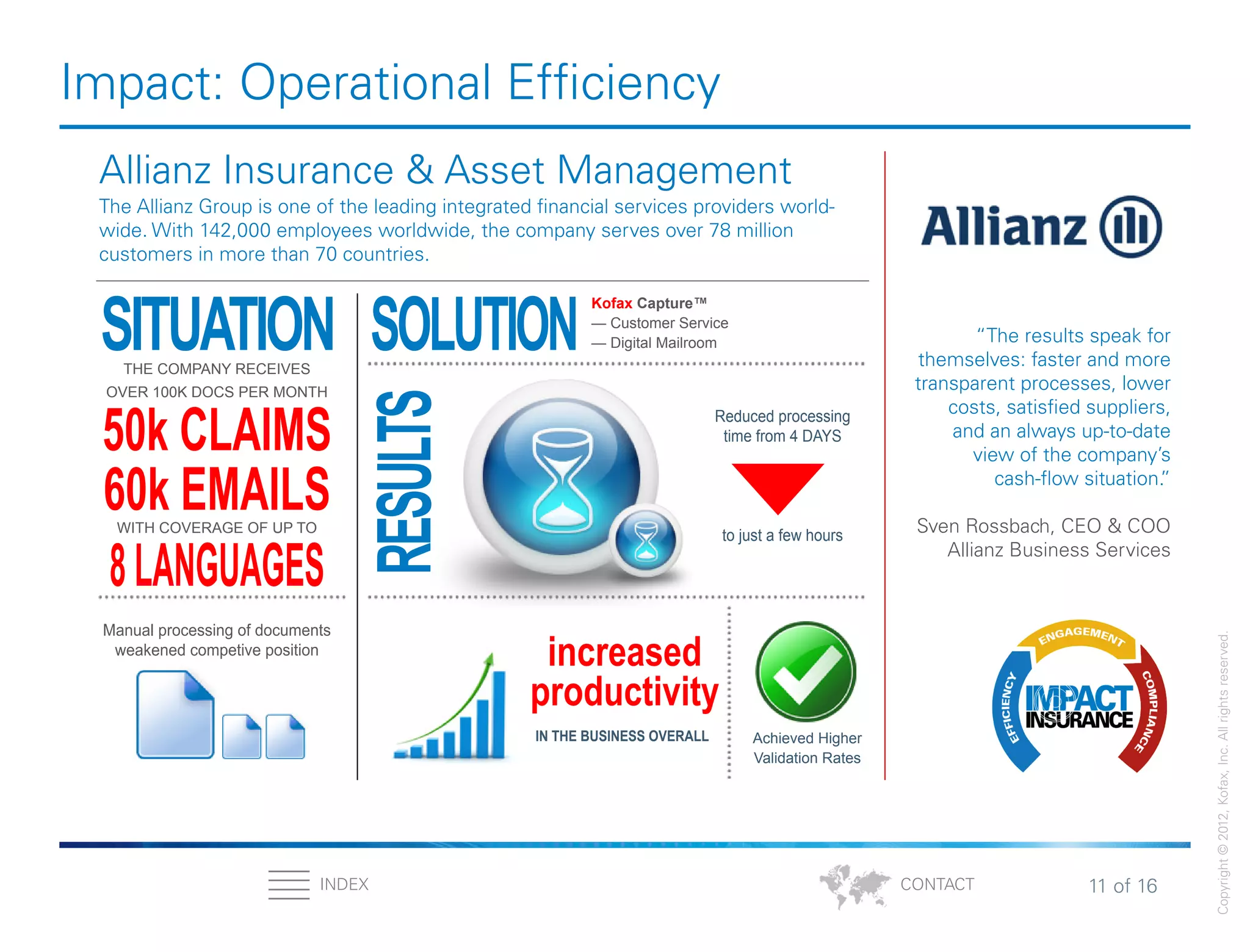

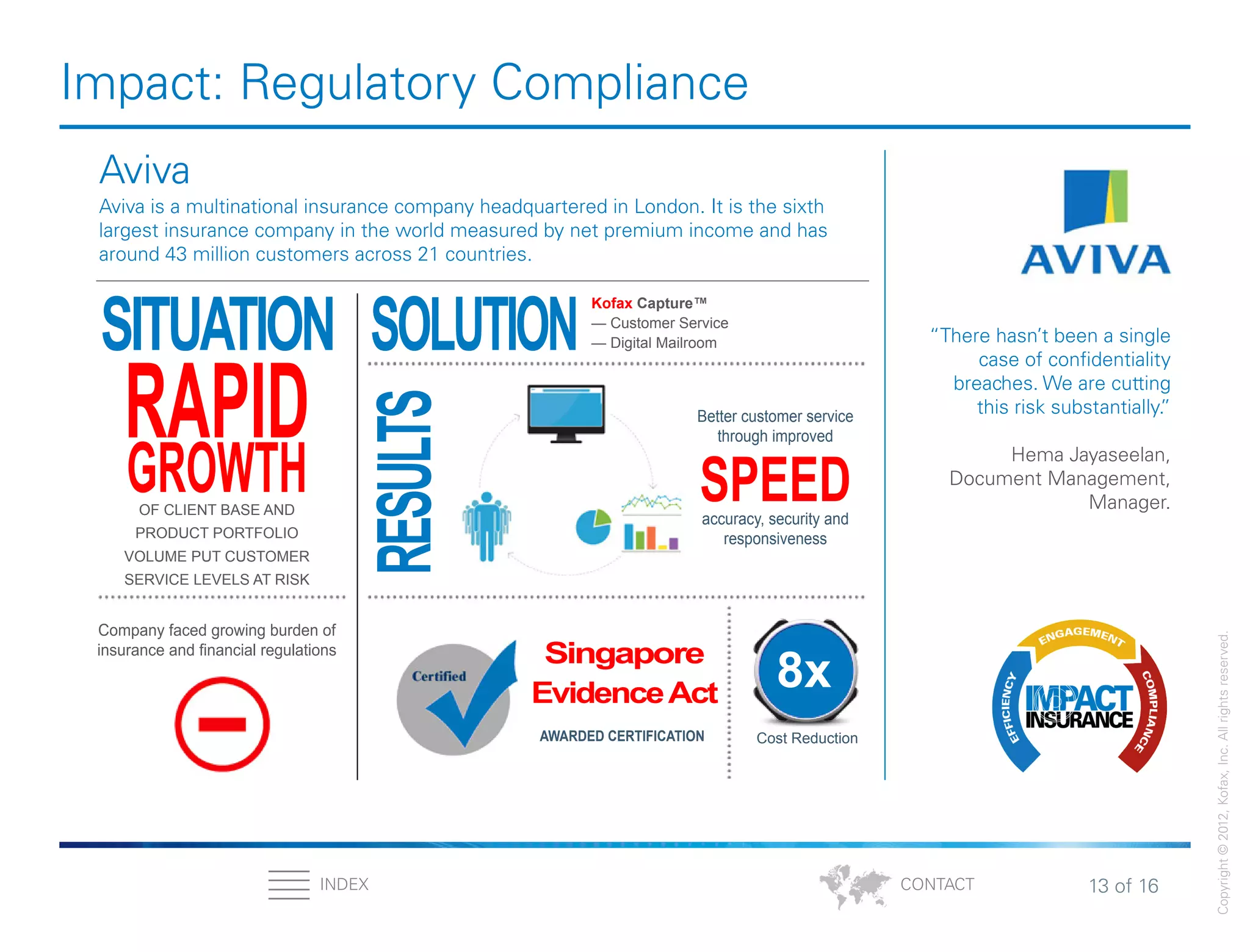

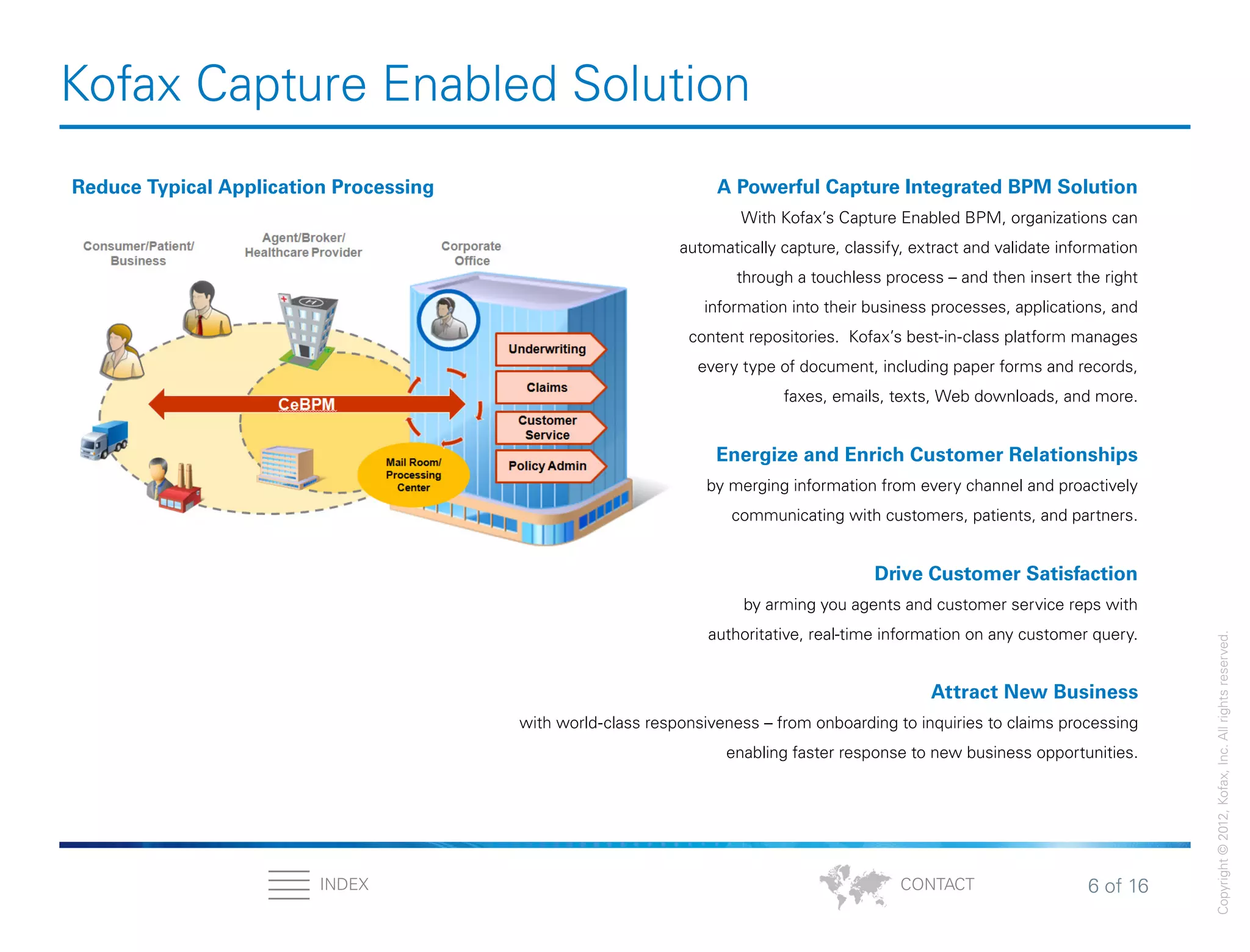

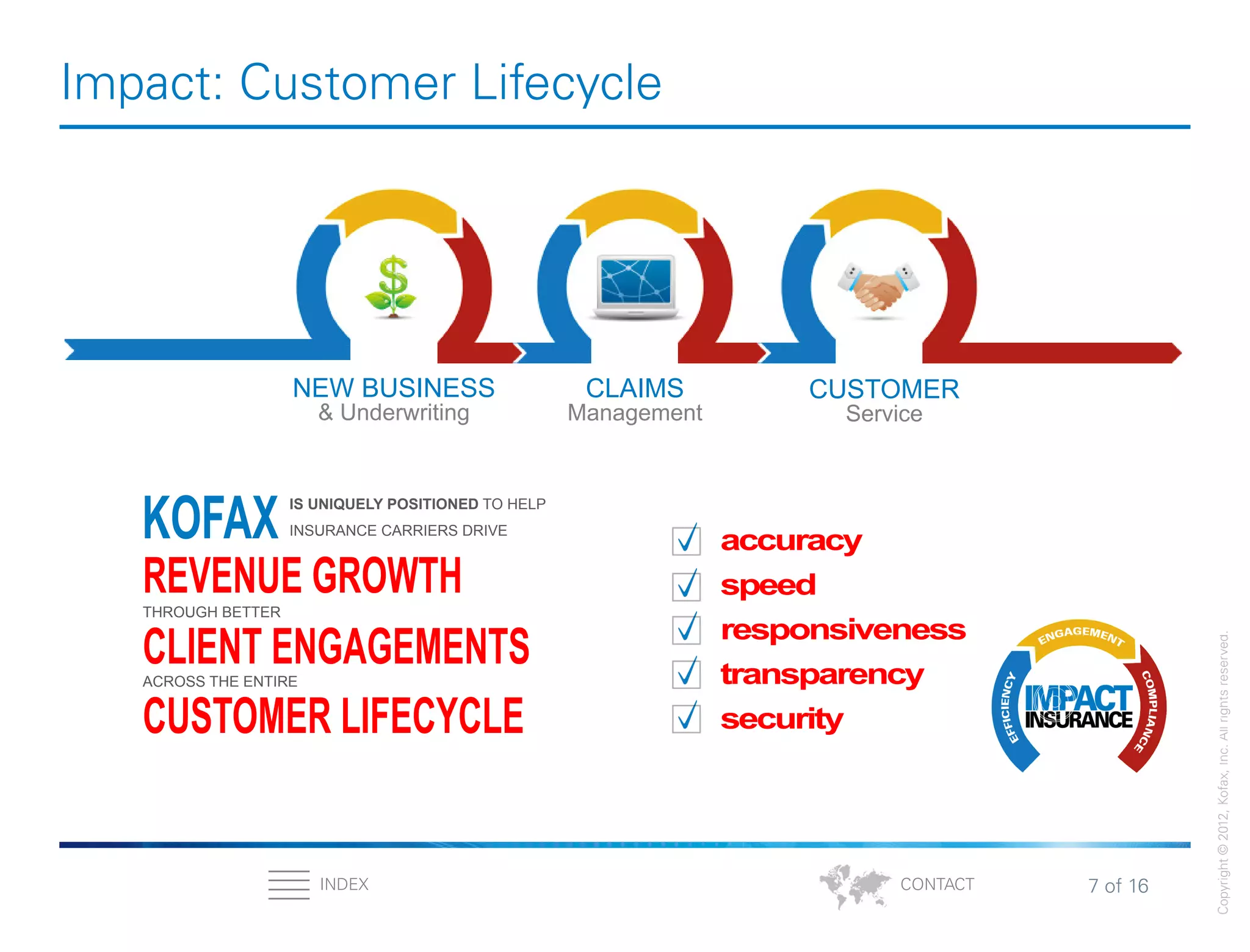

Kofax provides solutions to help insurance carriers address challenges related to customer engagement, operational efficiency, and regulatory compliance. Its software allows carriers to streamline processes, improve customer service and responsiveness, reduce costs, ensure security and compliance, and gain insights to drive growth. References are made to successful implementations at insurance companies that have realized benefits such as increased productivity, faster processing, and improved customer satisfaction through the use of Kofax's capture and workflow automation technologies.

![9 of 16INDEX

Copyright©2012,Kofax,Inc.Allrightsreserved.

CONTACT

Impact: Customer Engagement

Ecclesiastical Insurance Group

Ecclesiastical is a specialist insurance and financial services company specialising in

charity insurance , education insurance , heritage insurance and care insurance

alongside a range of other insurance and financial services products.

“75% of our users believe

[capture and BPM] help them

provide a more consistent

level of service to customers.”

David Green,

Program Manager,

Ecclesiastical

SITUATIONTHE COMPANY EXCEEDED ITS

CAPACITY TO MEET

CUSTOMER

EXPECTATIONSAND ADAPT TO THE

INDUSTRIES RAPIDLY

CHANGING BUSINESS MODEL

New entrants and a soft market

puts pressure on rates & margins

SOLUTION

RESULTS

quick &

intuitive

USERS RAPIDLY EMBRACED

THE SYSTEM

Reduction in Task

Allocation Time

5x

Kofax Capture™

— New Business/Underwriting

Reduced costly &

inefficient manually

intensive processes by

60%providing significant

capacity for growth](https://image.slidesharecdn.com/thekofaxsolution-final-150501133509-conversion-gate02/75/The-Kofax-Solution-and-its-Impact-on-Insurance-9-2048.jpg)