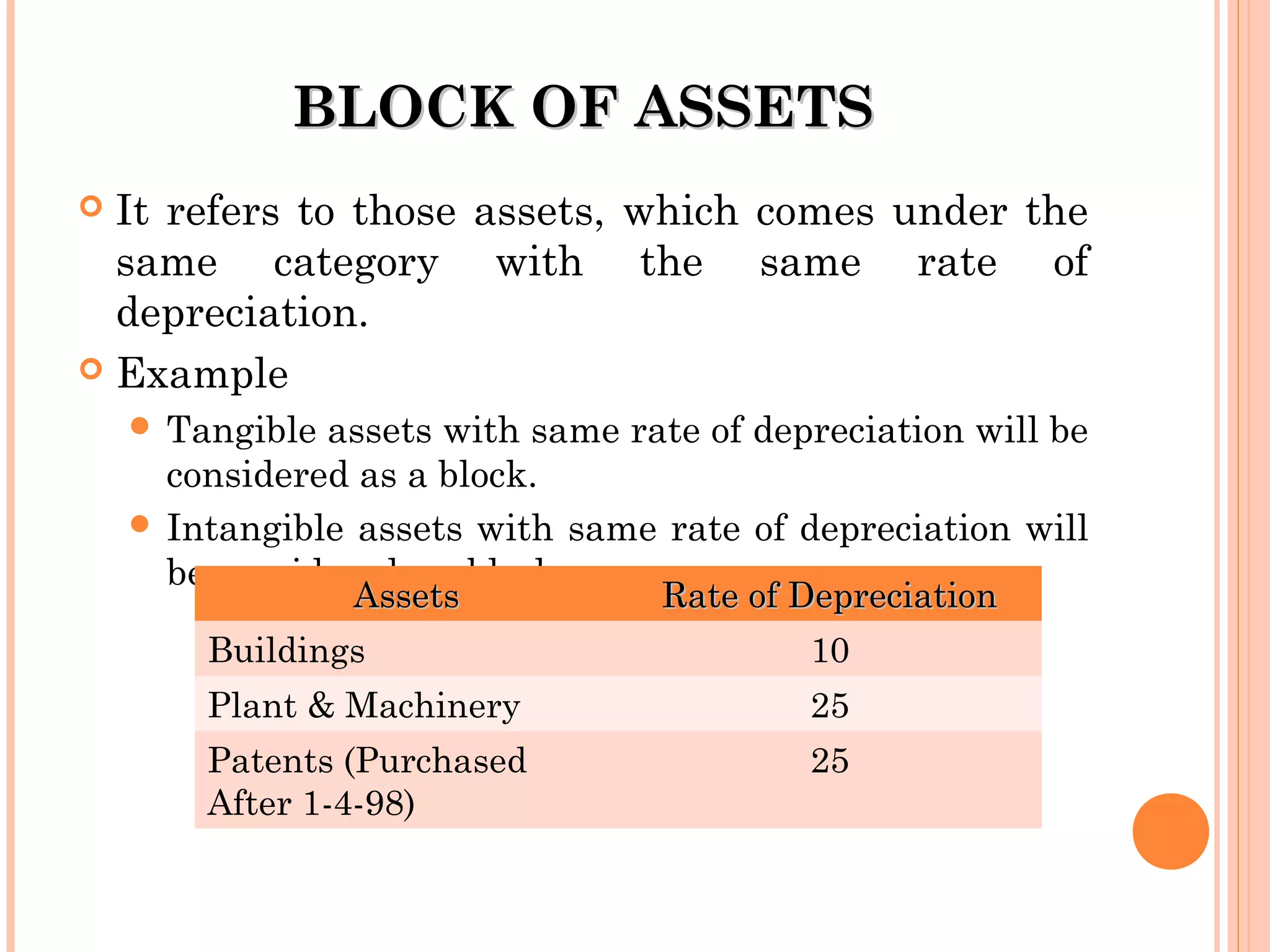

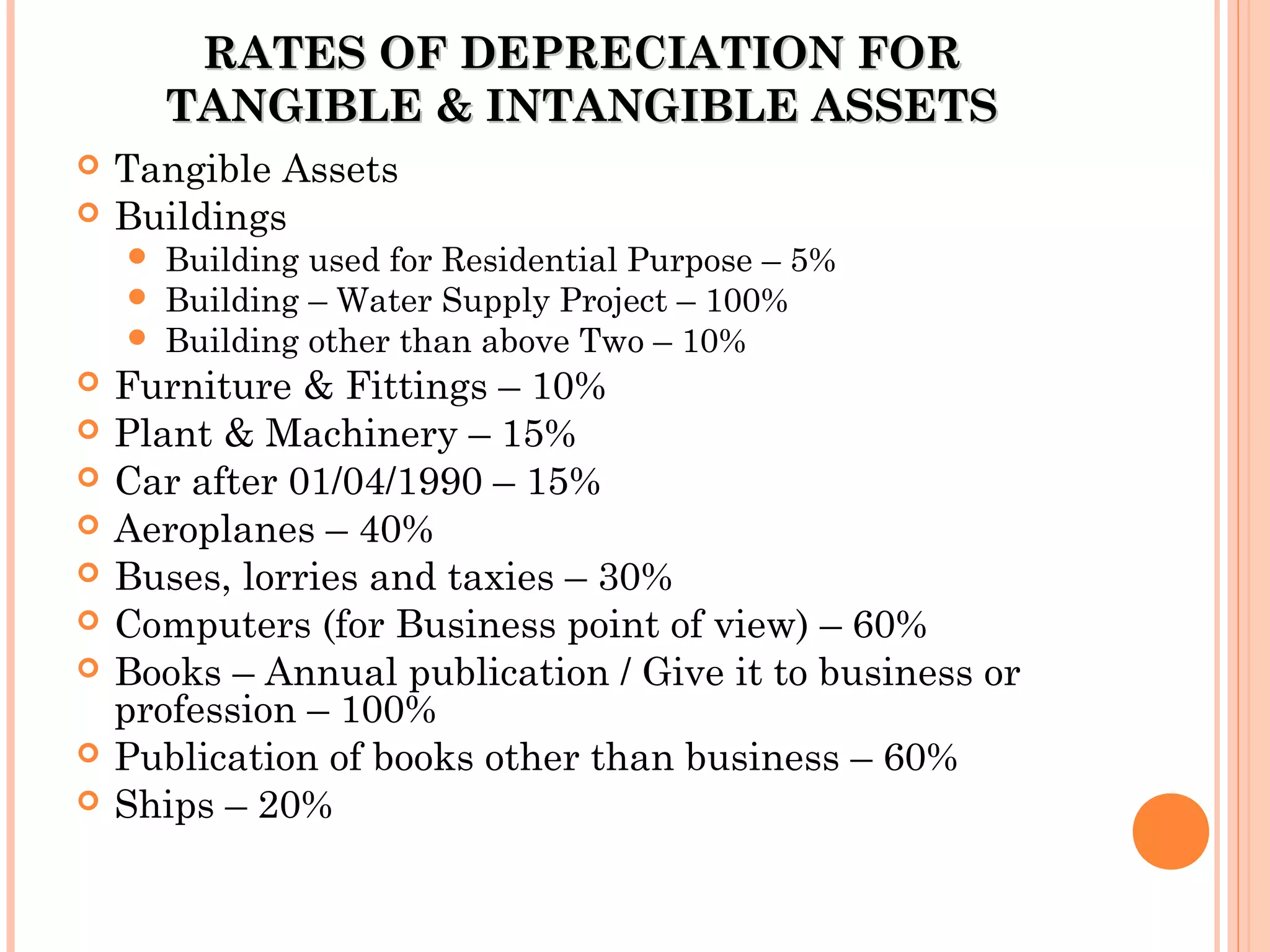

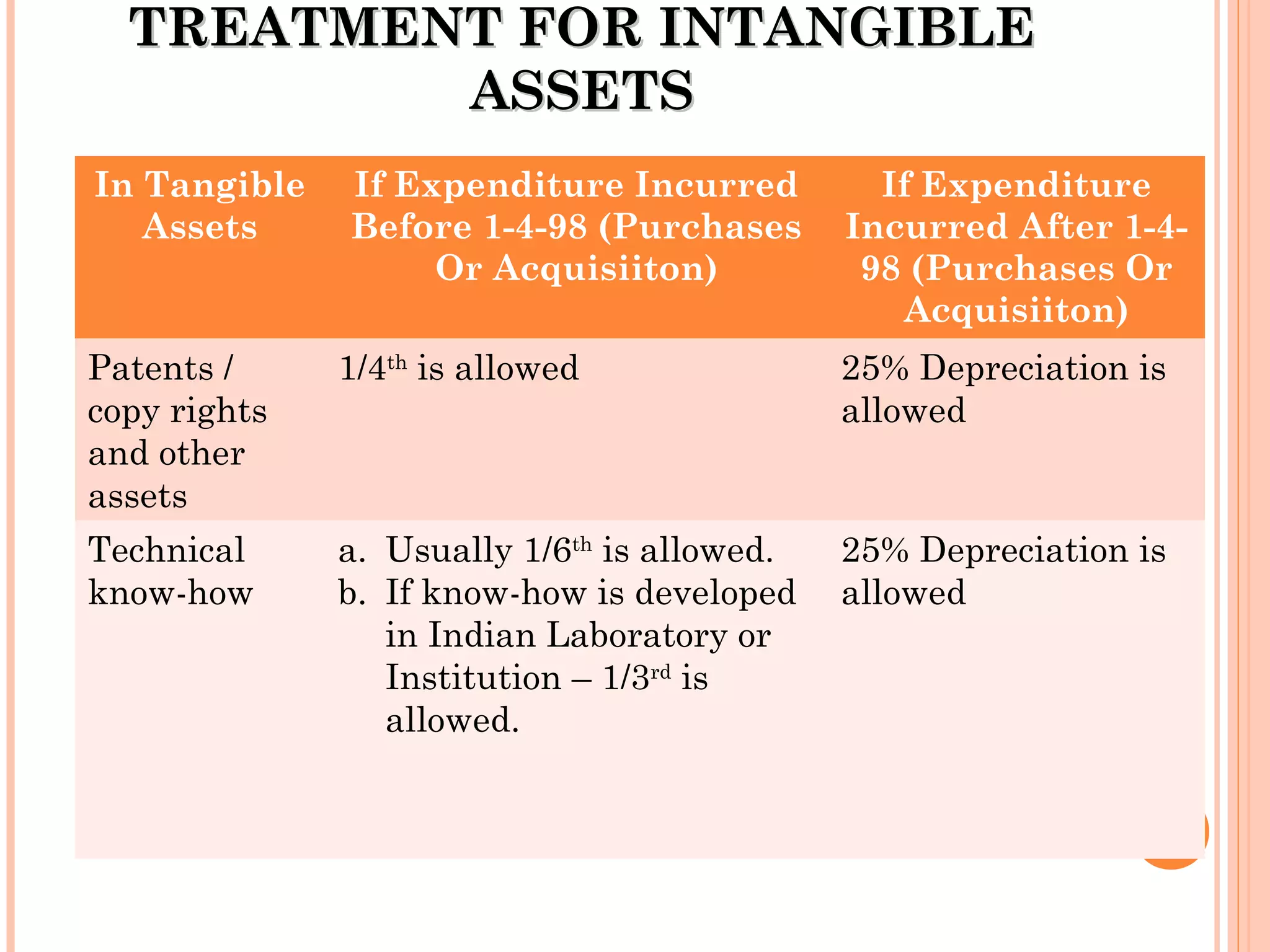

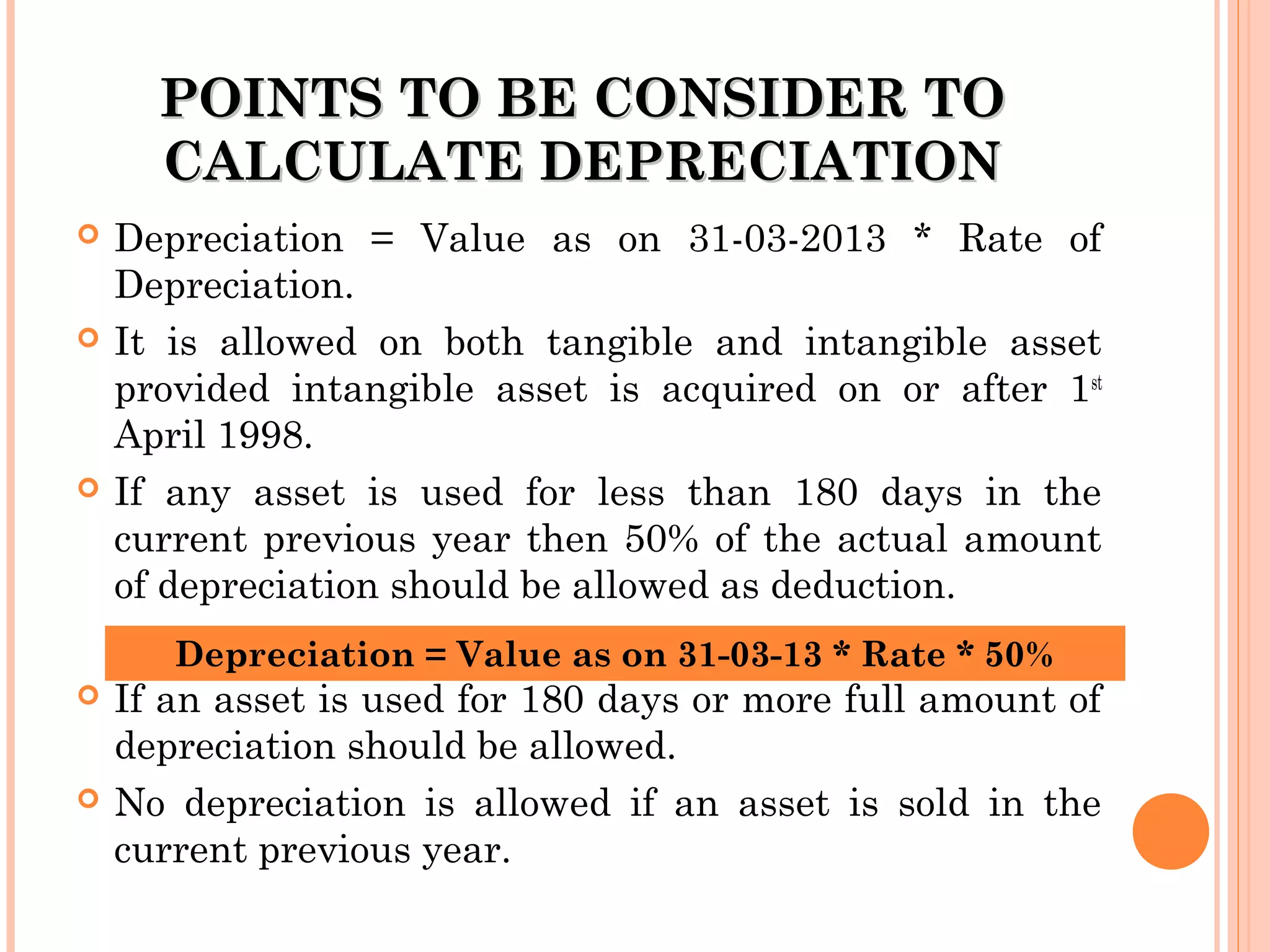

Depreciation is allowed to arrive at real business profits, determine the book value of assets over time, and know the real position of assets to arrange for replacements. Depreciation can be claimed for assets owned and used for business that were acquired after April 1, 1998. Assets are grouped into blocks based on category and depreciation rate, and depreciation is calculated using the block of assets, actual cost basis, or written down value basis. Rates vary from 5-100% depending on the asset type, and additional depreciation may be claimed for new machinery used in manufacturing.