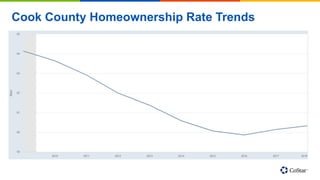

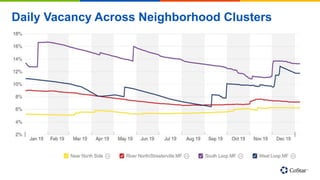

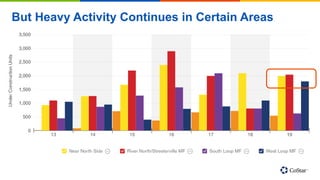

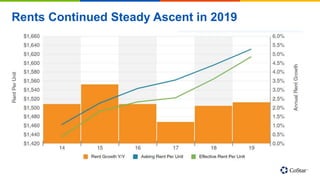

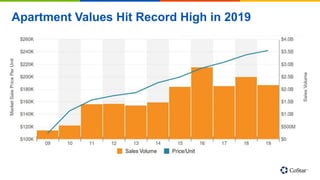

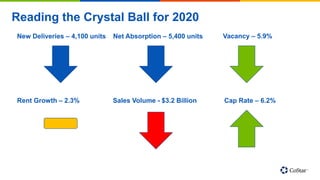

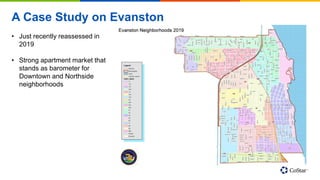

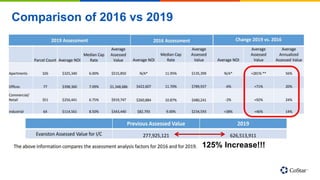

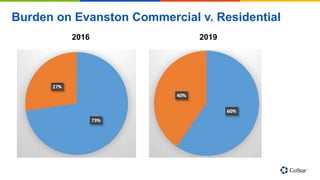

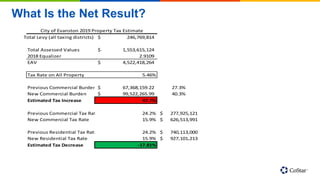

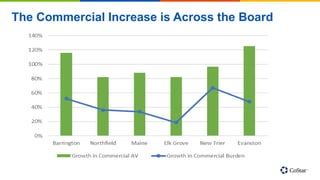

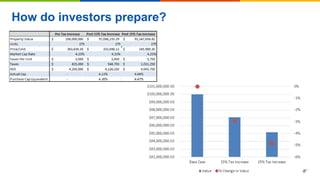

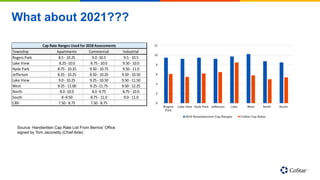

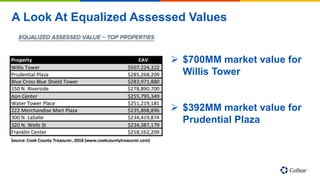

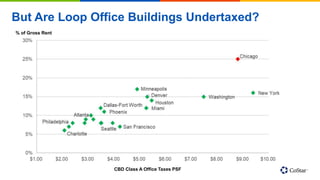

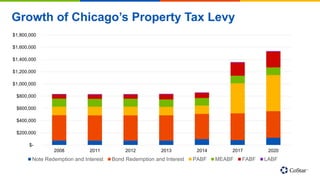

This document provides a summary and outlook of the Chicago commercial real estate market in early 2020. It recaps the trends of 2019, including multifamily fundamentals like declining vacancy rates and rising rents. Construction activity was pulling back after heavy development. The author projects continued rent growth, absorption, and high property values in 2020. It also details the impact of recent property tax reassessments, with commercial properties in some areas seeing tax increases up to 47%. Questions are asked about how investors should prepare for potential higher taxes going forward.