Embed presentation

Download as PDF, PPTX

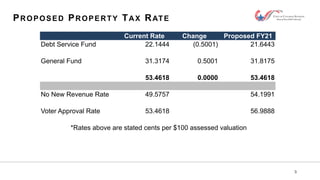

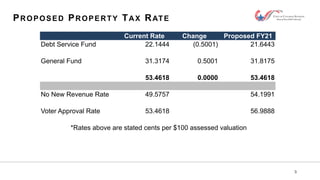

The document outlines College Station's FY21 ad valorem tax rate adoption process, including holding public hearings in August and adopting the tax rate at their August 27th city council meeting. It proposes keeping the total tax rate the same at 53.4618 cents per $100 assessed valuation, with a 0.5001 cent decrease to the debt service fund rate and a matching 0.5001 cent increase to the general fund rate. The document also provides the no new revenue and voter approval tax rates for FY21.