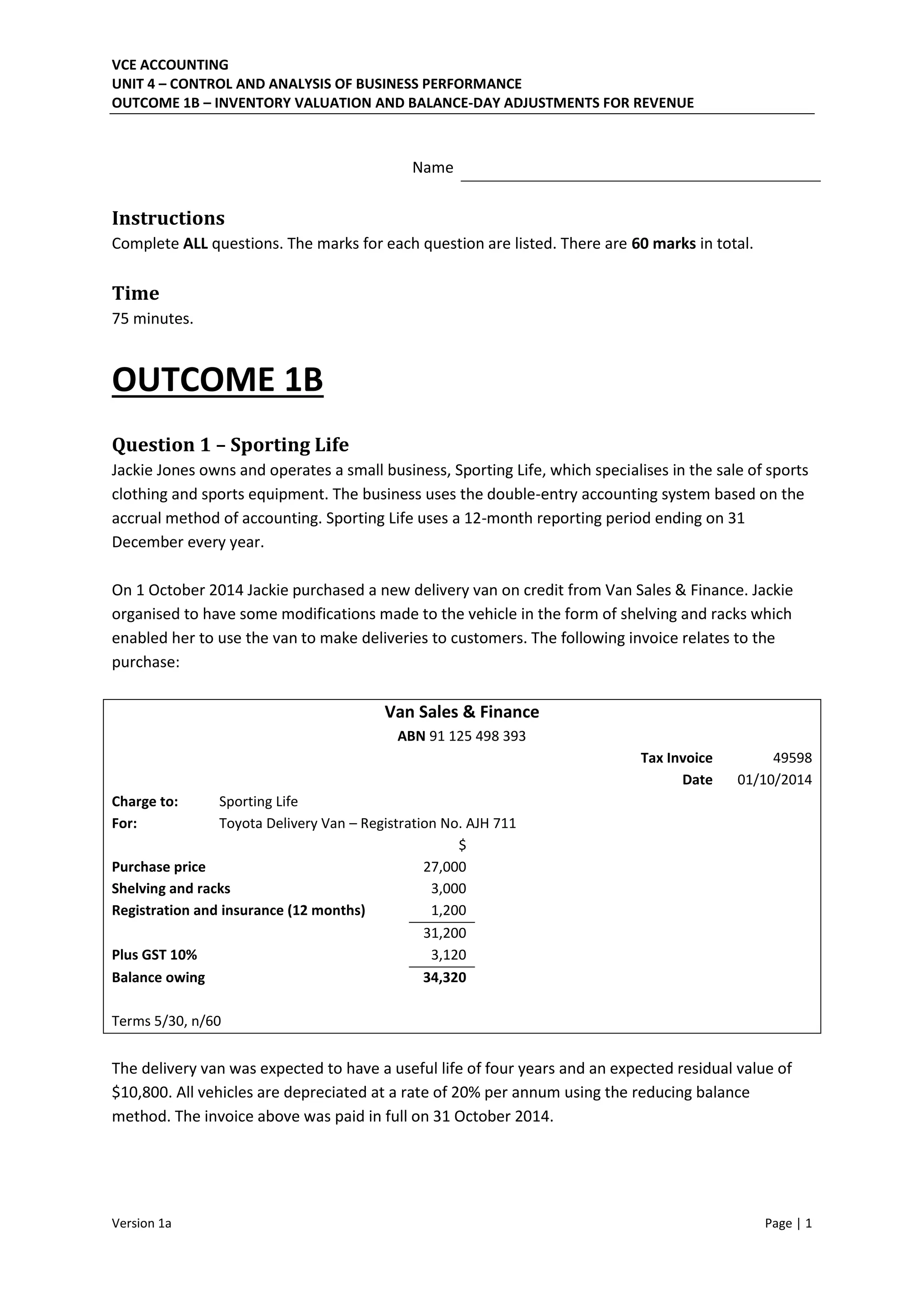

The document contains a multi-part accounting problem involving the purchase, sale, and depreciation of various non-current assets, including a delivery van and computer system, by two small businesses. It asks the student to calculate depreciation amounts, record journal entries, and explain the impact of different depreciation methods on the financial statements. The student must apply concepts such as reducing balance depreciation, straight-line depreciation, disposal of assets, and balance day adjustments.