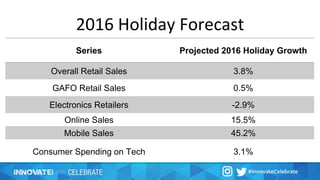

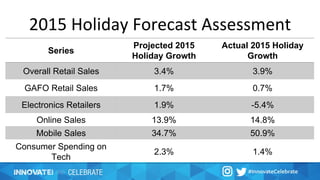

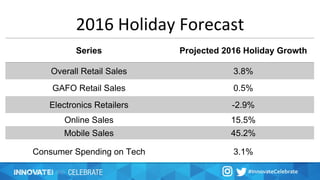

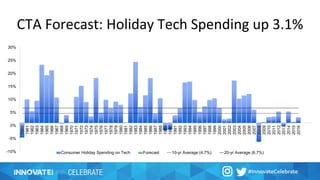

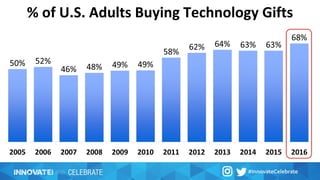

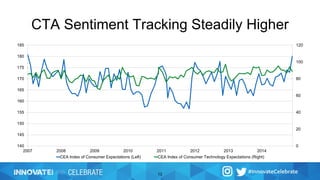

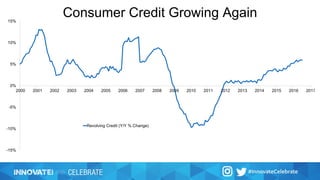

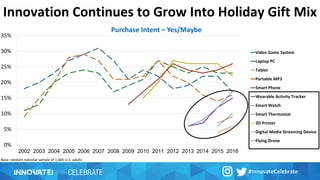

The CTA's 23rd annual holiday outlook predicts mixed signals for consumer spending during the 2016 holiday season, with overall retail sales projected to grow by 3.8%. While mobile sales are expected to increase significantly, electronics retailers anticipate a decline of 2.9% in sales. Additionally, consumer sentiment is steadily improving, with 75% of adults planning to buy technology gifts this year.

![Promo Programs Popular

IN-STORE RETAILER [NET]

64%

ONLINE RETAIL STORE [NET]

53%

83% plan to take part in a promo

program when shopping for tech products](https://image.slidesharecdn.com/2016holidayoutlook-160921202644/85/2016-Holiday-Outlook-53-320.jpg)