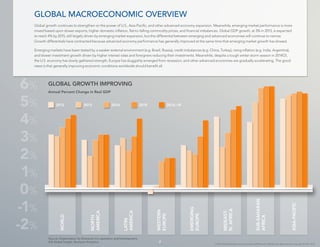

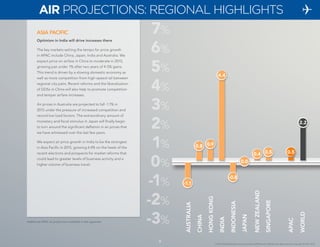

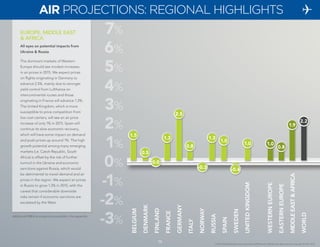

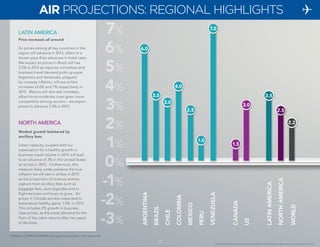

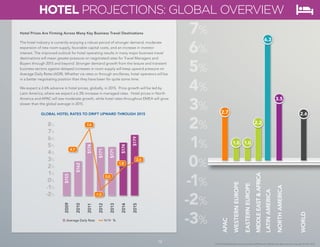

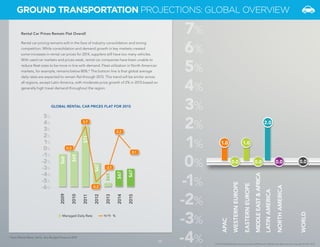

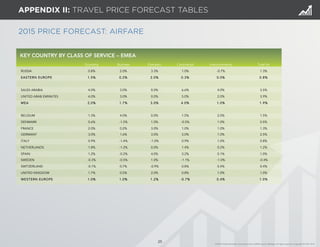

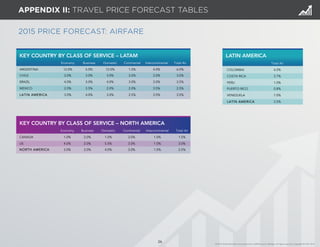

The 2015 Global Travel Price Outlook report offers insights into anticipated price changes for air, hotel, rental car, and meetings & events as the corporate travel industry faces a moderate economic recovery. Key findings indicate that business travel spending is set to increase, with airfares projected to rise by 2.2% globally, driven by improved demand and capacity management. However, several risks, including geopolitical tensions and economic volatility in emerging markets, pose potential challenges to these forecasts.